Nasdaq 100 Leaks Lower as Yields Drop, While Metals’ Resiliency Continues

Nasdaq 100 Leaks Lower as Yields Drop, While Metals’ Resiliency Continues

Also, 30-year T-bond, silver, crude oil and Japanese yen futures

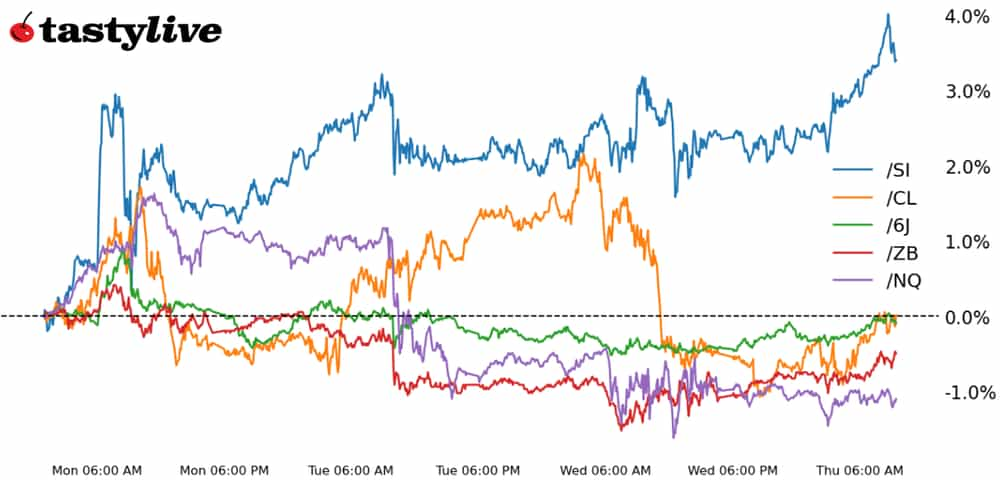

- Nasdaq 100 E-mini futures (/NQ): -0.21%

- 30-year T-bond futures (/ZB): +0.45%

- Silver futures (/SI): +1.65%

- Crude oil futures (/CL): +0.46%

- Japanese y en futures (/6J): +0.46%

The national day of mourning for President Jimmy Carter’s funeral sees U.S. equity markets closed and equity index futures trading with a truncated session. Interest rates and ag futures will close at 1:15 p.m. CST. Crypto, energy, FX and metals futures will remain open all day long.

Symbol: Equities | Daily Change |

/ESH5 | -0.18% |

/NQH5 | -0.21% |

/RTYH5 | -0.12% |

/YMH5 | -0.07% |

U.S. equity index futures closed this morning at 9:30 a.m. EST, but the overnight hours produced a modest sell-off. The Nasdaq 100 (/NQH5) traded barbs with the Russell 2000 (/RTYH5) to see which could lead to the downside, as all of the major indexes continue to trade in congestion patterns that offer little directional bias.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19750 p Short 20000 p Short 22700 c Long 22900 c | 65% | +1190 | -3810 |

Short Strangle | Short 20000 p Short 22700 c | 72% | +5460 | x |

Short Put Vertical | Long 19750 p Short 20000 p | 83% | +750 | -4250 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.05% |

/ZFH5 | +0.13% |

/ZNH5 | +0.2% |

/ZBH5 | +0.45% |

/UBH5 | +0.67% |

The December Federal open Market Committee (FOMC) meeting minutes yielded few surprises, although concern about the impact of tariffs and how they could influence the path of inflation are running high. Treasury auctions proved weaker at the start of the year, but yesterday’s 30-year bond auction stopped through, a sign that investors find current yields palpable enough in the short-term. Stability in global bond markets (mainly, the U.K.) may be flowing across borders as well.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 109 p Short 117 c Long 120 c | 65% | +687.50 | -2312.50 |

Short Strangle | Short 109 p Short 117 c | 69% | +1062.50 | x |

Short Put Vertical | Long 106 p Short 109 p | 82% | +421.88 | -2578.13 |

Symbol: Metals | Daily Change |

/GCG5 | +0.8% |

/SIH5 | +1.65% |

/HGH5 | +1.76% |

Metals, both base and precious, have proved resilient in recent days amid a bump higher in yields and the U.S. dollar, leaving them well-positioned to take advantage of a friendlier atmosphere today. Copper prices (/HGH5) are up over 6% this week, while silver prices (/SIH5) have erased nearly all their losses since the start of December 2023. A turn back above 31 in /SIH5 means the uptrend from the August and November 2023 lows has been retaken.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.5 p Short 28.25 p Short 34.25 c Long 35 c | 66% | +915 | -2835 |

Short Strangle | Short 28.25 p Short 34.25 c | 72% | +2915 | x |

Short Put Vertical | Long 27.5 p Short 28.25 p | 83% | +450 | -3300 |

Symbol: Energy | Daily Change |

/CLG5 | +0.46% |

/HOG5 | +0.63% |

/NGG5 | -0.14% |

/RBG5 | +0.12% |

Energy markets continue to yo-yo, with each of the four products swinging between gains and losses on a daily basis for the past week. Notably, crude oil prices (/CLG5) appeared to be failing in their bullish breakout attempt yesterday. But retention of the trendline from the July and October 2024 swing highs, plus a close above the one-week moving average, are keeping bulls in the game.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 64 p Short 64.5 p Short 82.5 c Long 84 c | 62% | +380 | -1120 |

Short Strangle | Short 64.5 p Short 82.5 c | 70% | +1840 | x |

Short Put Vertical | Long 64 p Short 64.5 p | 78% | +260 | -1240 |

Symbol: FX | Daily Change |

/6AH5 | -0.21% |

/6BH5 | -0.45% |

/6CH5 | -0.04% |

/6EH5 | -0.02% |

/6JH5 | +0.46% |

All major currencies save the Japanese yen (/6JH5) are down against the U.S. dollar despite the fact U.S. Treasury yields are lower on the day. Price action today is reminiscent of a classic risk-off move more than anything else. A quiet calendar the rest of the day, thanks to the closure of U.S. markets, will keep traders focused on the release of the December U.S. jobs report tomorrow morning.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.006 p Short 0.00615 p Short 0.00665 c Long 0.0068 c | 67% | +387.50 | -1487.50 |

Short Strangle | Short 0.00615 p Short 0.00665 c | 71% | +662.50 | x |

Short Put Vertical | Long 0.006 p Short 0.00615 p | 85% | +187.50 | -1687.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.