What Is Options Buying Power?

What Is Options Buying Power?

By:Mike Butler

Buying power comes up in many options trading conversations, but what is it exactly and why is it important?

Buying Power Definition

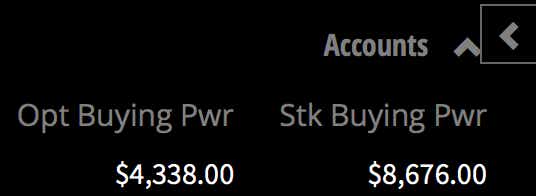

Buying power (sometimes referred to as ‘excess equity’) as it relates to trading stocks and options, is the maximum amount of capital (money) available to make trades with.

As you fund your brokerage account and use your capital to place trades, your available buying power will change.

Buying Power Reduction

Buying power reduction refers to the amount of capital required to place trades and maintain them. Or phrased a different way, the amount of capital that will be tied up when purchasing stock or trading options.

Buying power reduction is hard to quantify as a whole because it really depends on the factors like the product being traded (i.e. stocks, options, future, etc.), the type of trade (defined risk v. undefined risk), and the type of brokerage account (margin, portfolio margin, IRA, etc.).

Here is a little more information about buying power as it relates to the type of brokerage account (it’s important to note that each brokerage has their own policies in regards to buying power on certain types of accounts – the below information will help you understand the differences between the account types, but the exact values may vary slightly from brokerage firm to brokerage firm).

Buying Power & Account Type

Non-Margin Buying power

In traditional IRA & Cash accounts, your stock and option buying power will be the same number. This is because there is no margin or leverage in an IRA or cash account when it comes to buying stocks. In this type of account, your gains and losses are 1:1, as your trades are all for cash value. For example, if you buy 100 shares of a $50 dollar stock, your buying power reduction will be the full amount; $5000.

IRA (Individual Retirement Account) Buying Power

In traditional IRA accounts, your stock and option buying power will be the same number. This is because there is no margin or leverage in an IRA account when it comes to buying stocks. In this type of account, your gains and losses are 1:1, as your trades are all for cash value. You can never lose more than the cash value of your account.

Margin Buying Power

In a standard margin account, you have 2:1 leverage when you buy stock and sell stock. This means that if you buy 100 shares of stock, your buying power will only be reduced by half of the notional value: 50 shares of stock. In an IRA account, buying power reduction of all 100 shares would be required. Margin essentially allows you to double your profits or double your losses, less commission fees and interest on the margin you borrow.

Portfolio Margin Buying Power

Portfolio margin takes your account one step further, and gives you about a 6:1 leverage for stocks. The calculation for buying power reduction is also a little different, as it bases the requirement around the largest projected loss for the day on all your positions. Volatility also plays into this calculation.

The minimum entry equity is $125,000 to obtain portfolio margin, and a net liquidity of $100k is required at all times. Portfolio margin can be revoked at any time.

Remember...

...that leverage allows you to magnify your gains, but it also magnifies your losses. It is very important to understand the mechanics of buying power reduction, and how it can affect your overall trading experience.

Calculating Buying Power For Options

Undefined Risk Trades

Calculating buying power isn't very difficult, but it can be different depending on what type of brokerage account you have.

Selling naked options in a margin account is a very popular strategy for options traders. Why? There is quite a bit of leverage using stock options in terms of buying power reduction. Because selling a naked option has higher risk than putting on a defined risk trade, buying power reduction is reduced based on the greatest of the following three formulas:

Consider the following scenarios for this trade:

Sell one 49 put for a $1.50 credit in XYZ, trading at $50.00

- 20% Rule - 20% of the underlying, less the difference between the strike price and the stock price, plus the option value, multiplied by number of contracts.

- Underlying Value: 20% x [$50.00 x (1x100)] = $1000

- OTM Amount: (49-50) x 100 = -$100

- Current Option Value: $1.50 x 100 = $150

- Buying Power Requirement: $1050

- 10% Rule - 10% of the exercise value plus premium value.

- Exercise Value: 10% x [49 x (1x100)] = $490

- Premium Value: $1.50 x 100 = $150

- Buying Power Requirement: $640

- $50 Plus Premium Value - $50 multiplied by number of contracts, plus premium value.

- $50 Value: $50 x 1 contract = $50

- Premium Value: $1.50 x 100 = $150

- Buying Power Requirement: $200

More often than not, option number one will be used because this number will generate the highest value. Higher buying power reductions give the broker more protection on the risk that they are taking with naked options, which is why they use the higher value.

So what about buying power reduction when you buy naked options? The buying power reduction when you purchase a naked option is equal the debit paid for the trade (there are no fancy formulas necessary to calculate this number).

Defined Risk Trades

Defined risk trades are also very simple in terms of buying power reduction calculations. Just like buying naked options, buying a debit spread requires a BPR of what you pay for the spread. Buying spreads will always cost less than buying the same long option because we are really just buying the naked option and reducing our cost basis by selling an option against it (commence AHA! moment).

Defined risk credit spreads have a different BPR calculation. For credit spreads, you will have to take the width of the spread and subtract the credit received to see what your BPR will be. For example, if we sell a 5-point wide (110/105) put spread and receive $0.50 in credit for it, our buying power reduction would be $450. (500-0.50 = 450).

Conclusion

Buying Power reduction can be tricky, but it is very important to understand how it works so you can optimize your trading experience and avoid those pesky margin calls!

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.