Gold Price Outlook 2023: A Chance for Bulls to Capitalize?

Gold Price Outlook 2023: A Chance for Bulls to Capitalize?

Gold disappointed investors in 2022 amid blistering inflation, which typically acts as fuel for the yellow metal’s prices. A late-year rally revived bullish sentiment. Will gold shine in 2023?

Gold Started to Shine as 2023 Approached

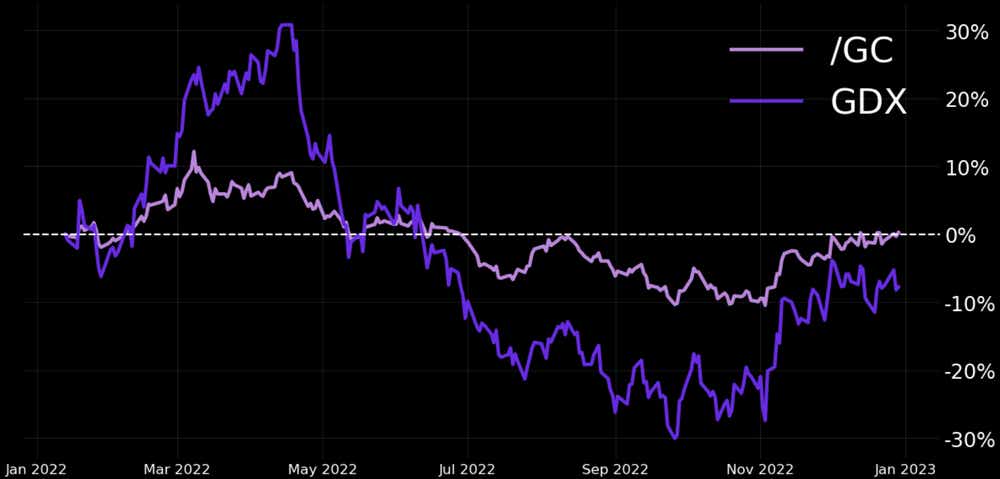

Investors had high hopes for gold at the start of 2022 amid rapidly increasing inflation rates. The yellow metal has historically performed well during periods of high inflation, but that didn’t turn out to be true. After a positive first quarter when prices hit $2,000, gold started to sink, falling to around $1,600 following seven consecutive down months. Gold miners saw a similar trend, although their performance was exaggerated compared to the metal they sought.

We can blame the Federal Reserve for gold’s poor performance. They hiked interest rates at the most aggressive pace in history to combat rising prices, which ironically should help gold. The non-interest-bearing metal couldn’t contend with the effects of those rate hikes: higher nominal and real yields and a stronger US Dollar. However, the story looks like it will change in bullion’s favor in the year ahead.

Monetary Policy to Provide a Tailwind to Bullion

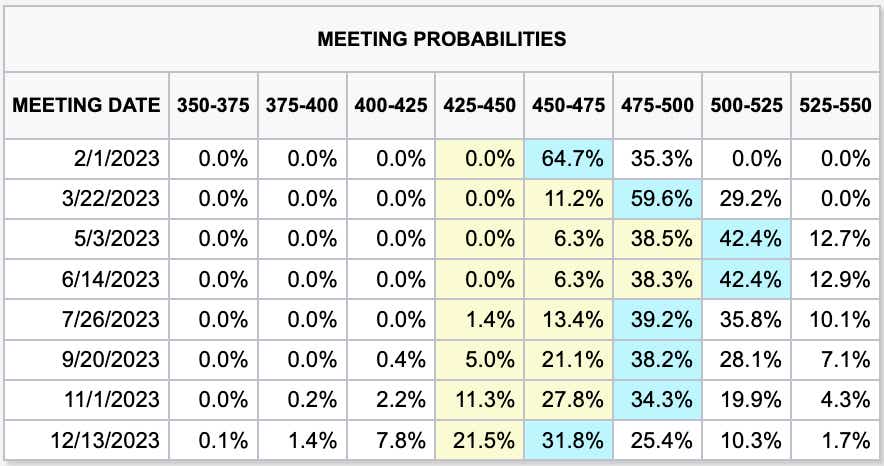

Whereas rising interest rates and the expectation of further rate increases typically hurt gold, a slowdown in rate hikes and expectations of falling rates should bode well for prices. That is because investors should become more bullish on Treasuries as the Fed slows its pace of tightening, pressuring bond yields. As of late December, Fed Funds futures were pricing in three hikes followed by two cuts, with a 31.8% probability of settling the year at the 4.5% - 4.75% range.

Image Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Gold Miners Set to Benefit from Rate Cuts

2022 hit gold miners hard, shown in the chart above displaying the annual performance of GDX (VanEck Gold Miners ETF), the largest gold miners ETF. Higher interest rates made borrowing more expensive, and the rising costs of fuel and labor squeezed profit margins.

As mentioned above, subsiding inflation and the potential for rate cuts in 2023 should bolster the price of gold. That, along with subsiding upward pressure on operating costs, such as fuel and labor, should make the gold mining sector an attractive investment option in the year ahead.

Most large gold miners had total costs per troy ounce of around $1,650, including taxes and interest expenses. With prices around $1,820 going into the New Year, miners look well positioned to expand profit margins, which should spark a bullish run—especially if prices continue climbing. Prices under the costs faced by miners would warrant caution, however, and traders may be attracted to short strategies on miners should that scenario play out.

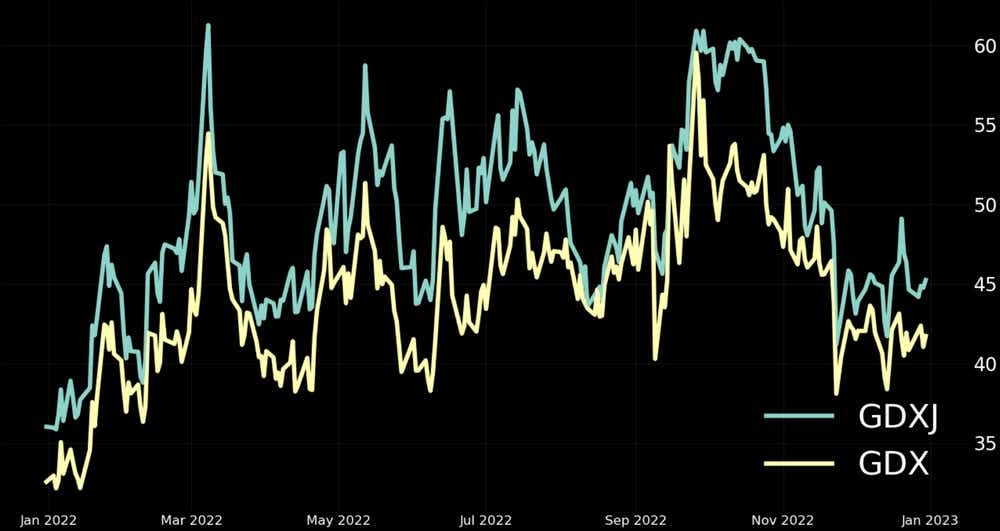

For those bullish on the miners, the juniors, given their higher beta relative to their senior counterparts, may provide an opportunity for those who want to take on a little more risk in return for greater return potential. The higher implied volatility of juniors compared to majors—displayed in the chart below—illustrates the potential for those who prefer strategies to collect premium.

Weak Corporate Earnings and Economic Headwinds May Boost Gold Prices

Investors are attracted to assets that yield a return. More specifically, they search for the highest yield in the market that has the lowest relative risk. Over the past decade, the stock market has provided attractive risk-adjusted returns. However, corporate profits started to decline as interest rates rose, and while the Federal Reserve is expected to reach the end of its rate-hiking cycle in 2023, the costs of borrowing money will remain high for some time.

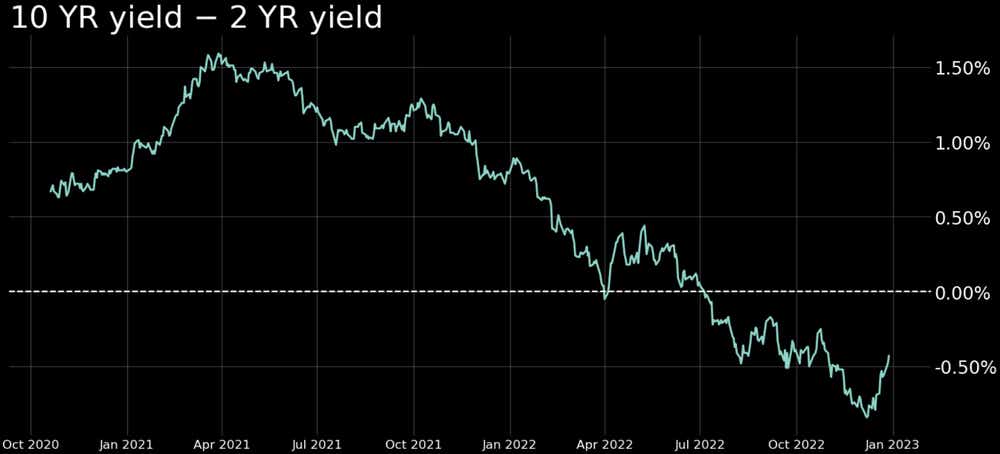

Because of the Fed’s actions, a recession in 2023 is on the cards. One of the best historical predictors of a recession—the yield curve—is inverted going into the New Year (see chart below). A recession means reduced economic output and activity.

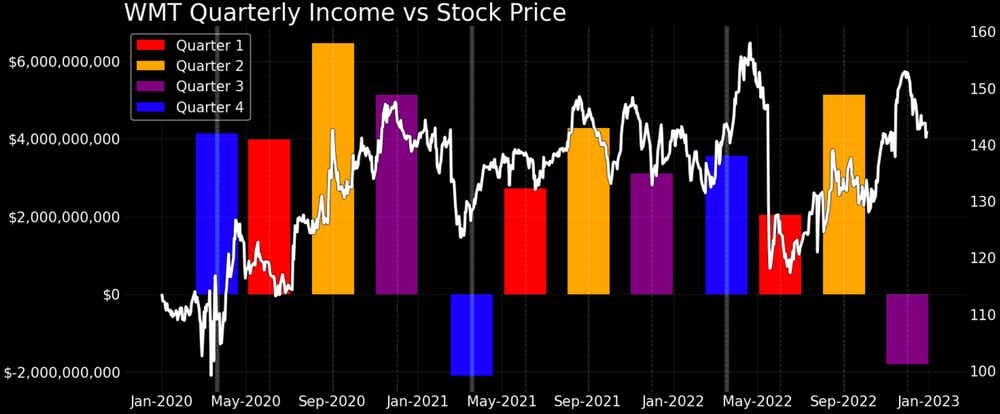

That is likely to weigh on corporate profits throughout 2023. In fact, the Fed’s impact on earnings was already apparent in 2022. Walmart, a company seen as a bellwether for the US economy, posted a 1$1.8 billion net loss for the quarter ending October 31. Gold is a prime candidate for investors to shift some of their capital while they wait out this contractionary phase in earnings. A tailwind for gold prices indeed.

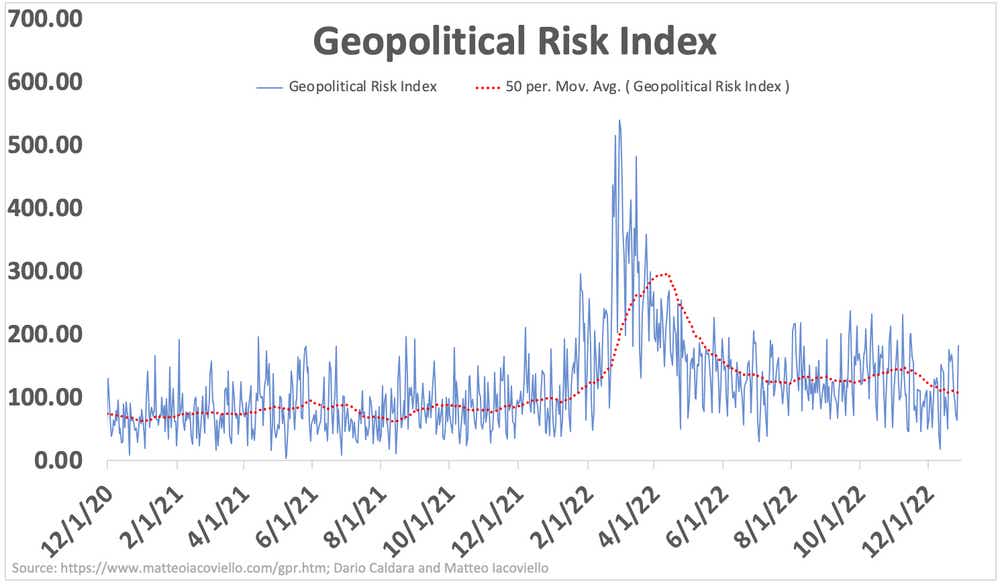

Geopolitical Instability is on the Rise and Should Benefit the Yellow Metal

As a traditional safe-haven asset and store of value, gold typically rises during times of increased geopolitical instability. We saw numerous developments in 2022 that increased these instabilities. Although forecasting events such as these are difficult, several ongoing factors will likely intensify.

First is a breakdown in globalization, most notably between the United States and China. Both superpowers have stepped up efforts to outcompete the other in something that looks like the Cold War. And even though it officially ended in the 1990s, relations between Russia and the U.S. remain as cold as ever. China and the U.S. are focusing on becoming less reliant on each other for trade and technology.

This trend will undoubtedly continue. Washington has taken measures to cut off China’s access to critical technology, stepped up enforcement efforts of US-listed Chinese stocks, and implemented spending measures to boost defense and buildup domestic computer chip manufacturing. China is taking similar steps. The United States holds an edge in this chess game, but the gap in US dominance has diminished in recent decades. There is also a chance that China, emboldened by Russia’s actions in 2022, may move against Taiwan. Even if China holds back, Beijing is working hard to boost the Yuan, its currency, to insulate itself against future US sanctions.

Europe is another potential source of geopolitical instability. A byproduct of the war in Ukraine and the end of cheap money from central banks, the European Union (EU) remains at risk from an economic crisis and internal division among member states. Although energy costs have soared after Russia mostly cut off its energy exports to the bloc, warm weather has allowed Europe to avert an energy crisis. However, the continent faces a precarious situation over the next couple of years as they transition from cheap Russian energy. Despite that, relations between France and Germany have weakened, and public disdain against the EU has risen in countries like Italy; although, positive views have increased elsewhere.

Balance of Risks Leans Bullish for Gold in 2023

Altogether, 2023 may see gold benefit from a continuation in geopolitical themes from 2022 or the onset of major risk events that stem from the buildup of tensions between countries like the U.S. and China. This should provide a tailwind for gold prices. Moreover, the Fed is expected to slow the pace of rate hikes and even deliver a cut. A weaker US Dollar, lower bond yields, and easing inflation should help gold and gold miners alike. A price of around $2,000 to $2,500 may be in the cards.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.