EUR/USD: The ECB May Lift the Euro Even as it Cuts Interest Rates Again

EUR/USD: The ECB May Lift the Euro Even as it Cuts Interest Rates Again

By:Ilya Spivak

The Eurozone monetary authority is expected to be the most dovish major central bank this year

- The European Central Bank (ECB) looks set deliver the first of four rate cuts expected for 2025.

- Economic green shots and sticky inflation are anchoring the stable policy outlook.

- The euro may rise as the ECB underpins narrowing yield differentials.

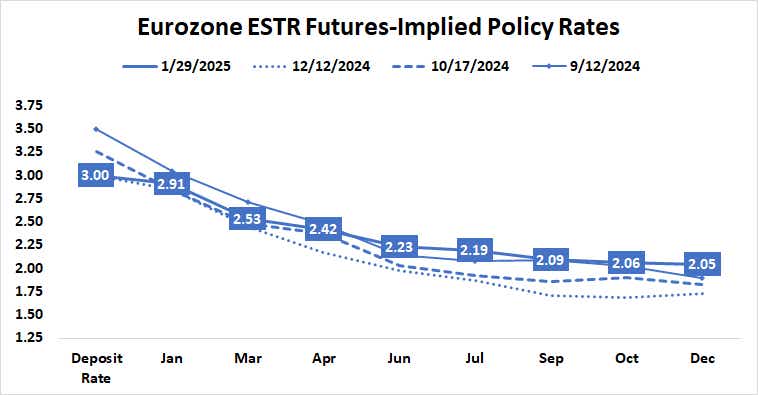

The European Central Bank (ECB) is on course to deliver its first interest rate cut of 2025. The Eurozone monetary authority is expected to be the most dovish among the major central banks this year. Benchmark ESTR rate futures imply that markets have priced in 95 basis points (bps) of easing, which rounds out to four standard-sized cuts.

Expectations for the path ahead have been remarkably stable in recent months. A sharp hawkish revision in Federal Reserve policy bets between its September and December meetings drove up Treasury bond yields. That lifted market rates globally as the price of borrowing the commercially ubiquitous U.S. dollar rose.

Markets think they know where the ECB policy is going

For the ECB, this has proven to be insufficient impetus to dislodge what markets think officials will do. The 2025 end point for the target deposit rate has oscillated within a meager 30bps range since mid-September. This suggests expectations are firmly anchored.

In the meantime, the currency bloc’s economy has shown a bit of renewed momentum. Purchasing managers index (PMI) data from S&P Global showed growth in economic activity unexpectedly returned in January. Taken together, the manufacturing and services sectors expanded at the fastest clip since August.

Financial markets have seemingly sniffed out some green shoots too. Near-term inflation expectations priced into bellwether German bond markets have been creeping higher since bottoming in early August. The “breakeven” rate implied in one- to two-year paper has ticked north of 1.6%, the highest in seven months.

The euro may rise as the ECB anchors yield spreads

The latest consumer price index (CPI) data showed Eurozone inflation accelerated to 2.4% year-on-year in December. The move marked the third consecutive month of increase and the highest reading since July. Moreover, the stickiest pocket of price growth in the hospitality sector still managed to shrug off cyclical pressure on discretionary spending.

On balance, all this suggests a more dovish lead from the ECB is decidedly unlikely to appear this week. In fact, it seems asymmetrically likelier that markets act on some degree of hawkish surprise in the central bank’s pronouncements, instead of the alternative.

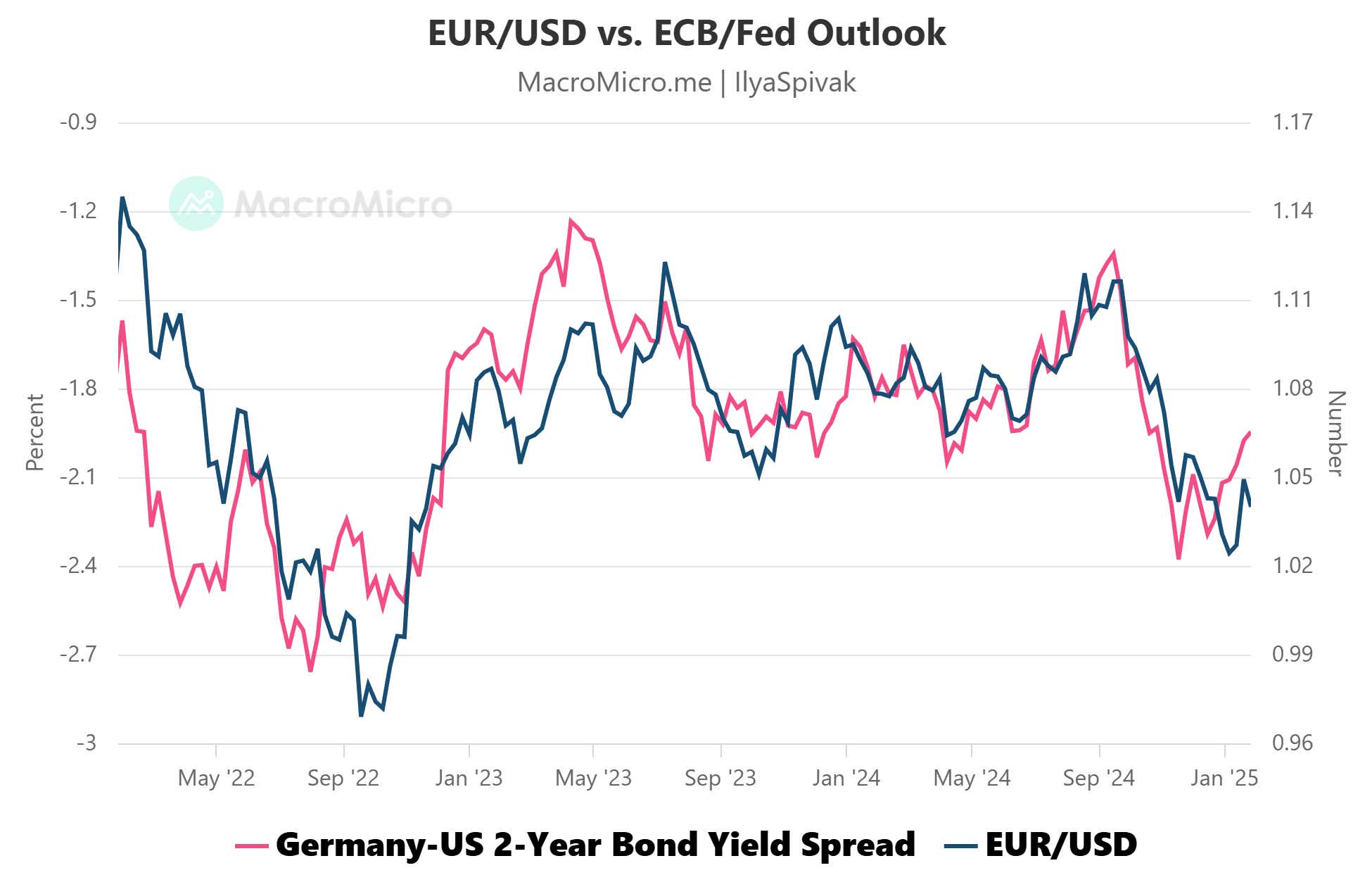

This might bode well for the euro. Its value against the dollar tends to track closely with the spread between German and U.S. two-year bond yields. Divergence since mid-November has seen the greenback’s advantage narrow but the single currency has struggled to capitalize. A steady message from the ECB might help it catch up.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.