Nasdaq Futures Trying to Break Three-Day Losing Streak

Nasdaq Futures Trying to Break Three-Day Losing Streak

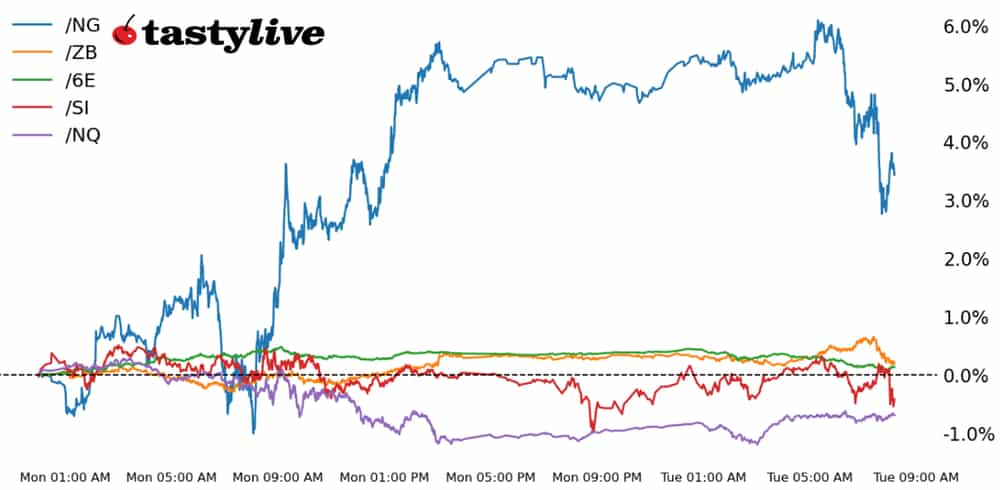

Also, 30-year T-bond, silver, natural gas and euro futures

Nasdaq 100 E-mini futures (/NQ): +0.48%

30-year T-note futures (/ZB): 0%

Silver futures (/SI): -0.14%

Natural gas futures (/NG): -1.1%

Euro futures (/6E): -0.26%

Tuesday trading is producing a mirror image of yesterday: The S&P 500 and Nasdaq 100 are higher while the Dow Jones 30 and Russell 2000 are lower. Bond yields are mixed once again, though a more consistent directional push may come later in the day after the two-year Treasury note auction. Elsewhere, energy prices are holding onto recent gains while precious metals continue to scratch and claw around key support levels. In foreign exchange (FX) markets, signs of political stress may be starting to emerge as traders gear up for the first round of the French parliamentary elections this weekend.

Symbol: Equities | Daily Change |

/ESU4 | +0.24% |

/NQU4 | +0.48% |

/RTYU4 | -0.20% |

/YMU4 | -0.16% |

Nasdaq futures (/NQU4) rose 0.34% this morning despite overnight losses in European stocks. Traders brushed off hawkish commentary from Federal Reserve Governor Michelle W. Bowman, who it is not yet the appropriate time to cut rates. Meanwhile, Nvidia (NVDA) seems to be recovering from its recent selloff, up over 3% in pre-market trading. FedEx (FDX) reports today after the bell.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18250 p Short 18500 p Short 21000 c Long 21250 c | 65% | +1210 | -3790 |

Short Strangle | Short 18500 p Short 21000 c | 71% | +4500 | x |

Short Put Vertical | Long 18250 p Short 18500 p | 86% | +550 | -4450 |

Symbol: Bonds | Daily Change |

/ZTU4 | 0% |

/ZFU4 | -0.02% |

/ZNU4 | -0.03% |

/ZBU4 | 0% |

/UBU4 | -0.07% |

30-year T-Bond futures rose about 0.07% this morning, with prices remaining near the top of a range carved out over the last week. The March swing high will come into focus if traders can push prices above 120’19, and the technical structure is showing a potential bull flag pattern. Consumer confidence data, regional Fed indexes and a two-year note auction are due today, any of which has the possibility of moving bond prices.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 114 p Short 115 p Short 125 c Long 126 c | 62% | +281.25 | -718.75 |

Short Strangle | Short 115 p Short 125 c | 70% | +1156.25 | x |

Short Put Vertical | Long 114 p Short 115 p | 85% | +156.25 | -843.75 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.23% |

/SIU4 | -0.14% |

/HGU4 | -0.76% |

Silver prices (/SIU4) remain below the 30 level, and there is no sign so far that traders are ready to reestablish a bullish trade, with prices 10% below the May swing high. Precious metals traders likely need to see bond prices make a new leg higher, and geopolitical risks from a potential Israeli invasion into Lebanon aren’t materializing in the metal.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 26 p Short 26.25 p Short 33.25 c Long 33.5 c | 65% | +310 | -940 |

Short Strangle | Short 26.25 p Short 33.25 c | 73% | +3285 | x |

Short Put Vertical | Long 26 p Short 26.25 p | 85% | +150 | -1100 |

Symbol: Energy | Daily Change |

/CLQ4 | -0.31% |

/HON4 | +0.49% |

/NGQ4 | -1.1% |

/RBN4 | +0.2% |

Natural gas prices (/NGQ4) trimmed some of yesterday’s gains this morning, down 2.34% as traders turn more bearish on the commodity on the threat of higher U.S. production. That concern is growing despite bullish weather forecasts that show above-average temperatures for much of the U.S. over the next several weeks. However, a series of higher highs and higher lows remain in place since early May, and price action isn’t threatening that bullish posture yet.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.3 p Short 2.35 p Short 3.3 c Long 3.35 c | 63% | +120 | -380 |

Short Strangle | Short 2.35 p Short 3.3 c | 77% | +740 | x |

Short Put Vertical | Long 2.3 p Short 2.35 p | 88% | +50 | -450 |

Symbol: FX | Daily Change |

/6AU4 | -0.19% |

/6BU4 | -0.06% |

/6CU4 | +0.03% |

/6EU4 | -0.26% |

/6JU4 | -0.06% |

Euro futures (/6EU4) are down as markets continue to grapple with the potential risks posed by the upcoming elections in France. The vote could shift the power balance to the right, stoking fears that the country’s fiscal policy could be upended. Factory activity has also signaled a slowdown in the Eurozone, putting the recovery in question and threatening progress toward the European Central Bank’s policy shift.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.05 p Short 1.055 p Short 1.095 c Long 1.1 c | 57% | +200 | -425 |

Short Strangle | Short 1.055 p Short 1.095 c | 66% | +775 | x |

Short Put Vertical | Long 1.05 p Short 1.055 p | 84% | +112.50 | -512.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.