The Six Most Important Takeaways From Nvidia's Q2 Earnings Report

The Six Most Important Takeaways From Nvidia's Q2 Earnings Report

In the AI chip sector, Nvidia remains the undisputed heavyweight.

Nvidia’s Q2 earnings report showed the company remains a tech juggernaut that dominates the AI-focused chip market.

Q2 delivered record revenue and a strong performance in its data center division.

But despite those strengths, Nvidia’s stock dipped after the report. Investors adopted a cautious stance while awaiting details on the much-anticipated rollout of the next-generation Blackwell platform.

Nvidia's (NVDA) meteoric rise has turned its quarterly earnings report into a must-watch event for investors. This time, the results were undeniably strong, but they also signaled a shift—the company’s growth is beginning to slow.

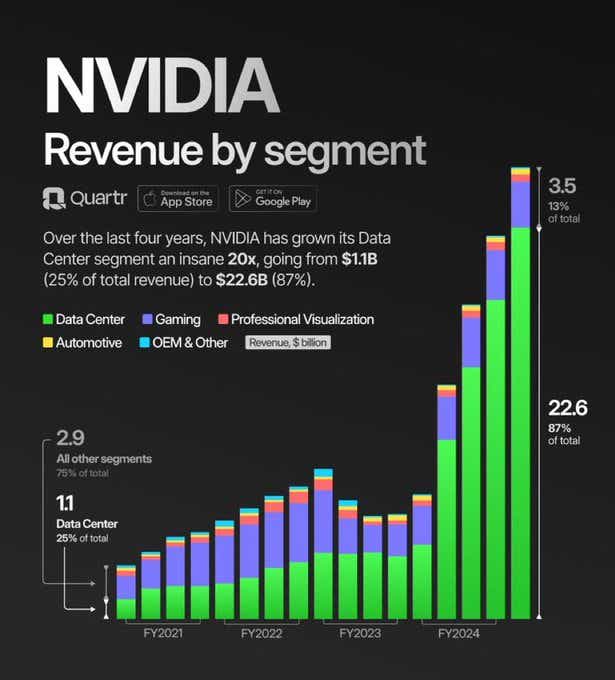

Its data center division, until recently the crown jewel of the portfolio, is still expanding but not as quickly. Other segments, like gaming and professional visualization, continue to post only modest gains.

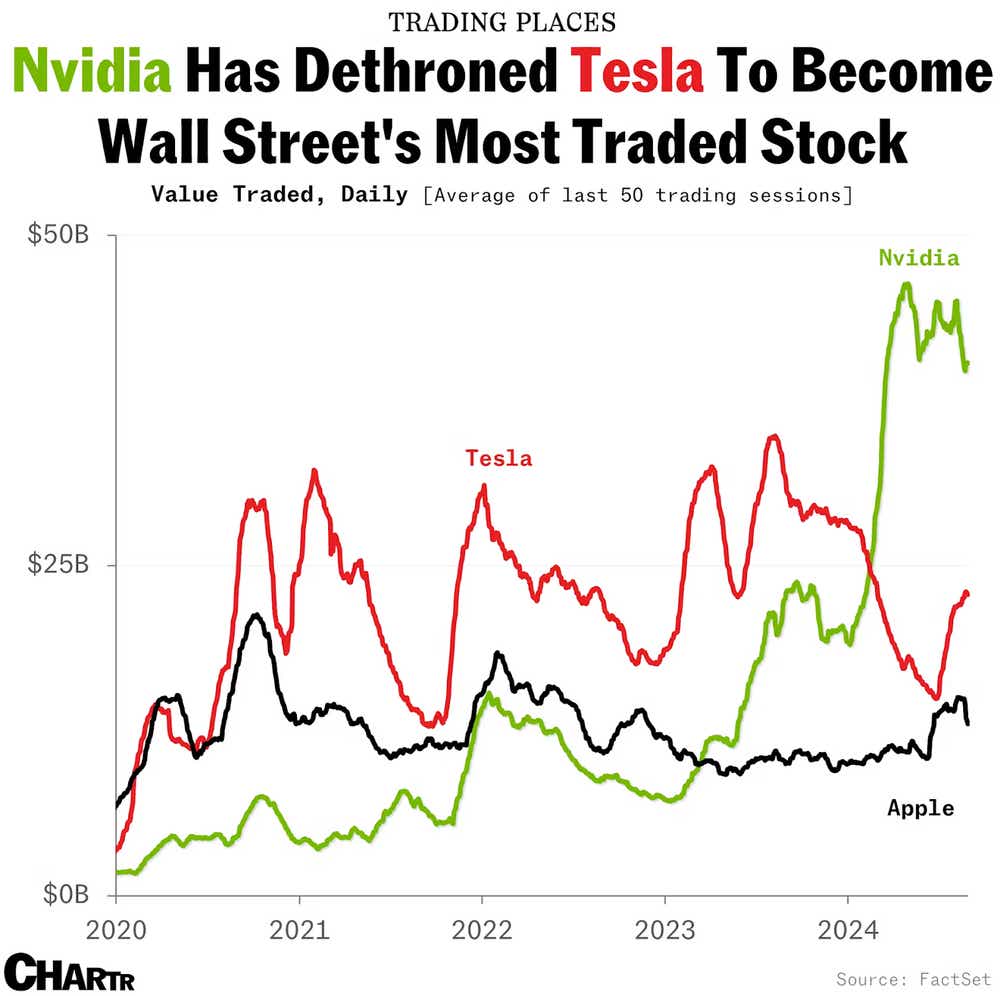

Five takeaways emerged from yesterday evening’s Nvidia’s earnings conference call. Let’s reflect upon what they mean for the company’s future. But first, here’s a quick reminder of why Nvidia’s earnings report matters: This company has become the most heavily traded single stock in the market, as illustrated below.

If you’ve been following Nvidia’s earnings, you might have noticed the company refers to its current fiscal year as 2025, even though we’re still in calendar year 2024. This might seem confusing at first, but it’s actually a relatively common practice.

Like many other companies, Nvidia operates on a fiscal year that doesn’t perfectly align with the calendar year. Nvidia’s fiscal year starts in February and ends in January of the following year. So, for Nvidia, fiscal year 2025 began in February 2024 and will run through January 2025.

Anyway, here are those takeaways we promised—six of them.

1. Nvidia posted strong Q2 headline earnings

While Nvidia’s stock took a hit in after-hours trading, the company turned in a Q2 earnings report that was still impressive by most measures. It posted non-GAAP earnings—which don’t include irregular or non-recurring costs—of $0.68 per share, beating expectations by $0.04. The company’s revenue soared to roughly $30 billion, a staggering 122% increase year-over-year, and 15% quarter-over-quarter.

Data center revenue, a key driver of growth, climbed to a new record of just over $26 billion, up 16% from the previous quarter and an eye-popping 154% compared to a year ago. This underscores Nvidia’s continued strength in the AI and data center markets, where demand remains robust for its cutting-edge graphics processing units, or GPUs.

Looking ahead, Nvidia’s Q3 outlook is equally strong. The company expects revenue to clock in around $32.5 billion, compared to the consensus estimate of $31.75 billion. Gross margins are also projected to stay in the mid-70% range, a sign Nvidia is continuing to manage costs effectively, even as it navigates challenges in the market.

So, while the stock markets’ reactions might suggest disappointment, the fundamentals in this earnings report tell a different story. They say Nvidia is still enjoying good health.

2. Blackwell chips are expected to roll out in Q4

The market’s reaction to this quarter’s strong numbers from Nvidia may have been tempered by deeper concerns—chief among them the anxiety surrounding the forthcoming Blackwell chip. It’s expected to drive a major shift in data centers toward direct-to-chip liquid cooling, an essential for managing the heat generated by advanced AI workloads.

The chip is slated to slated to begin shipping in Q4, and any further delays could disrupt industry plans and slow the adoption of this critical technology. During the Q2 earnings conference call, management indicated production remains on track. However, given the high stakes, any future delays could have significant consequences, not only for the company’s data center clients but also for its underlying shares.

Jensen Huang, Nvidia’s CEO, expanded further on the status of the Blackwell chip rollout in an interview with Bloomberg Television, immediately following the Q2 earnings call.

3. The new $50 billion buyback

As part of its Q2 earnings report, Nvidia announced a massive new $50 billion stock buyback program, a move that undoubtedly caught the market’s attention.

On the surface, this is a clear positive—it signals Nvidia’s confidence in its future and its belief that its shares are a good investment at current prices. By reducing the number of outstanding shares, buybacks can also boost earnings per share (EPS), and potentially drive the underlying stock’s price higher. For investors, the buyback may represent an attractive way for Nvidia to return value, especially when you consider the company’s strong cash position.

However, there’s a flip side to the buyback narrative. Nvidia’s growth prospects are among the most exciting in the tech world, particularly in AI and data centers. Critics might therefore argue that the company should be funneling more capital into R&D, acquisitions or other growth initiatives, instead of “manufacturing" stock price gains through buybacks. There’s also the concern that this move may indicate a lack of high-return investment opportunities.

While the buyback is a vote of confidence from Nvidia, it also raises questions about the company’s strategic priorities and whether it's the best use of its substantial resources at a time of fierce competition and rapid technological advances.

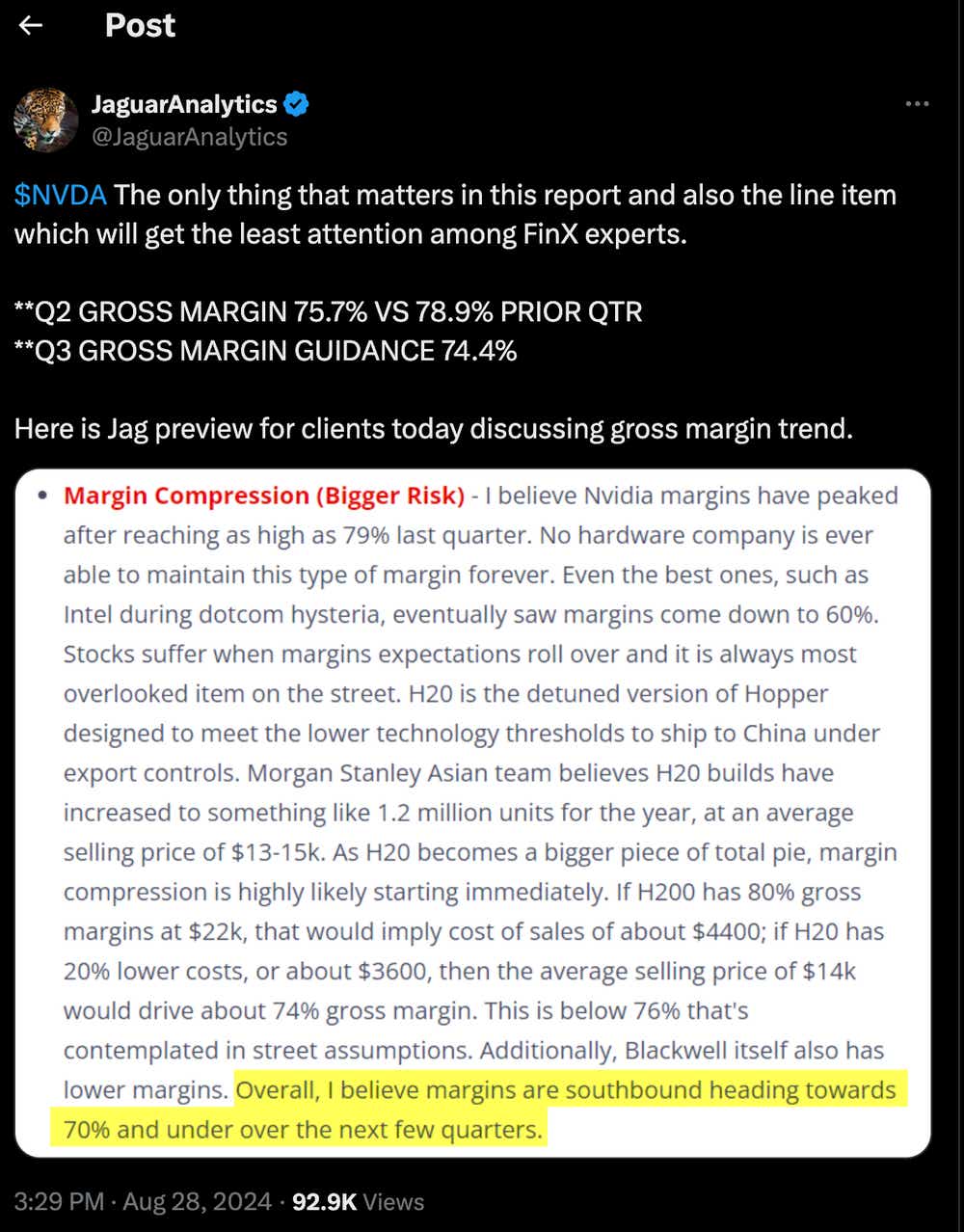

4. Margins have weakened but remain strong

Gross margin, a critical financial metric, offers insight into a company’s overall financial health. It represents the difference between the cost of producing goods and the revenue generated from selling them. The higher the gross margin, the more money a company keeps from every dollar of sales, after covering production and operating costs. Gross margin is a vital indicator because it provides insight into a company’s pricing power, cost management and profitability.

In Nvidia’s latest earnings report, gross margin took a noticeable dip, declining from 78% in Q1 to 75% in Q2. That isn’t exactly a red flag, but it does raise some eyebrows. A decrease like this could suggest Nvidia is facing higher production costs, perhaps dealing with supply chain pressures or that it’s been forced to price its products more aggressively to maintain demand.

In Q3, Nvidia expects its gross margin to clock in around 75%, but the exact figure—74.4%—would be lower than what was observed in Q2 (75.7%), although not by much. Going forward, investors will be watching closely to see whether gross margins deteriorate further. If that comes to pass, it would represent an incremental negative.

5. Risks intensify in the data center division

Nvidia's data center division has been the powerhouse behind its recent growth, with Q2 revenue reaching a record $26.3 billion, up 154% year-over-year. However, the 16% growth from Q1 to Q2 signals a slowdown compared to the previous quarter, raising concern about Nvidia's heavy reliance on this segment. Notably, quarter-over-quarter growth was higher at 23% from Q4 of last year to Q1 of this year, illustrating how the 16% growth from Q1 to Q2 might be interpreted as disappointing.

With other segments—such as gaming and professional visualization—showing more modest performance, Nvidia’s reliance on its data center division could become a double-edged sword. The data center segment now accounts for much of Nvidia’s revenue, making the company particularly vulnerable if growth in that area slows further.

Moreover, any downturn in AI-driven demand or increased competition could disproportionately affect Nvidia’s overall financial performance. Investors should keep a close eye on how Nvidia navigates this risk, especially as competition in the data center market heats up.

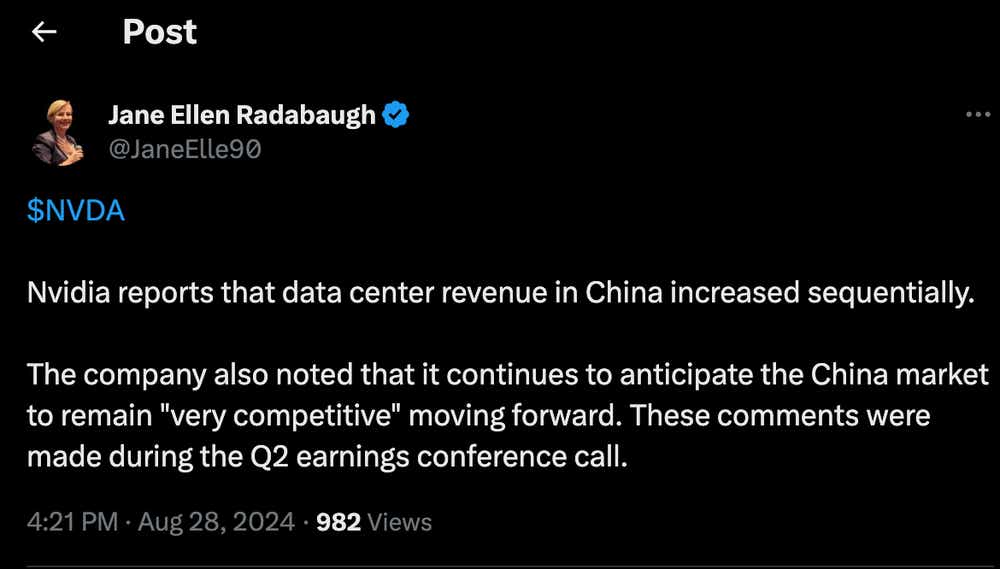

6. China remains a factor

Nvidia’s dominance in the global semiconductor market could face some challenges, particularly in China, a crucial market for the company. During Nvidia’s Q2 conference call, the company’s chief financial officer, Colette Kress, noted that “our data center revenue in China grew sequentially in Q2 and is a significant contributor to our data center revenue.”

This dependency makes the company vulnerable to fluctuations in the Chinese market. The ongoing economic slowdown in China, driven by a mix of weak consumer demand and regulatory uncertainties, could at some point weaken Nvidia's sales in the region. Moreover, increasing competition from local players adds another layer of risk because Nvidia might have to resort to more aggressive pricing , which could further compress margins.

Adding to these challenges are U.S. restrictions on doing business in China. The U.S. has imposed limits on the export of advanced semiconductor technology to Chinese companies, aiming to curb the country’s access to cutting-edge tech that could have military applications. For Nvidia, these restrictions limit its ability to sell its most advanced products in one of its key markets. This not only reduces potential revenue growth, but also opens the door for Chinese competitors to develop and deploy homegrown technology in the absence of high-quality alternatives.

The investment outlook

Nvidia’s Q2 earnings showcased strong performance, reinforcing its leading role in AI and data centers. However, a few challenges have emerged alongside those positive results.

Growth in the data center division, while still strong, is beginning to slow. That raises concerns about Nvidia’s heavy reliance on this segment. The highly anticipated Blackwell chip, critical for advancing data center technology, faces uncertainty because of potential delays. Meanwhile, other segments, like gaming and professional visualization. are delivering only modest gains.

These issues have likely contributed to the mixed reaction to the company’s Q2 earnings report, as investors reassess Nvidia’s near-term trajectory. While the company remains formidable, maintaining its momentum may be more challenging now. Plus a complex road lies ahead.

Nvidia has a market capitalization of roughly $3 trillion, and the company’s stock has appreciated by about 160% year-to-date (not including the move after earnings). At the close of trading yesterday, shares were priced at about $125 per share. According to The Wall Street Journal, 61 analysts cover Nvidia, with 47 rating the stock a buy, nine rating it overweight and five rating it a hold. Based on those 61 ratings, the average price target for Nvidia is $142 per share.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.