Nasdaq 100 Drops as NFP Crushes Fed Interest Rate Cut Odds

Nasdaq 100 Drops as NFP Crushes Fed Interest Rate Cut Odds

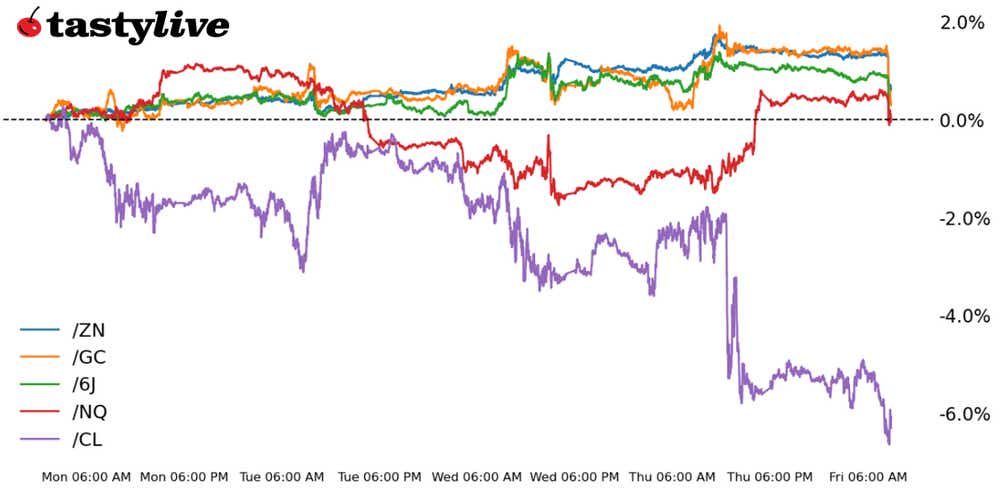

Also 10-year T-note, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.30%

- 10-year T-note futures (/ZN): -0.93

- Gold futures (/GC): -1.18%

- Crude oil futures (/CL): -0.66%

- Japanese yen futures (/6J): -1.18%

'The U.S. economy has started 2024 on strong footing, and the latest jobs report may suggest the economy is actually gaining positive momentum. But that is much to the detriment of stocks and bonds, which have been jolted lower amid another dramatic repricing because of the odds of a Federal Reserve interest rate cut.

The nonfarm payrolls report showed a headline gain of 353,000 vs. the consensus forecast of 180,000 (though it should be noted the end of the UAW strikes accounted for 28,000 jobs). The household employment survey indicated the unemployment rate (U3) held steady at 3.7% against a forecast of rising to 3.8%; workers reported 31,000 fewer jobs than in December. The labor force participation rate dropped to 62.4% from 62.8%.

But the biggest surprise in the data series was the wage figures, which showed an unexpected re-acceleration. Average hourly earnings increased by 0.6% month over month vs. the expected 0.3% month over month. Year over year hourly wages rose 4.5% vs. the forecast of 4.1%. Wages feed into inflation expectations, which took a turn higher after the data.

Overall, the January U.S. jobs report provoked a sharp pullback in both bonds and stocks, with the Russell 2000 (/RTYH4) leading the way lower. Both the S&P 500 (/ESH4) and Nasdaq 100 (/NQH4) remained in positive territory after trading higher after hours yesterday following the better than expected earnings results from Amazon (AMZN) and Meta Platforms (META).

Symbol: Equities | Daily Change |

/ESH4 | +0.03% |

/NQH4 | +0.30% |

/RTYH4 | -1.14% |

/YMH4 | -0.35% |

Nasdaq futures (/NQH4) are standing apart from the pack when it comes to equity trading today. Impressive earnings reports from Meta and Amazon are helping to keep the technology index afloat as the S&P 500 treads water and the small-cap Russell 2000 sinks. /NQ is trading near its recent all-time highs and would likely be higher if it were not for this morning’s jobs report that pushed back rate cut expectations.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17000 p Short 17100 p Short 17900 c Long 18000 c | 20% | +1220 | -780 |

Short Strangle | Short 17100 p Short 17900 c | 36% | +8730 | x |

Short Put Vertical | Long 17000 p Short 17100 p | 60% | +540 | -14760 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.38% |

/ZFH4 | -0.74% |

/ZNH4 | -0.93% |

/ZBH4 | -1.41% |

/UBH4 | -1.71% |

Treasury yields are rising across the curve after this morning’s jobs report reinforced the hawkish case for the Federal Reserve to push the start of rate cuts beyond March. 10-year T-note futures (/ZNH4) are down nearly 1%, with the underlying yield headed back up near the 4% mark. That, along with a recent adjustment in the Treasury’s funding outlook, may see yields continue the upward march for a while.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 109.5 p Short 114.5 c Long 115 c | 58% | +156.25 | -343.75 |

Short Strangle | Short 109.5 p Short 114.5 c | 66% | +640.63 | x |

Short Put Vertical | Long 109 p Short 109.5 p | 90% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCJ4 | -1.18% |

/SIH4 | -2.56% |

/HGH4 | -0.64% |

Gold futures (/GCJ4) fell as traders digested the U.S. jobs data, with the chances for a March rate cut quickly vanishing. That is bad for gold and silver because they are non-interest-bearing-assets. A stronger dollar and higher Treasury yields will likely keep the selling pressure on precious metals until next week when markets get a chance to recalibrate.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2000 p Short 2010 p Short 2090 c Long 2100 c | 35% | +570 | -430 |

Short Strangle | Short 2010 p Short 2090 c | 56% | +3680 | x |

Short Put Vertical | Long 2000 p Short 2010 p | 71% | +330 | -670 |

Symbol: Energy | Daily Change |

/CLH4 | -0.66% |

/HOH4 | -1.11% |

/NGH4 | 0.00% |

/RBH4 | -1.13% |

Crude oil prices (/CLH4) fell for a third day this morning as concerns about China’s economy accelerate and tensions in the Middle East see a chance of cooling. Still, the U.S. is expected to begin a retaliatory campaign against Iranian-backed forces in Iraq and Syria, which many expect to start tonight. Other signs in the oil market, such as the prompt spread, indicate physical markets are likely weakening, something that is also being reflected by key crack spreads.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 69 p Short 71 p Short 76 c Long 78 c | 33% | +1300 | -700 |

Short Strangle | Short 71 p Short 76 c | 56% | +4310 | x |

Short Put Vertical | Long 69 p Short 71 p | 62% | +680 | -1320 |

Symbol: FX | Daily Change |

/6AH4 | -0.45% |

/6BH4 | -0.59% |

/6CH4 | -0.37% |

/6EH4 | -0.60% |

/6JH4 | -1.18% |

Japanese yen futures (/6JH4) retraced gains from the past couple of days after the U.S. jobs report charged the dollar. While traders still see the Bank of Japan tightening policy later this year, the benefits to the yen have been undercut by a less dovish Federal Reserve, which has help up U.S. rates to the detriment of the Japanese currency.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.00665 p Short 0.00695 c Long 0.007 c | 56% | +187.50 | -437.50 |

Short Strangle | Short 0.00665 p Short 0.00695 c | 64% | +562.50 | x |

Short Put Vertical | Long 0.0066 p Short 0.00665 p | 83% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.