Natural Gas Prices Down Big: Traders May Target High IVR

Natural Gas Prices Down Big: Traders May Target High IVR

Natural Gas Prices Fall to Near Multi-Year Lows

U.S. Henry Hub natural gas prices (/NG) traded about 7% lower on Tuesday, adding to its recent losses and putting the benchmark on track to lose around 20% since the start of the month. That move follows a brutal 35.4% drop back in December. Prices are probing levels not traded since December 2021. European prices have seen a similar trend, earlier this month, prices printed the lowest number since November 2021.

Warm Weather Expectations Paint a Bearish Picture for Natural Gas

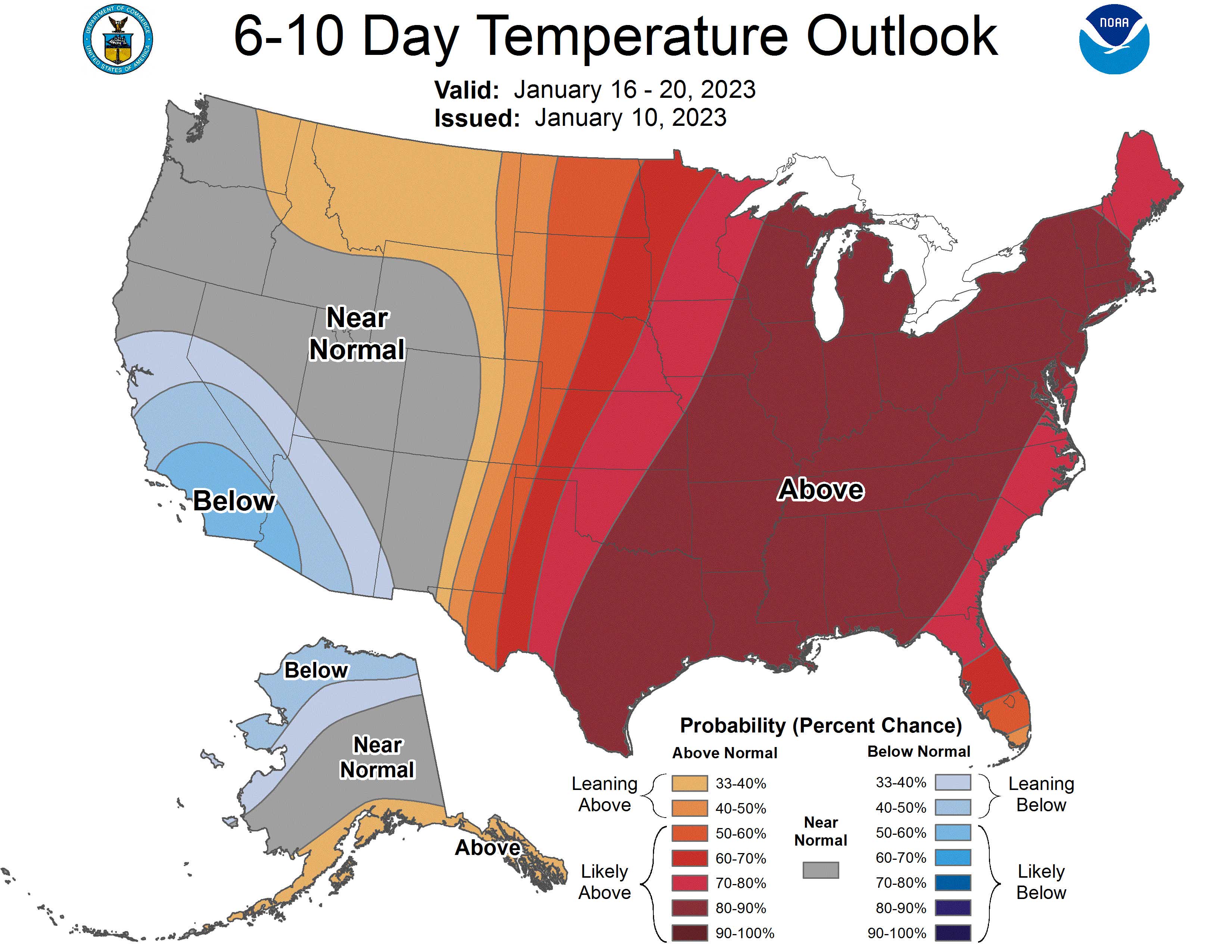

Warm winter weather across the United States and Europe has weighed on demand. For a Europe without Russia’s supply, it’s a godsend. It is also a welcome development for the U.S., where prices were at record highs just six months ago. And more warm weather is on the way, according to weather forecasting. The NOAA/National Weather Service’s 6-10 Day Temperature Outlook shows a very high probability (>70%+) for above-average temperatures in the Eastern United States.

Trading Strategy at Current Price Levels

Forecasting a directional move for prices is difficult, given the precarious conditions. On way hand, prices are near multi-year lows, which may underpin prices over the short term after weeks of steep losses, which could cause shorts to take profits. On the other hand, the weather is expected to remain well above average—a possible heatwave could drive prices even lower.

That said, taking a delta-neutral stance while being bearish on volatility makes sense for several reasons.

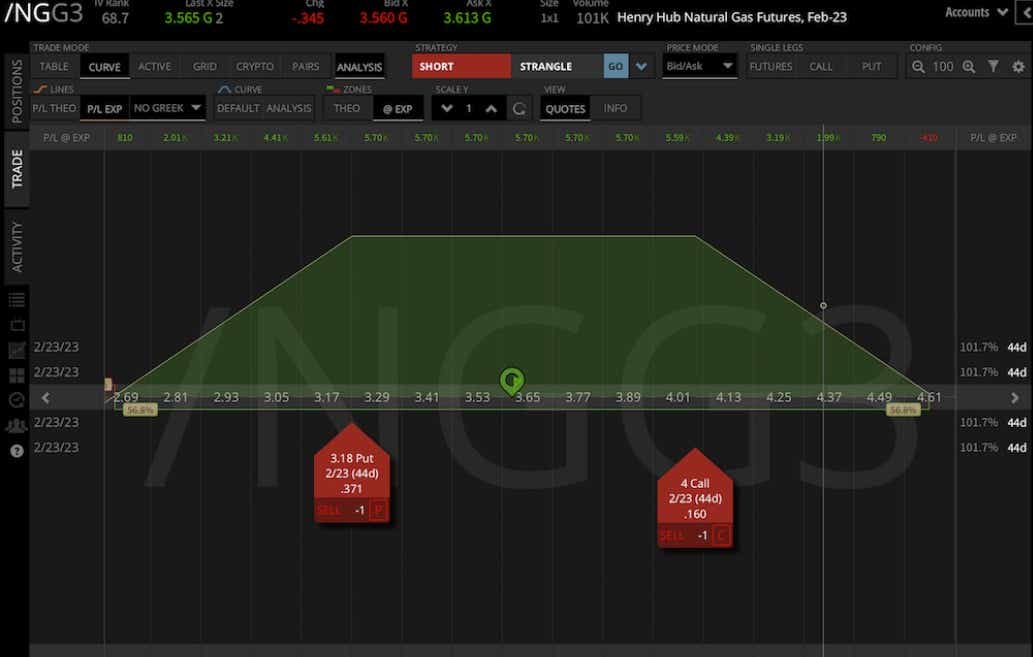

First, the recent price declines have driven implied volatility (IV) much higher than average—with a 68.5% IV rank. That reading suggests an IV reversion to the mean. That, along with prices at potential support, may protect prices from further downside. Second, a price rally in natural gas is unlikely over the short term if weather forecasters are correct.

Along with the high IV, current IV rank, and the commodity’s fundamentals, a short strangle trade could be a ripe strategy to collect premium. However, because of the risk profile of the trade, prudent management is vital, including monitoring underlying price drivers such as weather forecasts and weekly inventory levels. An iron condor could reduce some of those risks but at the cost of premium. Otherwise, moving your strikes further apart for less credit may be attractive. The example below demonstrates the P/L dynamics of a short strangle (it is not intended as a trade suggestion.)

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.