Gold and Silver Rebound from Multi-Month Swing Lows

Gold and Silver Rebound from Multi-Month Swing Lows

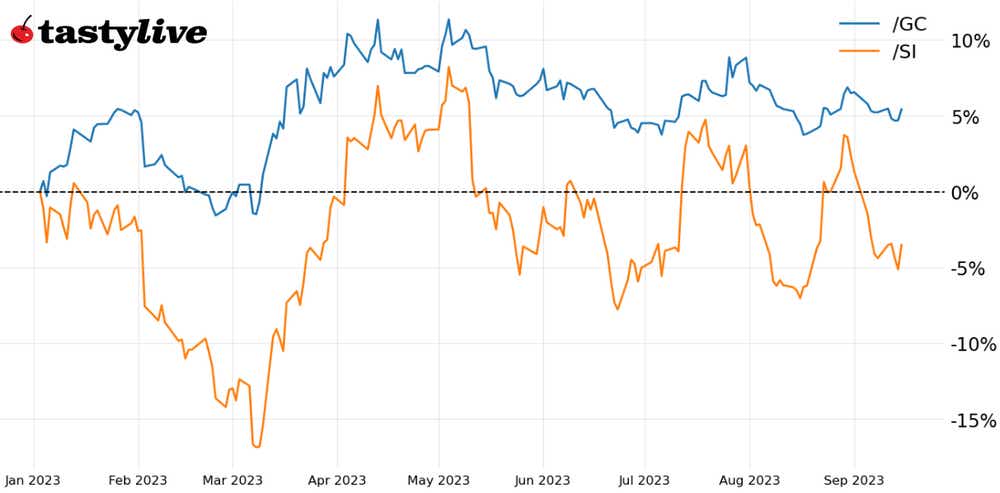

Gold prices down 1.08% month-to-date. But gold and silver prices turned around by Friday, squeezing out small gains on the week.

- Gold and silver prices turned around by Friday, squeezing out small gains on the week.

- The resiliency in gold prices comes against the difficult backdrop of a stronger U.S. dollar and rising U.S. Treasury yields.

- Silver prices are bouncing off multi-month support, suggesting the downswing may be ending.

A stronger U.S. dollar and persistently elevated U.S. Treasury yields are a toxic mix for gold and silver prices. Nevertheless, as was observed late last month, gold and silver prices were weathering the storm, despite weakness.

Treasury yields may be persisting near yearly highs (while real yields are at multi-year or multi-decade highs across the curve), and the U.S. dollar may be at its highest level in six months, but neither gold nor silver have come close to challenging their yearly lows.

/GC gold price technical analysis: daily chart (September 2022 to September 2023)

Gold prices may remain in their downtrend from the May, July, and September swing high, but support has once again been found at the 50% Fibonacci retracement of the November 2022 low/May 2023 high range in /GCZ3. Bullion is back above its daily five- and 13-day exponential moving averages (EMAs), while holding just below its daily 21-EMA (the EMA envelope is not yet in bullish sequential order). Moving average convergence/divergence (MACD) issued a bullish crossover today, albeit below its signal line, and slow stochastics have begun to rebound from oversold territory.

Choppy conditions may yet prevail, but a drop to new lows remains unlikely in the coming weeks (from both a technical perspective and given options market pricing through the end of September).

/SI silver price technical analysis: daily chart (September 2022 to September 2023)

In our prior precious metals update, it was noted that “while the series of lower highs and lower lows since May remains, we may now be on the verge of a more significant swing higher towards 24.500 in the coming weeks.” This played out, although the rebound was cut short, with /SIZ3 returning to the swing lows carved out in June and August near the 50% Fibonacci retracement of the September 2022 low/April 2023 high range.

For better or for worse, this /SIZ3 has been in a sideways range for the past four months, but the next swing higher could be around the corner if the ‘sin wave’ type of price action continues. 25.000 is in focus, a view that would only be negated if there is a weekly close below the 50% Fibonacci retracement at 22.585.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.