Nasdaq 100 E-minis, 10-Year T-Notes, Gold, Crude Oil and Euro Futures

Nasdaq 100 E-minis, 10-Year T-Notes, Gold, Crude Oil and Euro Futures

Five futures in focus. Right here, every weekday morning.

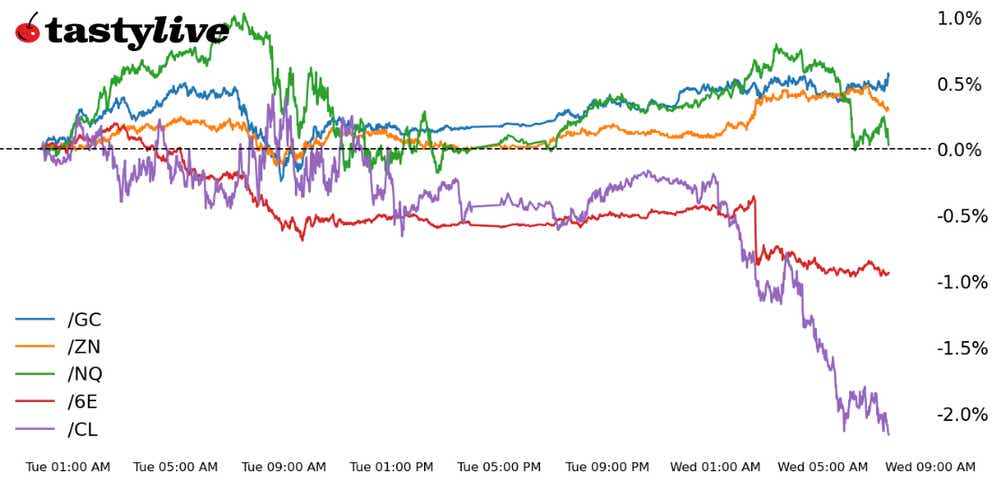

- Nasdaq 100 E-mini Futures (/NQ): +0.51%

- 10-Year T-Note Futures (/ZN): +0.01%

- Gold Futures (/GC): +0.20%

- Crude Oil Futures (/CL): -1.79%

- Euro Futures (/6E): -0.17%

The first bout of significant binary risk arrives on today when Nvidia (NVDA) announces earnings results. With options markets effectively pricing in a +/-11% move around the release, it’s likely a sizeable chunk of the action today arrives after U.S. cash equity markets close, keeping our attention on futures markets before the 5 p.m. EDT and immediately after their reopening for the Thursday session at 6 p.m. EDT.

Symbol: Equities | Daily Change |

/ESU3 | +0.18% |

/NQU3 | +0.27% |

/RTYU3 | +0.06% |

/YMU3 | +0.11% |

The bottoming efforts that were coming together on Monday found little follow-through on Tuesday, leaving markets in a bit of a lurch as we turn through the middle of the week. Failure to find any acceleration higher is a warning sign, indicating the underlying sentiment of the market has soured; we are no longer in ‘buy the dip’ part of the cycle. The ability of /ESU3 and /NQU3 to maintain turns higher, however, will ride or die with NVDA’s earnings—which may ultimately prove more consequential for equity markets than the Federal Reserve meeting later this week.

Strategy (2DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 14950 p Short 14960 p Short 14975 c Long 14980 c | 52% | +145 | -55 |

Long Strangle | Long 14970 p Long 14980 c | 45% | x | -5195 |

Short Put Vertical | Long 14970 p Short 14975 p | 51% | +40 | -60 |

Symbol: Bonds | Daily Change |

/ZTU3 | +0.05% |

/ZFU3 | +0.12% |

/ZNU3 | +0.23% |

/ZBU3 | +0.58% |

/UBU3 | +0.68% |

After hitting multi-month, multi-year and in some cases multi-decade highs earlier this week, U.S. Treasury yields have backed off modestly Tuesday and thus far today. Bonds are rallying, led by the long-end of the curve. Each of /ZNU3, /ZBU3 and /UBU3 are entering the U.S. trading session higher; and in concert with what’s happening in precious metals and FX markets, it appears this is a safe haven bid at work.

Strategy (2DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108.75 p Short 109 p Short 109.5 c Long 109.75 c | 35% | +156.25 | -78.13 |

Long Strangle | Long 109 p Long 109.5 c | 43% | x | -453.13 |

Short Put Vertical | Long 108.75 p Short 109 p | 69% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCU3 | +0.60% |

/SIU3 | +2.45% |

/HGU3 | +0.76% |

Gold prices are up nearly half a percent early today, building on earlier gains in the week. Treasury yields are slightly lower across the curve, which is helping to lift /GCU3, /SIU3 and /HGU3, even though the U.S. dollar is strengthening. U.S. purchasing managers' index (PMI) data from S&P Global is due this morning. Those numbers could influence the outlook on Fed rate hike bets, and thus gold prices. Meanwhile, silver prices are up over 2% as traders favor the metal, although the gold/silver ratio is trading toward lows not seen since mid-July.

Strategy (2DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1900 p Short 1905 p Short 1905 c Long 1900 c | 29% | +360 | -140 |

Long Strangle | Long 1905 p Long 1915 c | 44% | x | -1260 |

Short Put Vertical | Long 1900 p Short 1905 p | 75% | +110 | -390 |

Symbol: Energy | Daily Change |

/CLU3 | -1.38% |

/NGU3 | +0.66% |

U.S. oil prices (/CLU3) are down about $1.35 per barrel this morning as the malaise in the global economy deepens. Euro Area PMIs released overnight paint a gloomy picture for Europe’s private services sector, which fell to 48.3, according to the Hamburg Commercial Bank's (HCOB’s ) flash PMI gauge. That, compounded by recent woes in China, have seriously dented the demand outlook. Now, a short-term topping pattern (head and shoulders) appears to be coming together on /CLV3’s 4-hour chart. Today, the EIA will update inventory data for oil and distillate products for the week ending Aug. 18.

Strategy (2DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 78 p Short 78.25 p Short 78.75 c Long 79 c | 15% | +210 | -30 |

Long Strangle | Long 78.25 p Long 78.75 c | 48% | x | -1500 |

Short Put Vertical | Long 78 p Short 78.25 p | 56% | +100 | -150 |

Symbol: FX | Daily Change |

/6AU3 | -0.07% |

/6BU3 | -0.91% |

/6CU3 | -0.24% |

/6EU3 | -0.40% |

/6JU3 | +0.24% |

Stagflation is setting in across the Eurozone and the U.K. (per the latest PMI releases), a veritable death knell for currencies when central banks are increasingly facing the conundrum of continuing to raise rates to fight inflation and undermine growth, or halt their hiking efforts to try to restore growth at the cost of sustained higher inflation. It’s a policy corner that no central bank wants to get painted into, and yet that’s where the European Central Bank and the Bank of England find themselves, leaving both /6EU3 and /6BU3 under renewed pressure today.

Strategy (16DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.0775 p Short 1.08 p Short 1.085 c Long 1.0875 c | 22% | +262.50 | -50 |

Long Strangle | Long 108 p Long 1.085 c | 44% | x | -1300 |

Short Put Vertical | Long 1.0775 p Short 1.08p | 64% | +125 | -187.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.