Nasdaq 100 Grapples with Meta AI Investment and Weaker Texas Instrument Guidance

Nasdaq 100 Grapples with Meta AI Investment and Weaker Texas Instrument Guidance

Also, 10-year T-note, silver, natural gas and Japanese yen futures

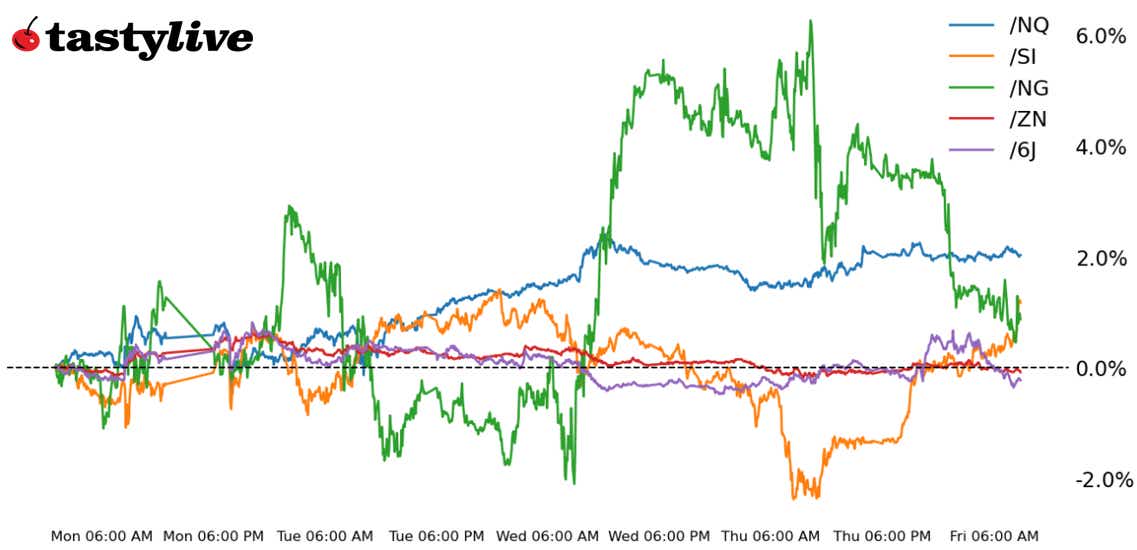

- Nasdaq 100 E-mini futures (/NQ): -0.01%

- 10-year T-note futures (/ZN): -0.03%

- Silver futures (/SI): +2.17%

- Natural gas futures (/NG): -2.61%

- Japanese yen futures (/6J): -0.38%

It’s a slow start for stocks this morning at the end of a week where the SPX cash index hit a new all-time high. Soft earnings and guidance from Texas Instruments is taking some of the punch out of tech stocks—semiconductors in particular—even as Meta announced an increase in capex spending on AI infrastructure immediately. Bonds are modestly higher after President Donald Trump said he’d “rather not” put tariffs on China, which has likewise sparked a move higher in metals. Despite the Bank of Japan’s 25-basis-point (bps) rate hike, the Japanese yen is the worst-performing major currency on the day, trailed only by the U.S. dollar.

Symbol: Equities | Daily Change |

/ESH5 | -0.08% |

/NQH5 | -0.01% |

/RTYH5 | -0.32% |

/YMH5 | -0.14% |

Nasdaq futures (/NQH5) were nearly flat through early morning trading today as Trump’s stance on trade continued to moderate. His administration signaled he is open to negotiating on tariffs instead of placing broad trade restrictions unilaterally. U.S. indexes are set to record their second week of gains as we head into one of the busiest weeks for corporate earnings. Novo Nordisk (NVO) rallied about 10% after positive results for its weight-loss drug were released. However, Texas Instruments (TXN) fell about 5% after the chip maker posted weak earnings results.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5775 p Short 5875 p Short 6450 c Long 6550 c | 63% | +737.50 | -4262.50 |

Short Strangle | Short 5875 p Short 6450 c | 67% | +2025 | x |

Short Put Vertical | Long 5775 p Short 5875 p | 83% | +462.50 | -4537.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.02% |

/ZFH5 | -0.01% |

/ZNH5 | -0.03% |

/ZBH5 | -0.06% |

/UBH5 | -0.05% |

Bonds fell across much of the curve, although the losses were modest. The 10-year T-note futures (/ZNH5) fell 0.03% in early trading. The contract is on pace to record a small loss for the week amid inflationary concerns around Trump’s trade policies. If President Trump continues to moderate his stance on tariffs, it could allow more downside for bond prices. However, his tax policies may affect yields as more information comes out in the coming weeks and months.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106 p Short 111 c Long 112 c | 66% | +218.75 | -781.25 |

Short Strangle | Short 106 p Short 111 c | 71% | +500 | x |

Short Put Vertical | Long 105 p Short 106 p | 87% | +125 | -875 |

Symbol: Metals | Daily Change |

/GCG5 | +0.97% |

/SIH5 | +2.17% |

/HGH5 | +0.2% |

News last night that U.S. President Trump and Chinese President Xi Jingping had a productive conversation, with the former noting he’d “rather not” must go down the tariff route. That’s been good news for growth-related commodities. Gold prices (/GCG5) have hit a fresh yearly high, returning to levels last seen on election day; silver prices (/SIH5) are pressing the downtrend from the October and December 2023 swing highs.

Strategy (61DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.25 p Short 28 p Short 34.75 c Long 35.5 c | 63% | +945 | -2805 |

Short Strangle | Short 28 p Short 34.75 c | 70% | +3770 | x |

Short Put Vertical | Long 27.25 p Short 28 p | 83% | +420 | -3330 |

Symbol: Energy | Daily Change |

/CLH5 | +0.02% |

/HOH5 | +1.21% |

/NGH5 | -2.61% |

/RBH5 | -0.03% |

Natural gas futures (/NGH5) fell today, dragging prices into negative territory for the week. Weather models for February are injecting caution into the market, with forecasters expecting cold air to retreat from the East Coast where energy demand is highly concentrated. Meanwhile, U.S. production has recovered over the past week to around 103 billion cubic feet per day.

Crude oil prices (/CLH5) were nearly flat Friday morning as traders took a pause following a week of losses. Traders see Trump’s energy policies and pressure on OPEC as being bearish for the oil market. There are still no significant actions on Iran or Venezuela's oil products, which could take off around 500,000 barrels per day from U.S. supply sources. February will likely bring more clarity on policies focused outside of domestic production, which leaves oil prices in limbo for now.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.65 p Short 2.8 p Short 4.05 c Long 4.2 c | 63% | +430 | -1070 |

Short Strangle | Short 2.8 p Short 4.05 c | 70% | +1540 | x |

Short Put Vertical | Long 2.65 p Short 2.8 p | 79% | +240 | -1260 |

Symbol: FX | Daily Change |

/6AH5 | +0.28% |

/6BH5 | +0.49% |

/6CH5 | +0.19% |

/6EH5 | +0.48% |

/6JH5 | -0.38% |

The Bank of Japan did as expected, hiking rates by 25bps to bring their main rate to 0.5%. However, a lack of strong forward guidance regarding the next hike left traders wanting more, leaving the Japanese yen (/6JH5) in the dust as the worst performing major currency on the day. FX markets have been slowly shifting into a more risk-on footing; the U.S. dollar’s ($DXY) multi-month uptrend has broken.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.00625 p Short 0.0066 c Long 0.00675 c | 65% | +362.50 | -1512.50 |

Short Strangle | Short 0.00625 p Short 0.0066 c | 68% | +537.50 | x |

Short Put Vertical | Long 0.0061 p Short 0.00625 p | 86% | +162.50 | -1712.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.