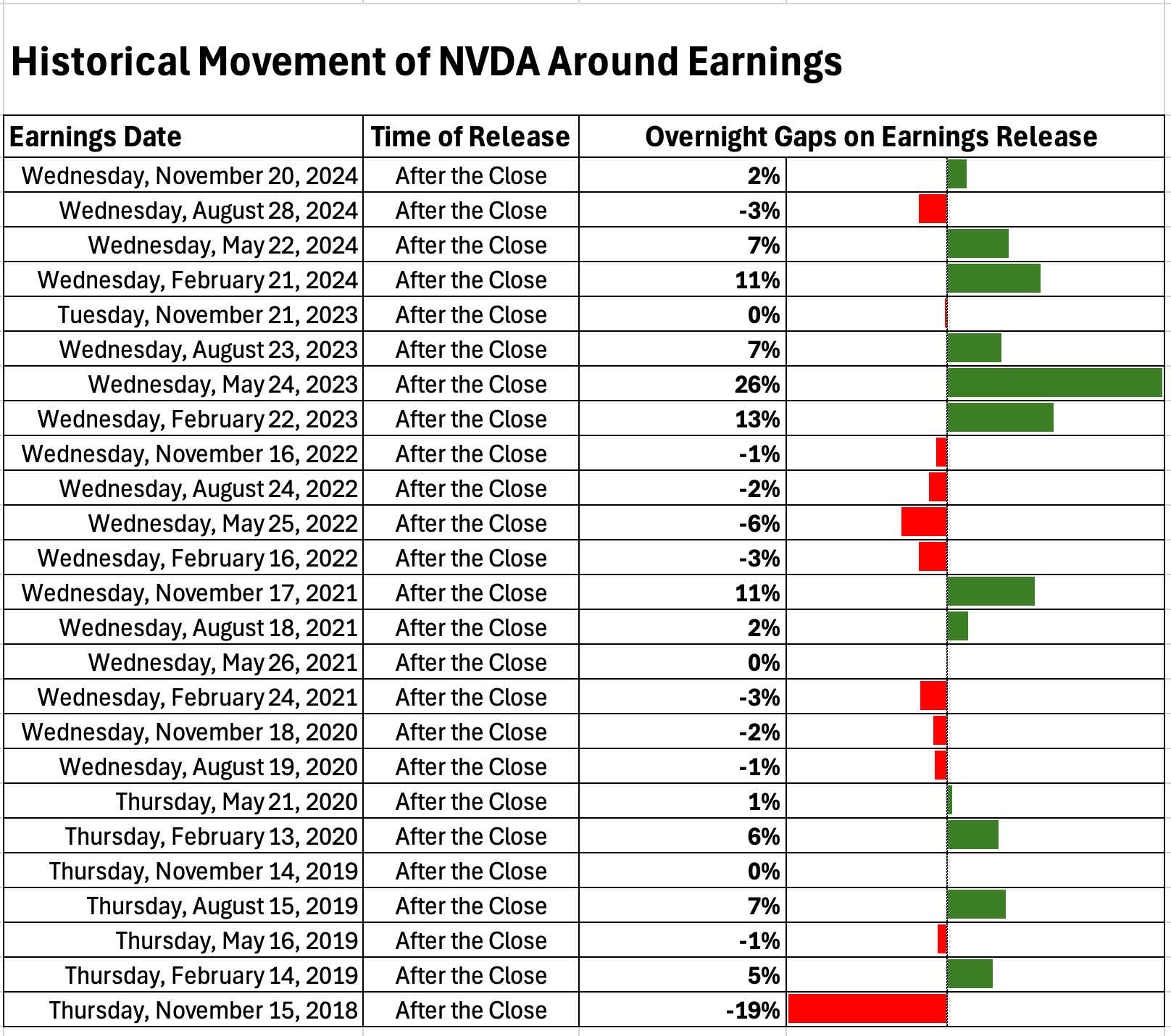

Nvidia Earnings Tomorrow: What to Expect

Nvidia Earnings Tomorrow: What to Expect

Given its weight in the VanEck Semiconductor ETF, NVDA’s earnings can create outsized volatility in the semiconductor sector.

Nvidia (NVDA) will report quarterly earnings after the market closes tomorrow, which could move the broader market significantly. The expected move, as of this morning, is expected to be ±$13, or roughly a 10% move.

Historically, overnight gaps in NVDA after earnings have averaged a slightly positive move, but with a standard deviation of ±8%. This suggests the stock moves up or down by 8% with a 68% probability (one standard deviation range) after reporting.

Given its 19% weight in the VanEck Semiconductor ETF (SMH), NVDA’s earnings can create outsized volatility in the semiconductor sector. A big beat or miss could pull the whole exchange-traded fund (ETF) up or down sharply.

With 7% of SPY and 8% of QQQ, NVDA’s earnings can move broad market indices as well, making it a key stock to watch for overall market sentiment.

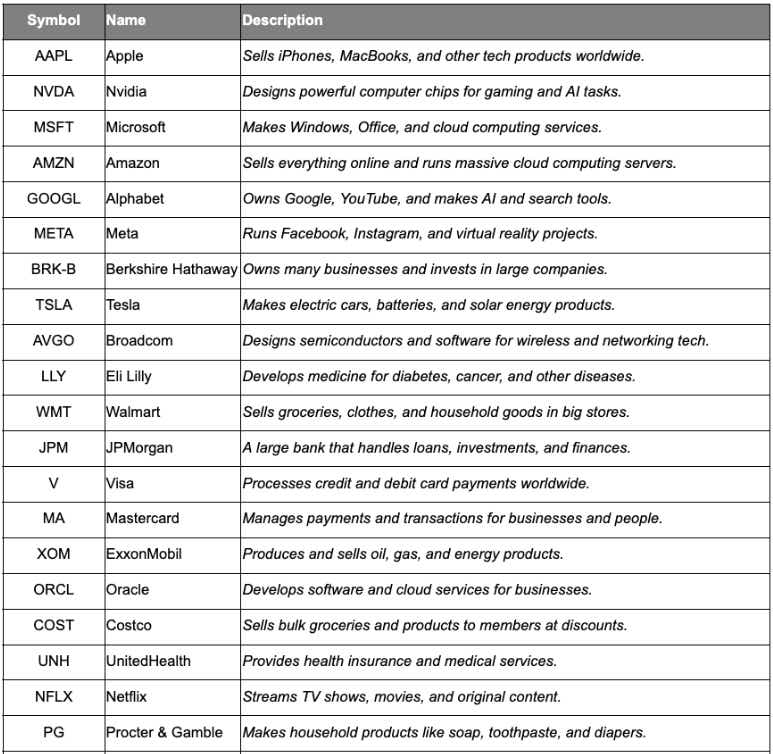

20 Stock Ideas for Kids and Grandkids

My kids are interested in the stock market. Instead of letting them pick any stock freely, I give them a choice of three from the list below. This list represents the top 20 stocks by market capitalization in the S&P 500—what I call "dad-approved."

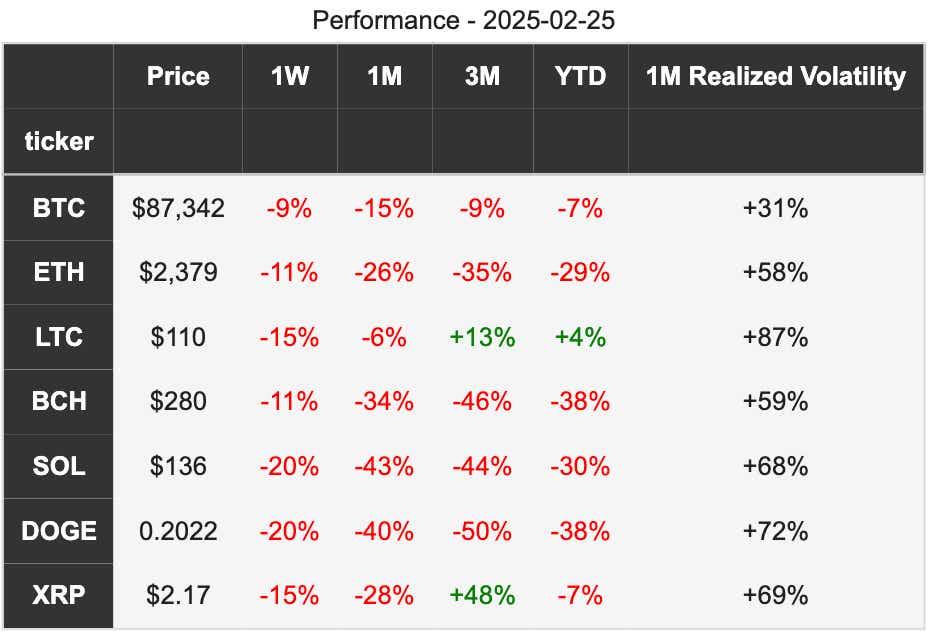

Crypto Movements

The Trump administration was "expected" to be favorable for crypto, but the market has declined. This highlights the inherent randomness of markets.

Todays ~8% down move is the seventh largest since the start of 2023.

The following coins can all be traded on tastytrade.

Two trade ideas

SPX ($5927) Iron Condor (APR17w) $6.60 Credit

Volatility continues to get bitten into this down move, with the VIX reaching 21 this morning. Is it the end of the sell-off? Who knows? But with vol this high, it's an interesting spot to play for some volatility contraction and maybe a bounce. Selling the 5600/5580 put spread and the 6225/6245 call spread is a delta-neutral, short-vol play with roughly a +/- 5% buffer during the next 51 days.

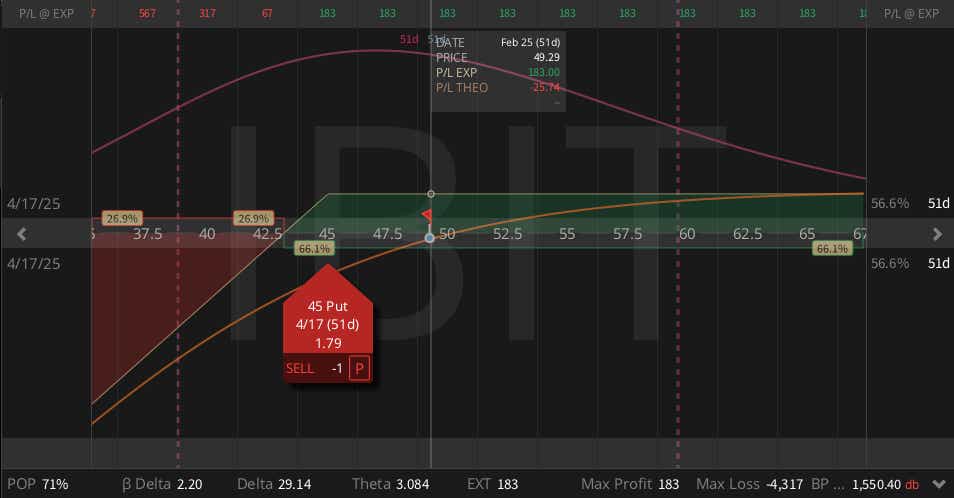

IBIT ($48) Short Put (APR) $1.79 Credit

Bitcoin has finally broken the 90,000-110,000 range, down almost 9% today with one of the biggest downside moves since 2022. If you think it might be a bit overdone, IBIT is a liquid ETF to trade spot bitcoin. Selling the 45 strike put represents a roughly $80,000 price on spot bitcoin, which is a roughly 30 delta, $1.79 in credit, and a roughly 10% ROC if IBIT stays above 45 (Bitcoin > 80k) through April.

Subscribe to Cherry Picks to be Cool. We’re OK with grifters, but to be on our good side by subscribing to our newsletter.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.