Corn Prices Sank 7% in February. Where are Grain Prices Headed?

Corn Prices Sank 7% in February. Where are Grain Prices Headed?

Corn Futures Fell 7% in February, Biggest Drop Since June as Supply Prospects Improved

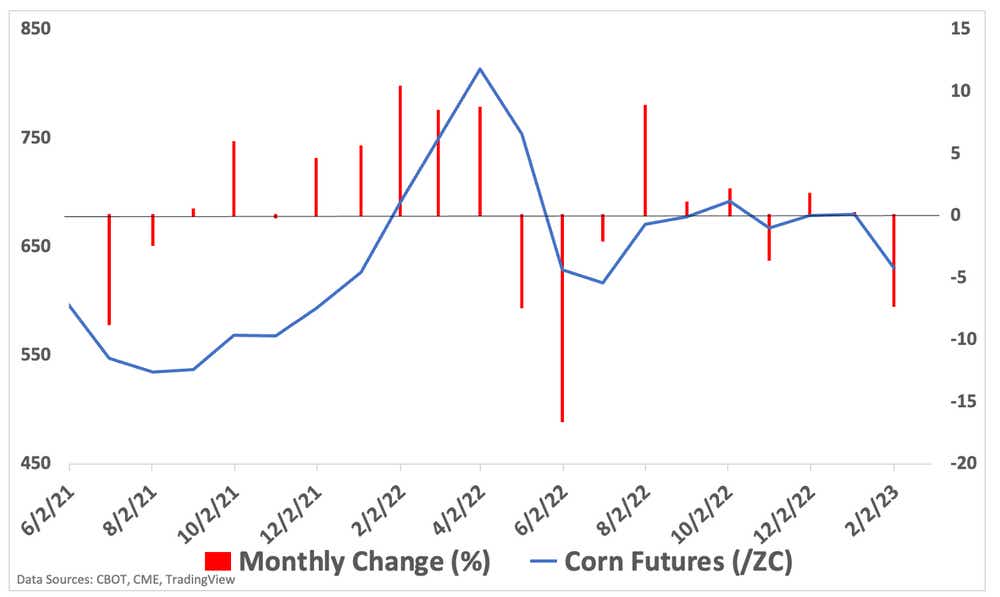

Corn futures (/ZC) fell 7.28% in February to the lowest level since August at $630 as the grain’s supply outlook improved. That was the sharpest drop since June when prices fell 16.56%, and it follows several months of rangebound trading.

The price for corn exploded last year as turmoil from Russia’s incursion into Ukraine and resulting Western sanctions threw the global agricultural markets into disarray. Farmers, particularly U.S. farmers, are reacting with plans to significantly increase their planted acreage this season.

That attitude is evident across the United States, according to recent surveys. Farmers are opting to go heavy on corn not only due to the relatively high prices compared to the last decade, but also because corn provides farmers with more certainty regarding crop yields versus other products. Those other products, such as soybeans, have outpaced corn prices in the second half of 2022, but not enough to entice enough farmers.

Waning Demand Points to Potential Supply Glut

As with most agricultural products, the impacts of supply and demand are the driving forces for prices. With farmers planning to plant more corn at a time when the global economy is expected to cool following rate hikes from central banks, the price outlook for corn is bearish.

Some expect China, a country that has steadily decreased its reliance on U.S. corn, to start buying in mass again as it exits years of harsh lockdown measures. However, that outlook is likely flawed, as China has increasingly turned to Brazil for its corn imports. While the United States remains the largest shipper of grain, export volumes have disappointed expectations for the last several years.

If Chinese buyers don’t start ordering corn in mass again, it may leave a glut of the grain in domestic U.S. markets. That would likely see prices fall back toward levels not traded since 2020 around the $350 mark. A drawdown may not occur until September, when supply hits the market following harvest. The United States Department of Agriculture’s WASDE report will cross the wires on March 8, which should provide the next directional cue for traders.

Trading Corn: Don’t Expect Prices to Pop

Corn prices declined sharply in February, with the last week of trading making up the bulk of its losses. That drove prices into oversold territory, as measured by the Relative Strength Index (RSI), which may suggest that the selling is overdone for now. That said, prices may see a retracement to the upside, but given the fundamental factors, an extended run higher is unlikely unless the backdrop changes significantly.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.