Strong Dollar, Weak Market? Exploring the Supposed Connection

Strong Dollar, Weak Market? Exploring the Supposed Connection

By:Kai Zeng

Here’s how the value of the dollar affects the stock markets—or doesn’t

- The conventional wisdom is that a strong dollar has a negative effect on the stock market.

- But evidence shows a weak correlation between the dollar's value and stock market performance over the long term.

- Our research shows the correlation between the S&P 500 performance and the dollar's value is weak, at -0.17.

- Currently, the correlation is positive1 despite the dollar's high level.

Traders tend to believe a strong U.S. dollar puts negative pressure on the stock market. That means if the dollar's value is rising, the market is generally expected to trend downward—and vice versa.

When the U.S. dollar is strong, it can affect the market in several ways:

- Economic growth concerns: A strong dollar, especially with high interest rates, might slow economic growth, which can reduce investor confidence.

- Reduced competitiveness for global companies: For multinational companies earning a lot of their income overseas, a strong dollar means foreign revenues convert to fewer dollars, potentially reducing earnings.

- Investment yield shift: Investors might prefer bonds or other high-yield investments instead of stocks because of better returns in the debt market.

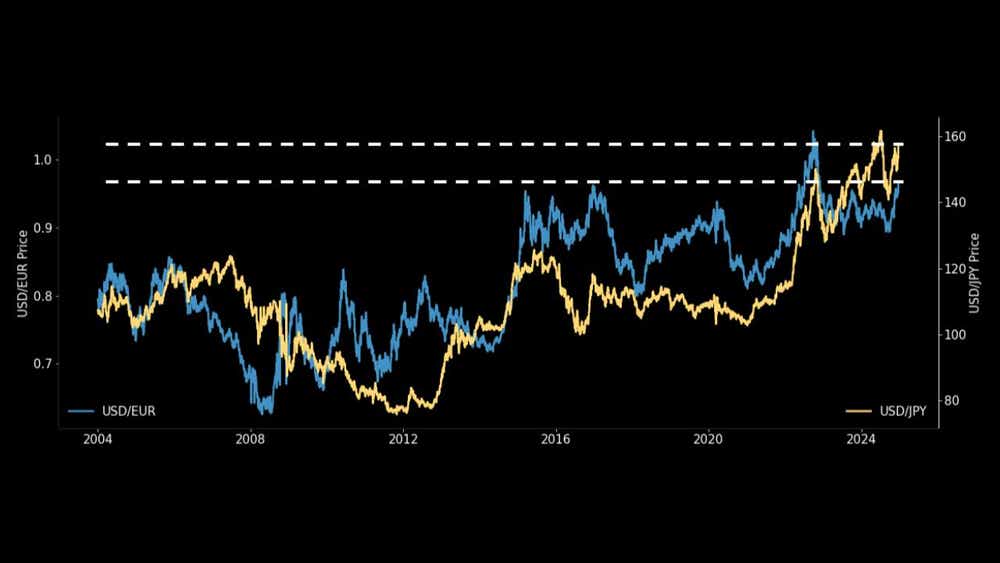

The U.S. dollar is at its strongest point in the past two decades. It's nearing its highest level against the yen and the euro.

Key Facts:

1. Interest rates:

The dollar is strong, and U.S. Treasury yields are at their highest since 2007, higher than in most developed countries.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

2. International exposure:

· Foreign revenue accounts for 28% of the S&P 500's total revenue.

· More than 3,000 U.S. companies, including 99 of the 100 largest industrial corporations, engage in foreign production.

· Major U.S. companies generate 41% of their revenue outside the U.S. For example, Intel earns 78.3% of its sales internationally, while Coca-Cola earns 68.6%.

Given this information, we want to see if the market supports the theory that a strong dollar negatively impacts stocks.

To address that question, we track the USDX index, which measures the dollar against six major currencies:

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Historically, the correlation between the S&P 500 performance and the dollar's value is weak, at -0.17. Currently, the correlation is positive despite the dollar's high level.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

We also looked at the five strongest and weakest years for the dollar since 1990 to see if its value significantly affects the stock market:

In the strongest dollar years, the correlation with market performance is weak, and the market often sees positive returns.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

In the weakest dollar years, the correlation is slightly stronger but still not significant. Overall, there's no strong pattern between dollar value and stock market performance over the long term.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.