China is Struggling as Economic Reopening Disappoints Investors

China is Struggling as Economic Reopening Disappoints Investors

By:Ilya Spivak

Hopeful markets cheered as China scrapped restrictive 'zero-Covid' policies, fueling hopes for a rapid rebound. It now looks more like a headwind for global economic growth.

- China slowing down as domestic demand struggles to sustain momentum

- ‘Zero-Covid’ reopening came too late for the globalization-linked economy

- Supply chain diversification has cost China some trade flow market-share

China’s economy seems to be losing steam

Investors cheered at the start of 2023 as China scrapped restrictive “zero-Covid” policies, fueling hopes for a rapid rebound in the world's second-largest economy.

The optimism seemed sensible. First, doing away with strict lockdowns keeping a sea of consumers behind closed doors promised to deliver a meaty boost to global growth. Second, allowing the army of workers powering China’s export engine to return to their posts would help unclog supply chains disrupted by the pandemic. That would have the twin benefits of stoking economic activity and lowering inflation.

What has transpired in the six months since reopening began in early December 2022 has turned out far less rosy.

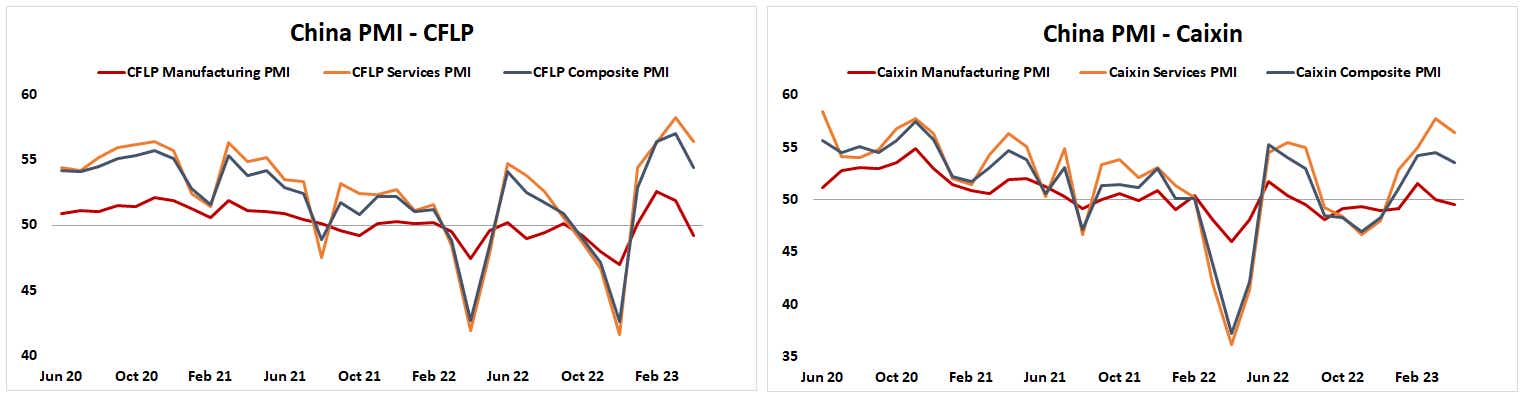

A burst of domestic demand materialized as expected. Official and private-sector PMI surveys show a strong pickup in service-sector activity powering brisk catch-up growth as restrictions are lifted. The all-important manufacturing sector – reflective of China’s critical role as a value-add intermediate trade hub – barely managed to get off the ground before slinking back into contraction mode (in the logic of PMIs, the dividing line between growth and retrenchment is set at 50).

Data source: Bloomberg

Scrapping ‘Zero-Covid’ policy: too little, too late

Now, activity across sectors looks to be in retreat as the premium from unleashing pent-up demand at home wanes while externally focused industry continues to struggle. This is because – predictably enough – the world did not just stand still and wait for Beijing to rethink its Covid containment plans.

By the time China scrapped the “zero-Covid” regime, its largest rich-world customers in the US and the Eurozone saw the peak in their catch-up bursts of reopening activity a year and a half prior. Fading support from pandemic-era fiscal stimulus coupled with brisk Fed-led monetary tightening to rein in inflation were already slowing demand that Chinese suppliers hoped to rely on.

Furthermore, China’s self-isolation stocked supply chain diversification elsewhere. Its share of global trade turnover has fallen by nearly 3 percent while volumes have fallen far more dramatically than the global average. Cumulative import and export activity worldwide fell 1.2 percent year-on-year as of the end of 2022 as central banks cranked up financing costs. In China, it fell by a staggering 14.9 percent over the same period.

Frustratingly for China bulls, the East Asian giant looks to have gone from hope to headwind for global growth.

Data source: Bloomberg

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.