Lululemon Earnings Preview—Can the Rally Continue?

Lululemon Earnings Preview—Can the Rally Continue?

By:Mike Butler

Analysts are feeling bullish because of reduced competition, but high volatility signals uncertainty

- Lululemon is set to report quarterly earnings after the market closes on Thursday.

- The company’s stock has a projected move this week of over an 8%.

- It missed revenue estimates last quarter, and earnings-per-share (EPS) and revenue estimates have been reduced.

- LULU is expected to report EPS of $2.72 on $2.36 billion in revenue.

- Analysts are in a bullish state because Lululemon competitors are leaving the athletic clothing business, but high implied volatility means we don't know what to expect.

LULU Earnings Preview

Lululemon Athletica (LULU) will report earnings after the market closes on Thursday, Dec. 5. The premium athletic apparel retailer has rebounded from annual stock price lows, but there are still plenty of question marks around the state of the company with a stock price move of over 8% projected for this week. Many analysts state they expect LULU stock to continue to recover with competitors like privately held Alo ditching the yoga/athleisure market with plans to shift to a luxury brand.

Lululemon is expected to report earnings per share (EPS) of $2.72 on $2.36 billion in revenue.

LULU stock is opening earnings week in a strong way with the stock price up over 4% today. However, the company opened 2024 at $508.57 and currently sits around $333 per share after bouncing off an annual low of $226.01 in August. All eyes are on this week's earnings announcement to see if the stock can continue to rebound.

LULU CEO Calvin McDonald offered words for the future in the last earnings call: “In the second quarter, Lululemon delivered revenue and earnings growth, with ongoing strength across our international business. In the U.S., our teams continue to optimize our product assortment and remain focused on driving forward our opportunities in the market. Looking ahead, we feel confident in the long runway in front of us as we execute on our Power of Three ×2 growth plan."

That plan is aimed at doubling the net revenue of $6.25 billion from 2021 to $12.5 billion by 2026. Product innovation, guest experience and market expansion are keys to the plan. Lululemon is setting out to double men's and e-commerce revenue relative to 2021 and to quadruple international net revenue.

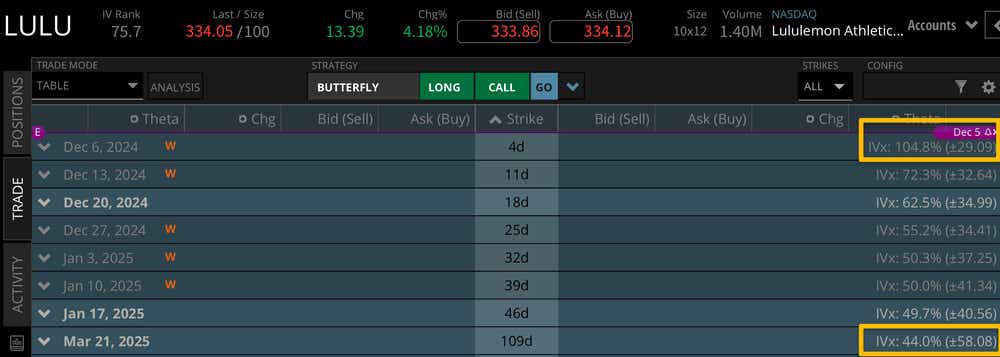

Looking at the implied volatility of the LULU options market can tell us about market sentiment around the size of the move for this week's earnings announcement. LULU stock has a +/- $29.09 expected move, just over 8% of the stock price. This is a large expected move relative to other earnings announcements that typically land between the 5%-10% notional value range. Looking to spring 2025, we see the stock has a +/- $58.08 expected move. That means this week makes up almost 50% of the expected range that spans a quarter of next year. Potential fireworks ahead!

Bullish on LULU stock for earnings

With competitor Alo potentially leaving the business sooner rather than later, it’s easier for Lululemon to take back marketshare and boost numbers. With that said, the company missed revenue estimates last quarter. EPS and revenue estimates have been reduced from last quarter, which could be seen as a blessing or a curse. If you're bullish on LULU for earnings, you're looking for a strong 2025 forecast and an EPS and revenue beat on Thursday.

Bearish on LULU stock for earnings

Reduced EPS and revenue estimates after an earnings miss could spell trouble if there is a consecutive miss in either category. LULU has made a strong recovery recently from lows, rallying over $100 in a few months. If you think this rally has a “too strong, too quick” feel and you're bearish on the stock for earnings, you're looking for mediocre or weak guidance for 2025 and an EPS or revenue miss.

Tune in to Options Trading Concepts Live on Thursday at 11 a.m. CST for a look at LULU options strategies ahead of the earnings announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.