Broadcom Earnings Preview—6% Stock Price Move Expected

Broadcom Earnings Preview—6% Stock Price Move Expected

By:Mike Butler

Plus, our analyst’s strategies for bullish and bearish takes

Broadcom will report quarterly earnings Thursday after the market closes.

The company is expected to announce earnings-per-share of $1.20 on $12.96 billion in revenue.

Earnings per share and revenue figures are both higher than the estimates the company exceeded last quarter.

Broadcom Earnings Preview

Broadcom (AVGO) opened the year trading at $109.21 and surged as high as $185.16 after the last earnings call in June. The stock has since retreated to around $153 per share, but it's still up just under 50% on the year. Broadcom has benefited from the spike in interest in artificial intelligence because it is a semiconductor and infrastructure software company.

Late last year, Broadcom acquired VMware for $61 billion. That further entrenched Broadcom in the tech sector because VMware is an established cloud computing company.

On July 12, Broadcom (AVGO) issued a 10-1 stock split, bringing the price down from around $1720 to $172 the next trading session.

A lot has changed for Broadcom in the past year, and that could result in opportunity for the tech stock. It has gained plenty of popularity in the trading world recently.

Hock Tan, president and CEO of Broadcom, offered positive remarks in the last earnings call:

“Broadcom's second quarter results were once again driven by AI demand and VMware. Revenue from our AI products was a record $3.1 billion during the quarter. Infrastructure software revenue accelerated as more enterprises adopted the VMware software stack to build their own private clouds ... We are raising our fiscal year 2024 guidance for consolidated revenue to $51 billion and adjusted EBITDA to 61% of revenue."

As one might expect, AI demand is a driving factor for success for many big-name tech stocks these days.

This quarter, Broadcom is expected to report earnings-per-share (EPS) of $1.20 on $12.96 billion in revenue. Both of these figures are higher than last quarter's. Broadcom's earnings history is quite strong, beating expectations for a number of quarters in a row.

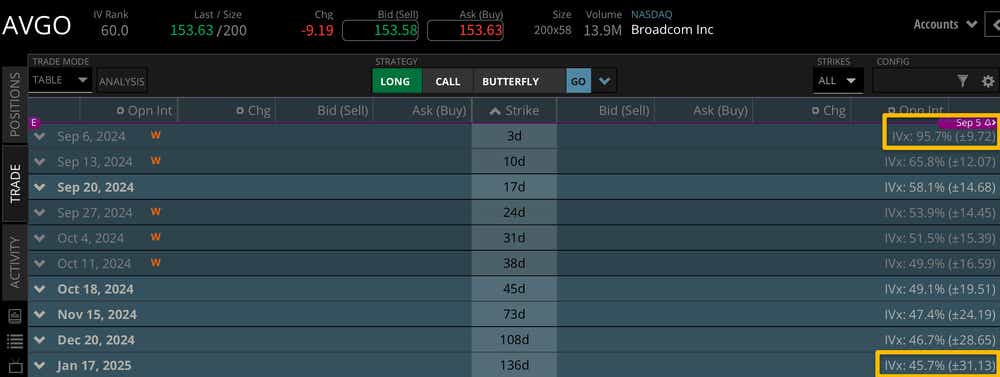

Looking at the implied volatility for near-term options cycles can help us put context around the expected stock price move for earnings announcements. This week, AVGO stock has a +/- $9.72 s expected move. This is about 6% of the notional value of the stock, putting this earnings announcement on the lower end of the range for expected moves relative to other AI stocks we've seen report.

Looking through the end of the year, we can see a +/- $31.13 stock price expected move in the January 2025 options cycle. That means the expected move this week accounts for about a third of the implied volatility range for the rest of the year.

Bullish on Broadcom for earnings

If you're bullish on Broadcom for earnings, you're likely looking for another earnings beat and maybe some surprise guidance for the rest of the year. The sector has seen so much growth recently that these tech stocks really need to outperform to see continued investment in the stock. We saw NVIDIA report earnings recently and the stock price sold off even after a strong earnings report.

Bearish on Broadcom for earnings

If you're bearish on Broadcom this week for earnings, you're certainly looking for an earnings miss in either the EPS or revenue department. Any sort of weak guidance could be seen as a bearish indicator as well. The stock market is down over 100 points yesterday, which could make it harder for AVGO stock to really outperform to the upside even on an earnings beat this week. A lot of factors play into earnings announcements, but any sort of negativity in such a bullish AI market could prevent the stock from rallying after earnings.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.