How a Presidential Debate Could Affect the Markets

How a Presidential Debate Could Affect the Markets

Don’t rely on intuition or your expectations—they could be the direct opposite of what’s to come

We’ve received numerous questions regarding how the candidates statements in tonight’s presidential debate could influence the equities markets. While we've experienced a Donald Trump presidency, we haven’t seen a Kamala Harris presidency. However, we can perhaps make an assumption based on the historical performances of the markets and their outcomes.

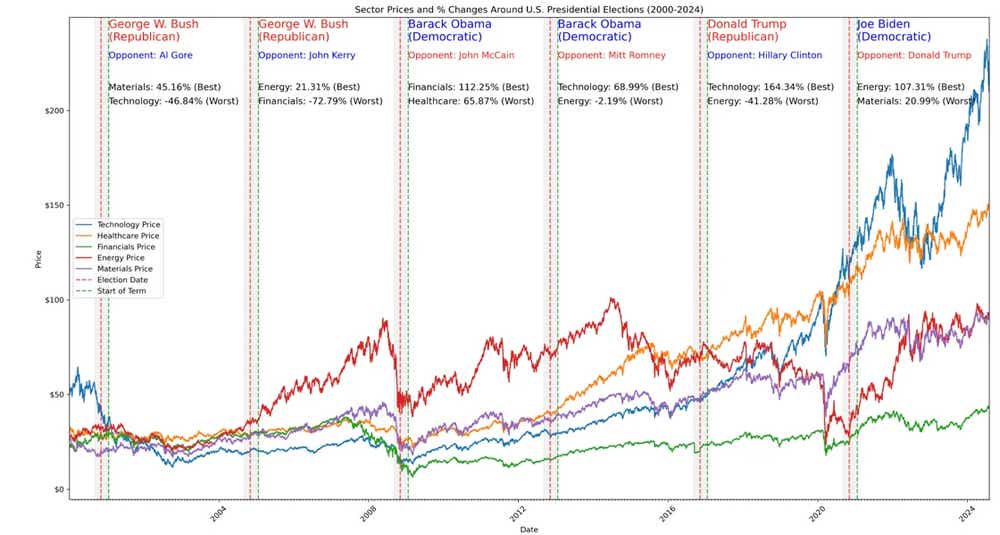

Some of the sectors performed contrary to expectations tied to political narratives.

As shown in the chart, the widespread belief the Trump administration would negatively affect the technology sector just wasn’t true. In fact, energy became a top performer under the Trump regime.

In similar fashion, the Biden administration, which was expected to be detrimental to energy, saw it become the best-performing sector. And energy suffered during the Trump presidency.

This shows just how difficult it can be to make predictions. So for help, we turned to PredictIt.org and downloaded historical data related to the election betting markets.

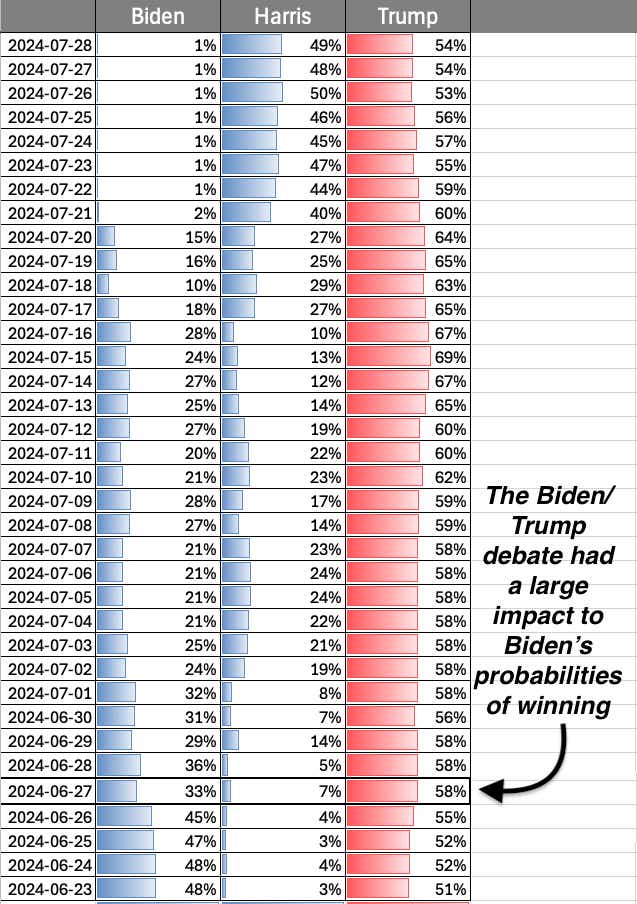

These markets operate like a bet ranging from $0.01 to $1.00. For example, if you buy a Trump ticket for $0.52, you’d receive $1.00 if he wins. Because markets often reflect public sentiment, paying $0.52 suggests a 52% probability of Trump winning. These probabilities fluctuate daily based on events like debates and other developments.

First, you’ll see how the election markets were influenced when Biden had a bad debate performance.

In tonight’s contest between Trump and Harris, much hinges on how the markets interpret their performance and to what degree it will have influence.

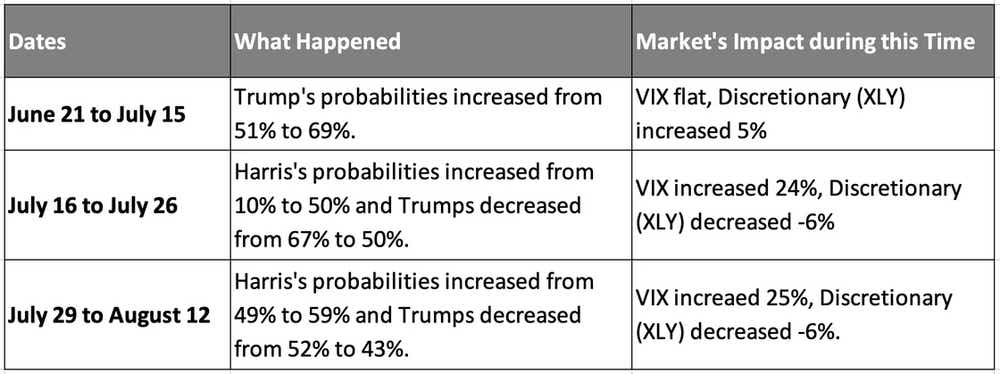

While many factors come into play during a presidential debate, such as the Japan currency unwind and interest rate meetings, the data suggests the market is displaying uncertainty around Harris—particularly consumer discretionary (XLK).

However, as we demonstrated earlier, market predictions about a presidency's impact can often turn out to be very different from expectations.

A big thank you to Gad Nishimwe for his work in compiling these statistics and creating the graphics.

Two Trade Ideas

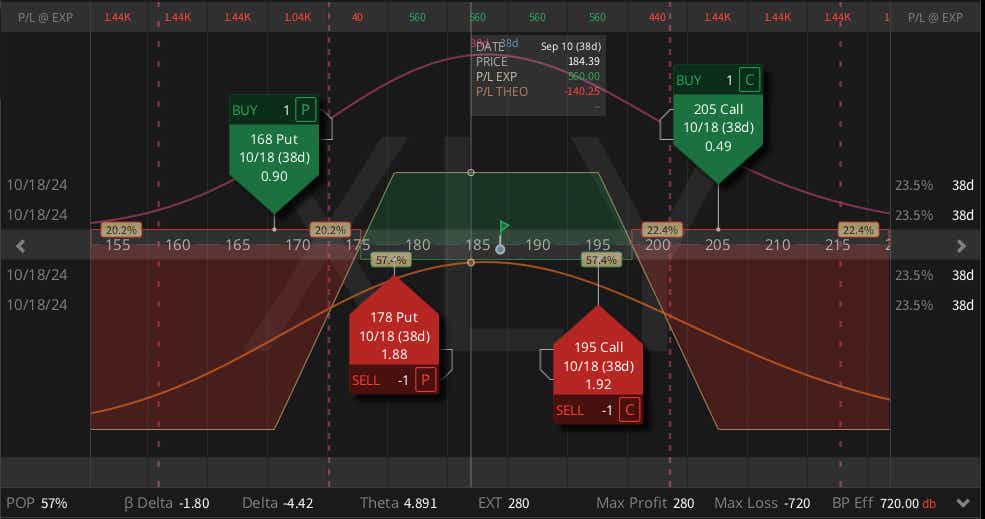

- XLY ($186) Iron Condor (SEP) $2.80 Credit

Consumer Discretionary tends to move with the change in the probability of election outcomes. The exchange-traded fund (ETF) is heavily weighted toward Amazon (AMZN) and Tesla (TSLA) with roughly 37% total. But it also includes many household names such as Home Depot (HD) at 9.7% , McDonald’s MCD (4.9%) and Lowe’s (LOW) at 3.8%. If you think it might chop around a bit, an iron condor would fit the narrative. Selling the 178/168 put spread with the 195/205 call spread trades at $2.80 and covers most of the range over the last quarter.

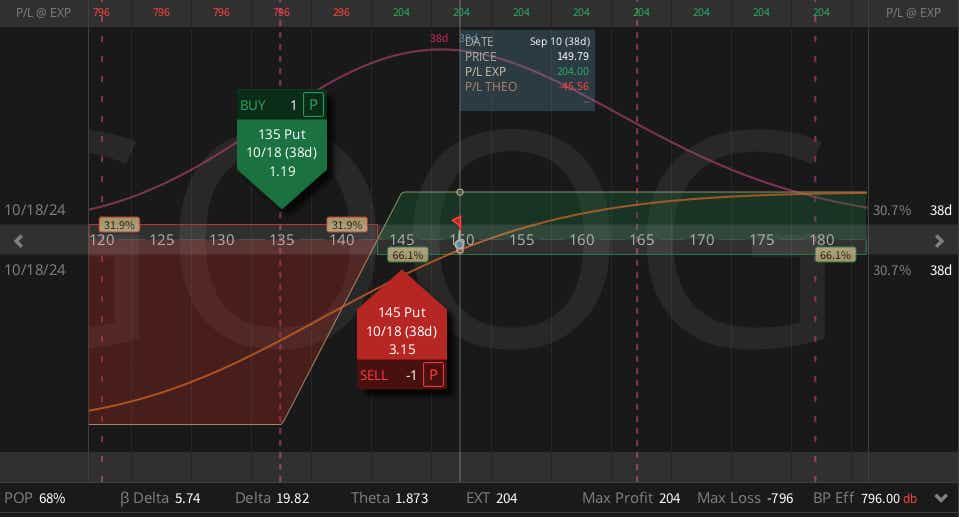

2. GOOGL ($149) Short Put Spread (SEP) $2.04 Credit

The most unloved tech name in the Magnificent 7, Alphabet (GOOG) is down from near $200 to $150 in just a couple months. Google opened the year near $140. If you think that level will hold, and maybe we’re due for a bounce, a short put spread is a defined risk play on a sideways/up move. Selling the SEP 145/135 short put spread trades at around $2.04 with a 68% probability of profit.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.