How stocks move around NVDA's earnings release

How stocks move around NVDA's earnings release

High volatility is expected post Nvidia earnings release. Plus, two trade ideas.

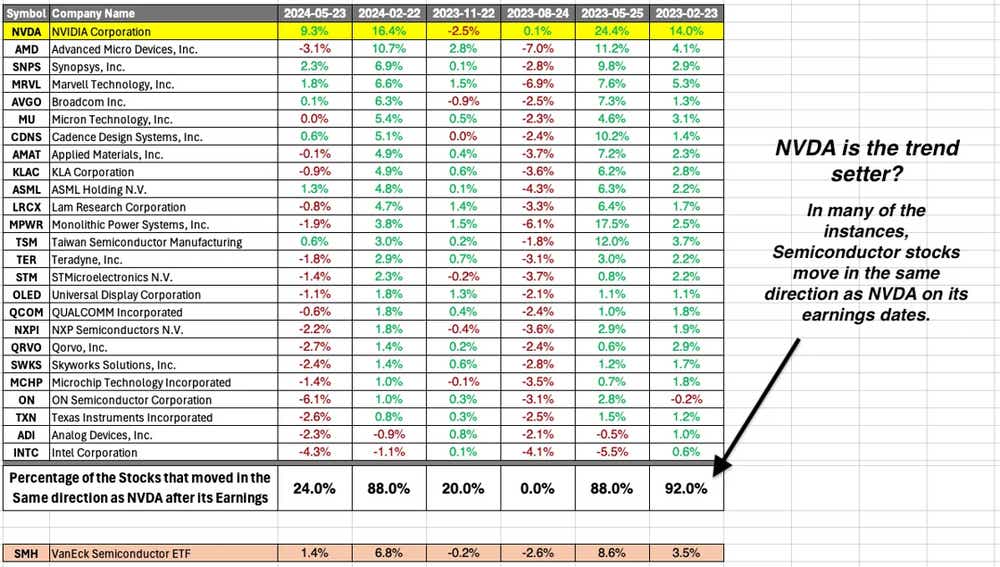

Tomorrow’s Nvidia (NVDA) earnings release has the potential power to affect the major indices. Some 22% of the Semiconductor ETF (SMH) weight is in NVDA. It also makes up 7% of the S&P 500 (SPY) and 8% of the Nasdaq (QQQ).

_earnings.webp?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

NVDA's influence on competitors

Last earnings, NVDA’s price moved 9% after its release, and the earnings before that was 16%. High volatility is expected.

Below we show how other Semiconductor companies moved on NVDA’s previous six earnings quarters.

Other big names in earnings

Some big names besides Nvida that report earnings this week include Crowdstrike Holdings (CRWD), Salesforce (CRM), Lululemon Athletica (LULU) and Ulta Beauty (ULTA).

NVDA is the most anticipated earnings coming out this week:

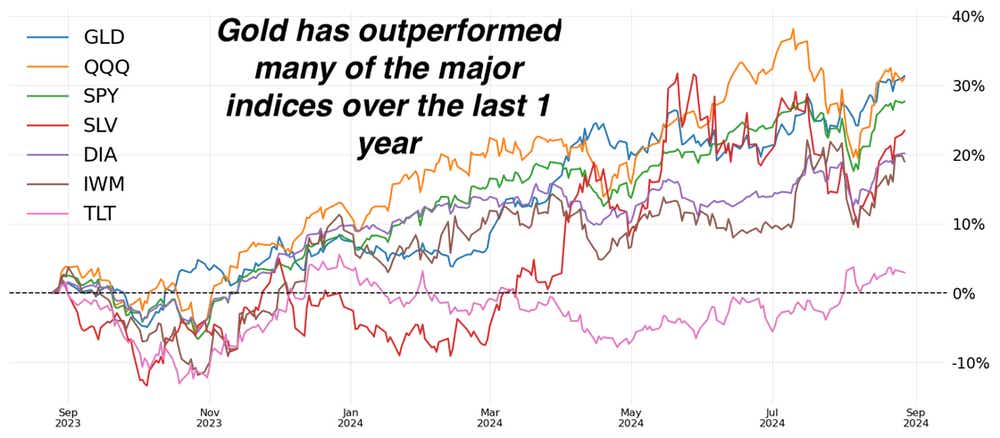

Gold outperforms ...

It’s always about context, but for the past year, gold is outperforming the overall indices.

Two trade ideas

SMH ($243) broken wing butterfly (AUG30)

1. NVDA earnings are on tap this week—it accounts for nearly 22% of the weighting in SMH, the semiconductor ETF. If you think it might move higher but don't want the downside risk with NVDA near highs, a broken wing butterfly would fit the assumption. Using the weekly expiration, long the 247.5 call, short 1x of the 250 and 255 call, and long a 265 wing trades for a $0.38 credit, no risk to the downside and up to an additional $250 if the ETF expires between 250-255.

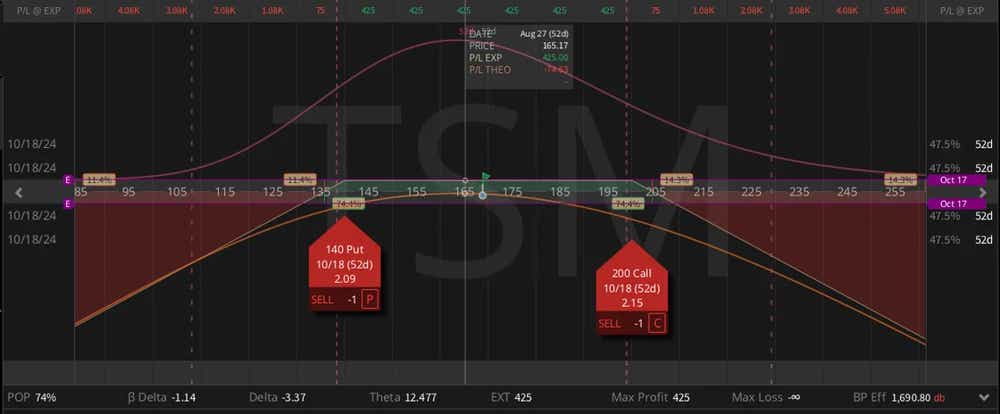

2. TSM ($168) short strangle (OCT)

TSM is the second largest holding in the SMH ETF at almost 14%. It tends to move with a high correlation to NVDA, but much lower beta. If you think NVDA might be an inside move—or at least a significant vol crush in the space—a wide strangle in TSM would fit the assumption. Short the 140/200 strangle is a roughly one standard deviation strangle trading at $4.25 with risk starting at new highs, or nearly new lows over the last couple months.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.