Nasdaq 100 Starts Seasonally Weak September on Sour Note

Nasdaq 100 Starts Seasonally Weak September on Sour Note

Also, 10-year T-note, gold, crude oil and Japanese yen futures

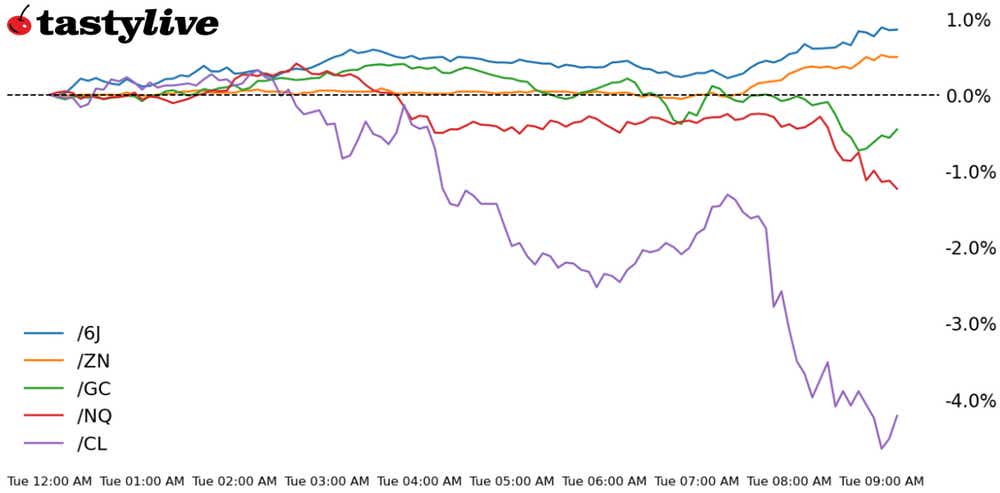

Nasdaq 100 E-mini futures (/NQ): -1.88%

10-year T-note futures (/ZN): +0.43%

Gold futures (/GC): -0.72%

Crude oil futures (/CL): -3.90%

Japanese yen futures (/6J): +0.42%

Summer is officially over, and the worst part of the calendar has arrived for financial markets. Cash is king over the next two months, as the U.S. dollar and bonds to do quite well from now through Halloween. Indeed, that’s how this week is starting: it’s a sea of red in everything except for Treasuries and the greenback. A Federal Reserve interest rate decision in 15 days (about two weeks) retains a 39% chance of a 50-basis-points (bps) rate cut as traders continue to question whether the rate cut cycle will be starting for good reasons or bad.

Symbol: Equities | Daily Change |

/ESU4 | -1.36% |

/NQU4 | -1.88% |

/RTYU4 | -1.96% |

/YMU4 | -1.21% |

Nasdaq futures fell nearly 1% at the open this morning after traders returned from a long holiday weekend. The selling resumes losses from last week, which reversed a three-week winning streak for U.S. equities. This week has the jobs report is in focus but that isn’t until Friday. This morning’s manufacturing report may shift some vibes on the economy. United States Steel (X) fell nearly 5% after Presidential Candidate Kamala Harris said she would oppose the sale of the company to Japan.

Strategy: (27DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19200 p Short 19250 p Short 19800 c Long 19900 c | 60% | +1170 | -840 |

Short Strangle | Short 19250 p Short 19800 c | 52% | +11955 | X |

Short Put Vertical | Long 19200 p Short 19250 p | 59% | +340 | -660 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.12% |

/ZFZ4 | +0.28% |

/ZNZ4 | +0.43% |

/ZBZ4 | +0.91% |

/UBZ4 | +1.07% |

The bond market is anticipating several reports on the U.S. labor market that are due later this week. Yields are down across the curve as traders return from an extended weekend, with 10-year T-note futures (/ZNZ4) up 0.34% this morning. There are no meaningful Treasury auctions to watch this week.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112.5 p Short 113 p Short 115 c Long 115.5 c | 32% | +343.75 | -156.25 |

Short Strangle | Short 113 p Short 115 c | 55% | +1453.13 | X |

Short Put Vertical | Long 112.5 p Short 113 p | 75% | +171.88 | -328.13 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.72% |

/SIZ4 | -3.53% |

/HGZ4 | -3.66% |

Gold prices (/GCZ4) aren’t getting much help from yields or the dollar this morning, both of which are lower and typically help precious metals. Gold hit a record high last month and prices have modestly but steadily trimmed lower from there.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2475 p Short 2480 p Short 2550 c Long 2555 c | 20% | +390 | -110 |

Short Strangle | Short 2480 p Short 2550 c | 56% | +8390 | X |

Short Put Vertical | Long 2475 p Short 2480 p | 62% | +230 | -270 |

Symbol: Energy | Daily Change |

/CLV4 | -3.90% |

/HOV4 | -3.03% |

/NGV4 | -0.66% |

/RBV4 | -4.72% |

Crude oil prices (/CLV4) fell over 4% after reports surfaced about a deal to resolve problems with Libya’s oil production and exports. That news came amid reports that cast further doubt on China’s economy. Traders are watching tomorrow’s figures from the American Petroleum Institute (API) to help gauge demand in the United States. For now, however, the drop below 71 puts crude oil prices in danger of further losses.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 68 p Short 68.5 p Short 72 c Long 72.5 c | 20% | +390 | -110 |

Short Strangle | Short 68.5 p Short 72 c | 53% | +4,500 | X |

Short Put Vertical | Long 68 p Short 68.5 p | 57% | +190 | -310 |

Symbol: FX | Daily Change |

/6AU4 | -0.75% |

/6BU4 | -0.22% |

/6CU4 | -0.53% |

/6EU4 | -0.13% |

/6JU4 | +0.42% |

The Japanese yen (/6JU4) is up after three days of losses after the Bank of Japan governor submitted a report to a government panel that supported a view of more rate hikes should the economy continue to perform. The yen would have to challenge the 0.0070 level before breaking into higher ground above the August swing high.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00685 p Short 0.0069 p Short 0.00705 c Long 0.0071 c | 27% | +425 | -200 |

Short Strangle | Short 0.0069 p Short 0.00705 c | 50% | +1,737.50 | x |

Short Put Vertical | Long 0.00685 p Short 0.0069 p | 65% | +237.50 | -387.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.