The Surprising Pitfalls of Small Iron Condor Trades

The Surprising Pitfalls of Small Iron Condor Trades

By:Kai Zeng

Understand the critical differences between wide iron condors and small iron condors—it's not just the width

- The iron condor strategy could make sense for you.

- Learn how to manage your risk with small iron condors.

- Here is how wide iron condors differ from small iron condors.

In today's unpredictable trading landscape, marked by volatility in both equity and bond markets, the iron condor strategy presents a viable option for traders, especially those starting out.

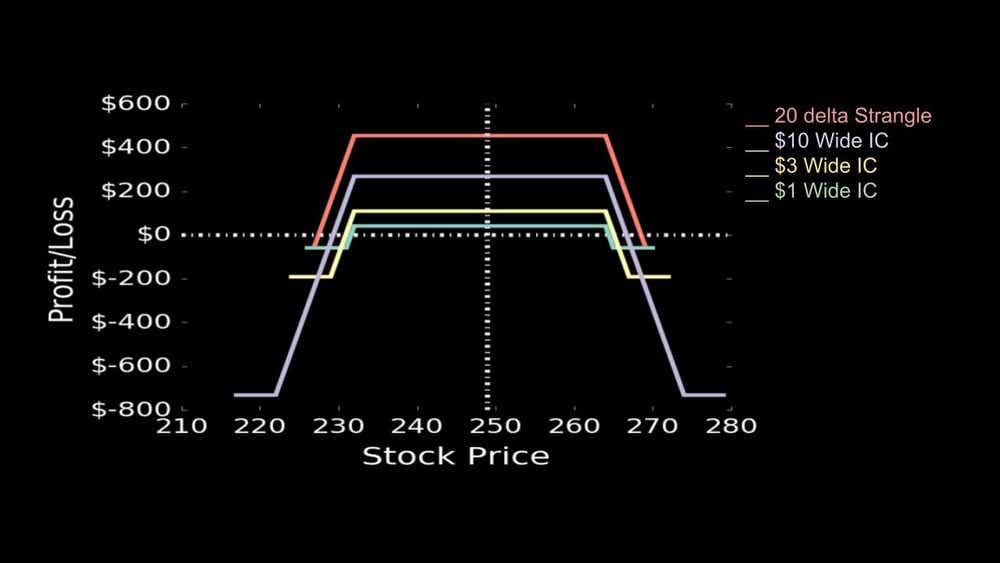

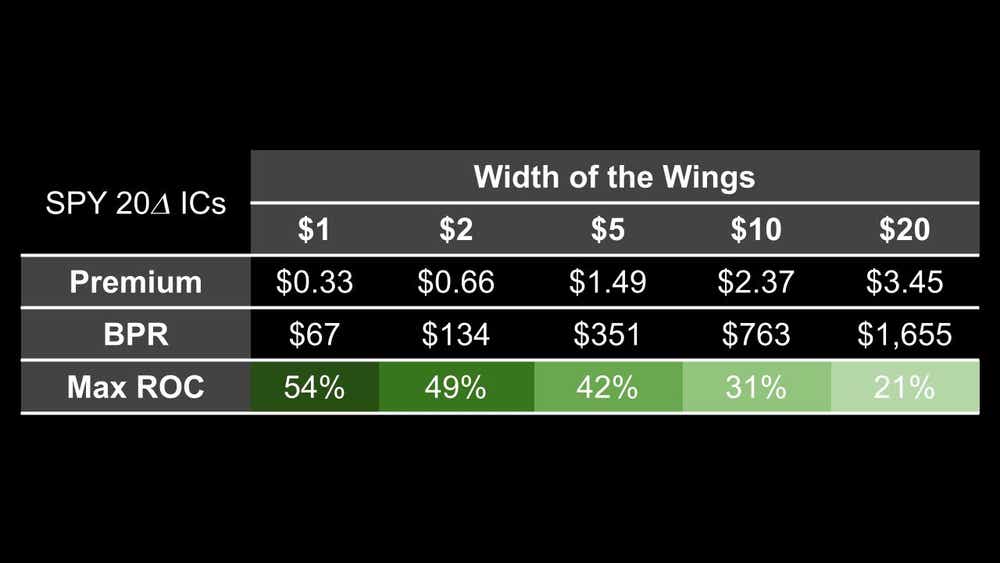

The beauty of this approach lies in its flexibility, which allows traders to determine the maximum risk of their position before entering an order. However, to truly capitalize on this strategy, a thorough understanding of its intricacies is crucial. One key aspect to consider is the size of the iron condor, as it can significantly affect the results.

Why use a small iron condor?

Small iron condors, with their narrow ranges, are often attractive to new traders. They require a low initial investment, have a capped risk, and offer the potential for high returns. On paper, these benefits make them an ideal choice for beginners.

However, the practical reality of trading small iron condors can differ from the theoretical advantages. The reduced premium leads to a lower probability of profit (POP) and tighter breakeven points. Those things introduce potential challenges.

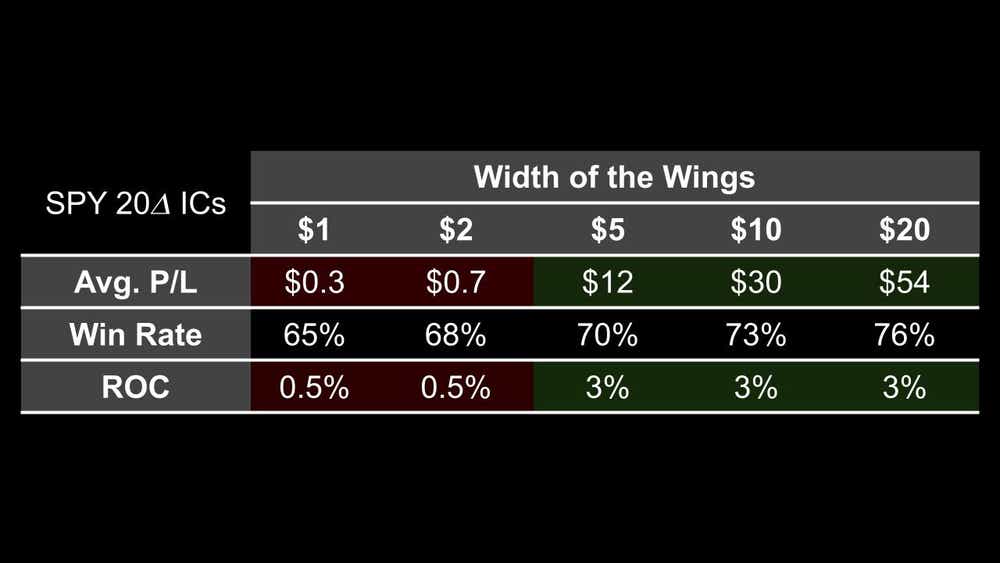

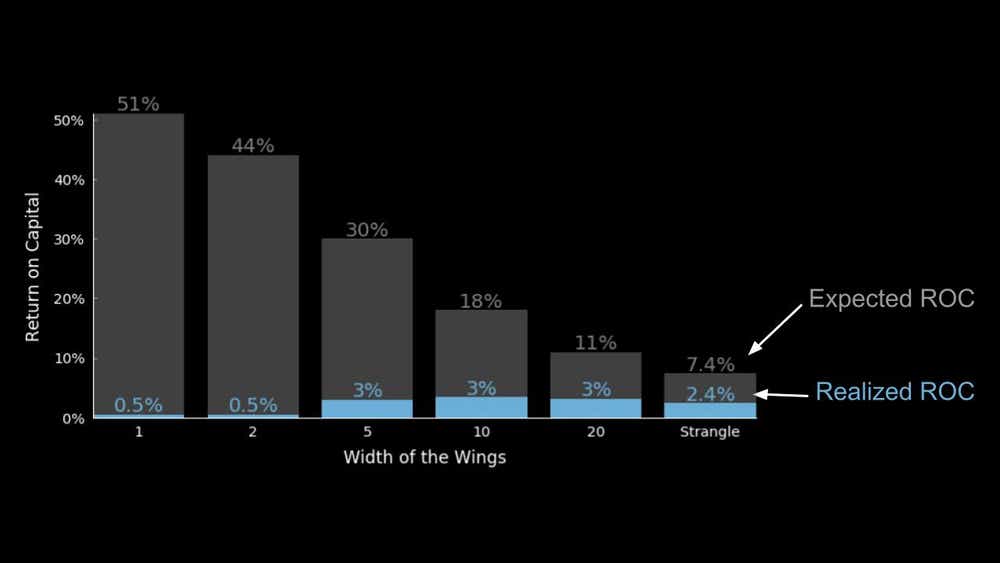

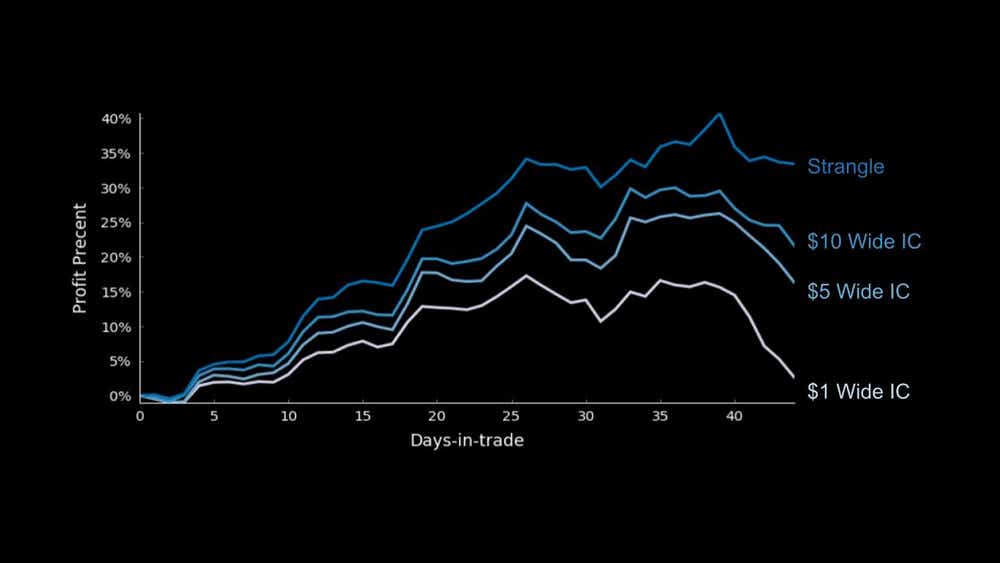

Historical data show that tightly sized iron condors, such as those that are $1 or $2 wide, have not been as profitable as their wider counterparts. This is because their profit/loss (P/L) volatility is significantly higher, resulting in a larger gap between expected and actual returns.

Additionally, these positions may take longer to reach their profit targets and have a higher number of losing positions.

Advantages of wide iron condors

On the other hand, wide iron condors, with their larger ranges, offer a higher likelihood of profit and wider breakeven points.

Experienced traders often prefer this option, as it involves a higher risk but also presents a higher potential payout. The risk-to-reward ratio is more favorable in the case of wide iron condors, making them a popular choice among successful traders.

In conclusion, although small iron condors may seem like an attractive choice for beginners, they may prove to be challenging in practice.

It is essential to look at the data, which points towards wide iron condors as a more sustainable and potentially profitable strategy, particularly for experienced traders.

Before implementing this approach, it is critical to thoroughly understand the risks and benefits of each option and carefully assess one's risk tolerance and trading goals. It is beneficial to consider widening the wingspan if it is feasible to do so.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.