Can Stocks Keep Rising if the Fed Dials Back Rate Cut Prospects?

Can Stocks Keep Rising if the Fed Dials Back Rate Cut Prospects?

By:Ilya Spivak

All eyes are turning to the Federal Reserve after the Trump rally—a hawkish signal may slow surging markets

- Wall Street is soaring after Donald Trump’s victory in the presidential election.

- Treasury bond yields and the U.S. dollar have marked sharp gains amid bets on inflation.

- Stocks may pause to reconsider if the Fed delivers a hawkish pivot on interest rate cuts.

U.S. stock markets roared as former president and third-time Republican nominee Donald Trump beat out his Democratic rival Kamala Harris—the sitting Vice President—for who will succeed President Joe Biden at the helm next year. Mr. Trump’s victory was decisive: He won the popular vote as well as a plurality in the Electoral College.

That a resounding victory might help explain Wall Street’s chipper mood. Trump and his allies expended great effort to try to overturn his loss to Biden in 2020, and they still refuse to concede that election. A loss to Harris, especially a narrow one, might have triggered another bitter tussle that prolonged the uncertainty.

Wall Street cheers, dollar and yields surge

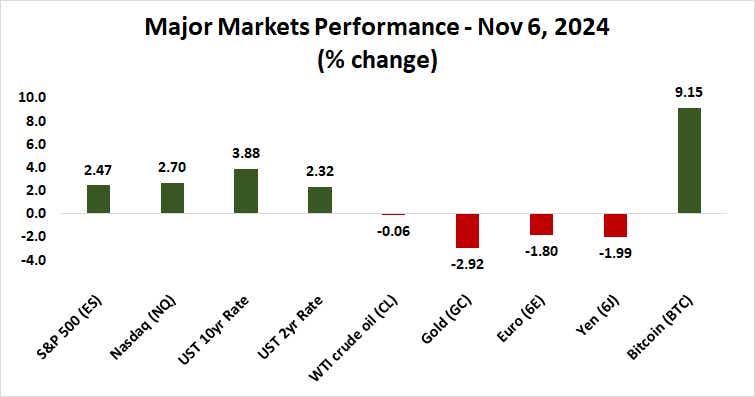

Faced instead with finality, the equities markets boomed. Trump’s appetite for corporate tax cuts, deregulation and realpolitik deal-making probably helped. The bellwether S&P 500 index jumped 2.45% on the day, marking its best one-day performance in eight months. This brought the benchmark to a record high.

Such runaway optimism makes for a curious pairing with the post-election signals emerging from the fixed income and currency markets. Treasury yields shot sharply higher, with most of the action at the long end of maturities. The U.S. dollar raced upward against its major counterparts.

This seems to reflect the expectation that the new administration will preside over a rapid rebound of inflation, which will in turn dilute the capacity for interest rate cuts at the Federal Reserve. Trump’s penchant for deficit expansion (by way of tax cuts) and a combative trade stance—notably, a professed love of tariffs—point in this direction.

Stocks may get cold feet if the Fed backtracks on interest rate cuts

This makes for a pivotal moment as the Fed’s policy-setting Federal Open Market Committee (FOMC) delivers the penultimate policy update of the year this week. Another interest rate cut is widely expected. Rate futures markets price in the probability of a 25-basis-point (bps) reduction at a commanding 99.1%.

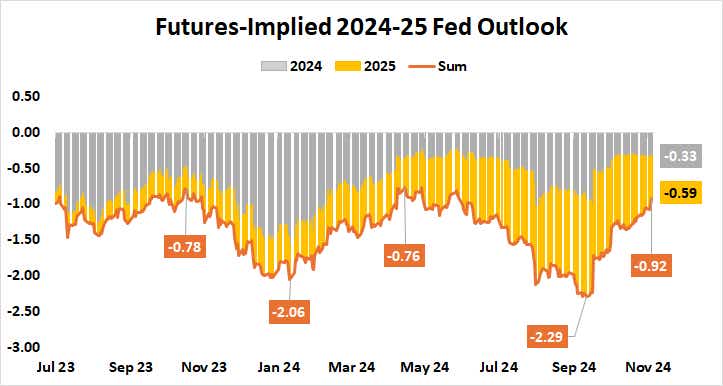

The likelihood of another such move in December has narrowed to just 70.6% in the wake of Trump’s victory, down from 77.3% on the day before the election and 80.2% a month ago. The path for 2025 has been shortened by half. The markets see just 59bps in cuts next year, down from 123bps after the Fed’s last meeting in September.

Rate cut expectations were already getting marked down before Americans went to the polls following a run of increasingly better-than-expected U.S. economic data over the past two months. Traders will be keen to parse the U.S. central bank’s guidance on how this has informed their thinking. Officials had 100bps in cuts penciled in for 2025.

If Fed Chair Jerome Powell and company strike a hawkish tone, hinting that rate cuts would be reconsidered were inflation turn higher, yields and the dollar look likely to press higher. That will stress credit markets just as diverging growth trends boil down to the slowest global expansion since January. Stock markets’ optimism may sour in turn.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.