Crude Oil Prices Rise as Key Spread Narrows: Where to for WTI?

Crude Oil Prices Rise as Key Spread Narrows: Where to for WTI?

Crude Oil Prompt Spread Falls to Multi-Year Lows

Crude oil prices rose about 1.5% on Monday after an upbeat U.S. housing sentiment survey buoyed worries about a slowing economy. The housing sentiment index from Fannie Mae showed that potential homebuyers were more confident in December than they were the month prior. While not directly linked to an oil-sensitive industry, the results are encouraging for the broader economy.

The Monday bounce comes after a heavy week of losses for crude oil prices. The U.S. benchmark—West Texas Intermediate (WTI)—fell more than 8% last week. Brent crude prices—the global benchmark—saw similar losses. Optimism quickly faded over China’s reopening as virus cases surged, forcing many to remain indoors out of fear of the virus.

Crude Oil Market Dynamics

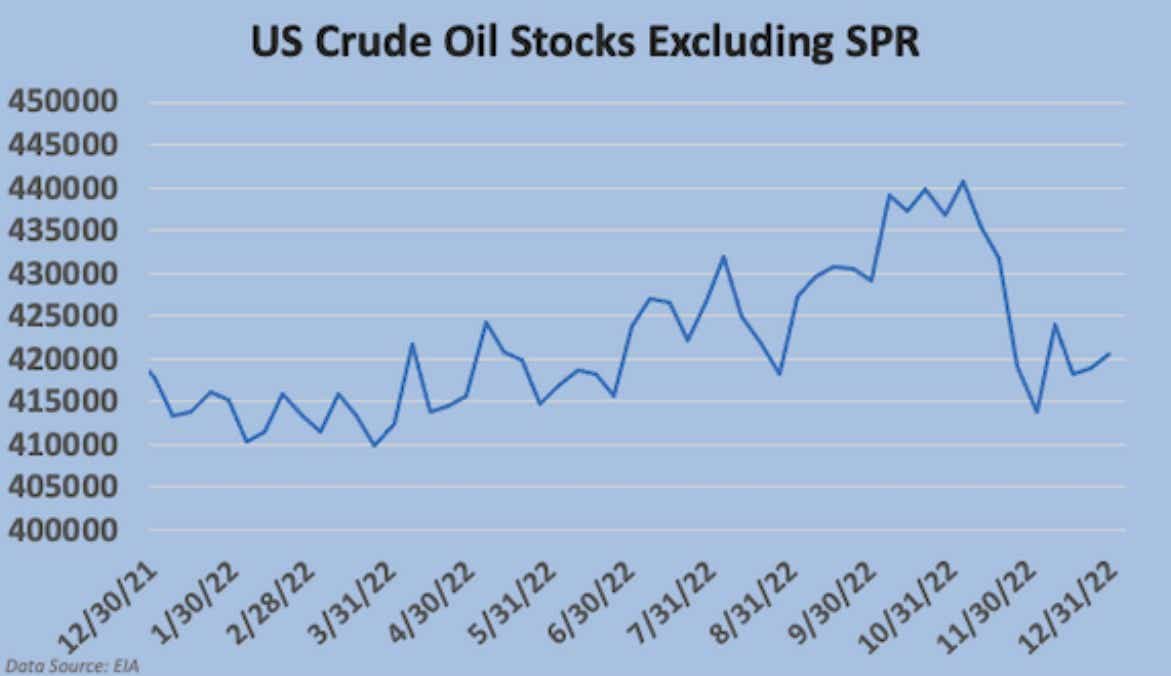

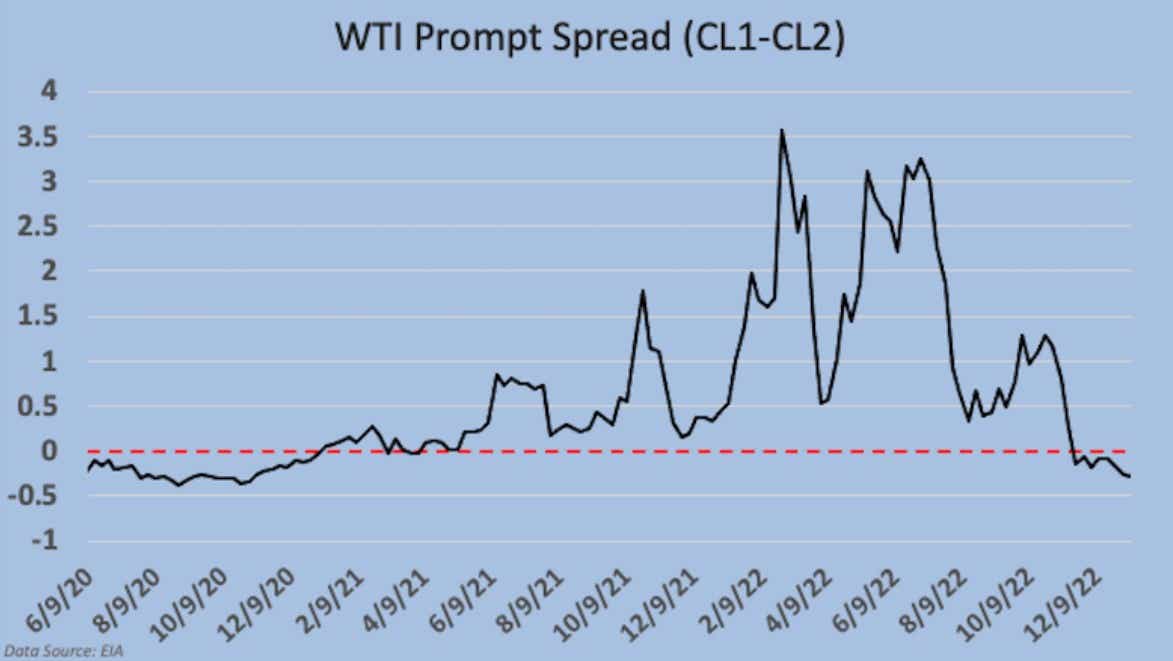

Low inventory levels around the globe have many analysts calling for higher oil prices. The United States has made only marginal progress in boosting storage. But slowing economic growth amid central bank tightening is throttling positive traction in sentiment. The WTI prompt spread, the difference between front-month and next-month prices in the futures market, fell to the lowest level since November 2020.

The discount for the front-month prices is typically seen as a bearish sign for price due to weakening supply and demand imbalances. The latest data from the U.S. Energy Information Administration (EIA) showed a 1.7-million-barrel increase in crude oil stocks for the week ending December 30.

That said, if this week’s weekly EIA data due on Wednesday shows another inventory build, crude prices may reverse lower and resume last week’s downward trend. The Bloomberg consensus forecast showed a -2.37-million-barrel draw on Monday. That potentially sets up oil prices for a volatile immediate reaction if we see a positive number cross the wires.

Potential Oil Trades to Play This Week

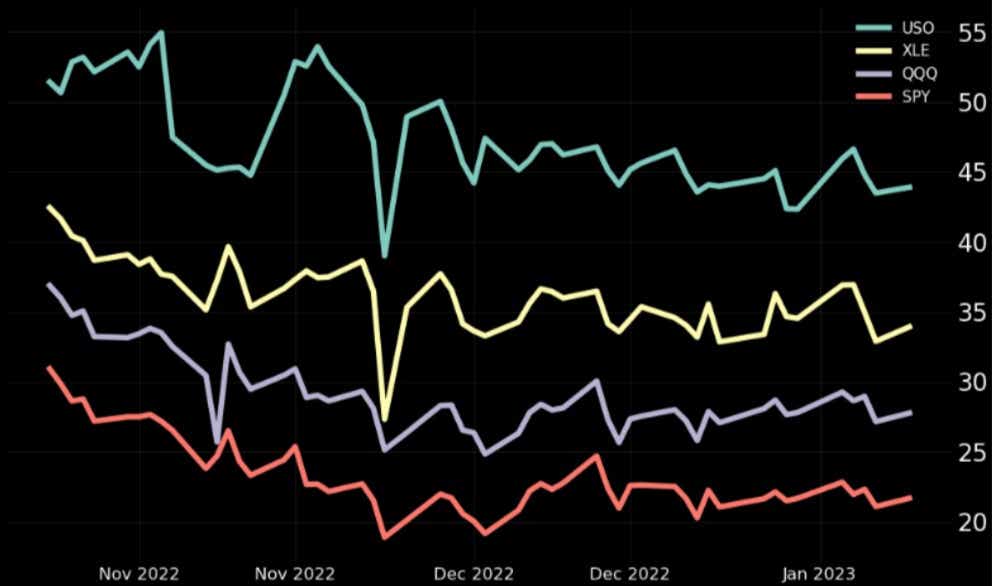

The high implied volatility in the USO fund and XLE energy ETF relative to SPY and QQQ (shown in the chart below) makes them a potentially interesting pick for traders who wish to sell premium. If a trader believes that oil stockpiles are set to increase, which would likely lead to a drop in prices, placing a short call spread may be a desirable trade setup in the weeks ahead.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.