Natural Gas Price Surges Most Since October as Warmer Months Approach

Natural Gas Price Surges Most Since October as Warmer Months Approach

U.S. Natural Gas Prices Surge on Weather Anomalies

U.S. natural gas prices (/NG) surged over 10% on Friday in the biggest single-day gain since October as extreme weather roiled the energy market. Henry Hub prices started tracking higher on Wednesday after briefly falling below $2.00 per million British thermal units (MMBtu) for the first time since September 2020.

An extreme weather event in the Western United States, specifically Southern California, where blizzard warnings are being issued for the first time in recorded history, is causing regional spot prices to diverge sharply from Henry Hub benchmark prices. That divergence is likely influencing the broader benchmark, as abrupt increases in demand is pressuring supply elsewhere in the country.

Still, prices remain about 80% lower from August, when prices were at the highest on record, mostly because of the unusual import demand facing the United States from Europe, where a war with Ukraine and Western sanctions on Russia has transformed the pre-war flow of energy products.

Spring Weather May Hamper Further Gains

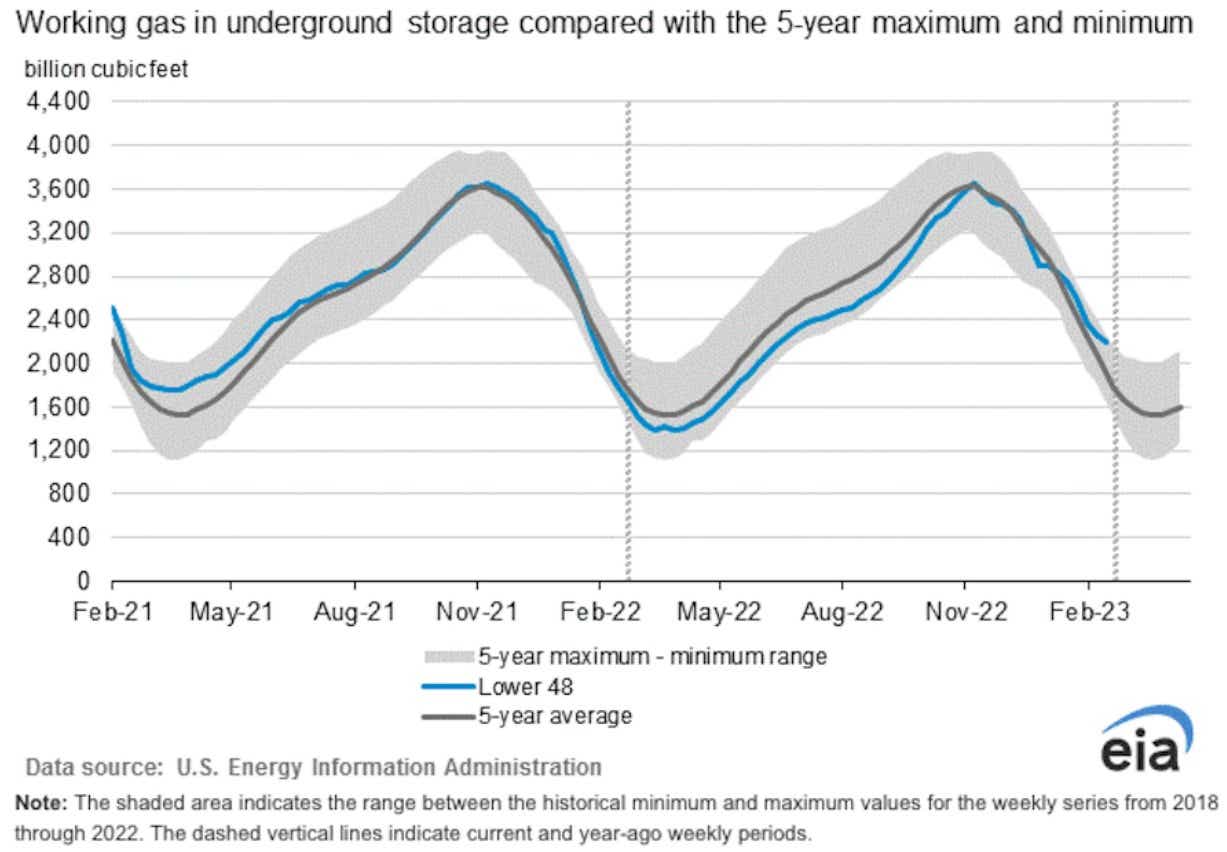

Does Friday’s price action suggest a trend reversal to the upside? It’s unlikely. Prices have declined for about six months despite Russia cutting off most of its gas to Europe. Unusually mild weather across the United States and Europe allowed the stockpiling of inventory to hold above seasonally historical averages.

In fact, inventory levels in the United States are holding above the 1-year and 5-year averages. The U.S. Energy Information Administration (EIA) revealed that stocks ending on February 17 were 395 billion cubic feet (BCF) higher than this time last year and 289 Bcf higher than the five-year average. This comes shortly before the injection season starts, which is when demand falls so low that storage levels typically rise until October.

Natural Gas Price Action and Volatility: What Does the Chart Say?

Natural gas prices remain volatile, with an IV rank (IVR) recently ranging around the 50 to 90 levels over the past month. While some may see the $2.00 price level as a suspected bottom holding psychological support, the volatile nature of price action makes a directional position risky. Neutral strategies to capture increases in volatility, such as straddles or strangles, could offer another route to play price action, although volatility contractions or expansions can still threaten these trades.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.