Bonds are Breaking Bad

Bonds are Breaking Bad

As U.S. 10-Year yield up to 4.191%, a 10-Month High, our macro analyst shares a trade idea

- The bond market isn’t pricing in more Federal Reserve rate hikes, but instead higher U.S. growth and inflation expectations.

- 3Q ’23 U.S. GDP is tracking at +3.9% annualized (in real terms), according to the Atlanta Fed GDPNow estimate.

- Market measures of U.S. inflation expectations have reached their highest levels since May 2022.

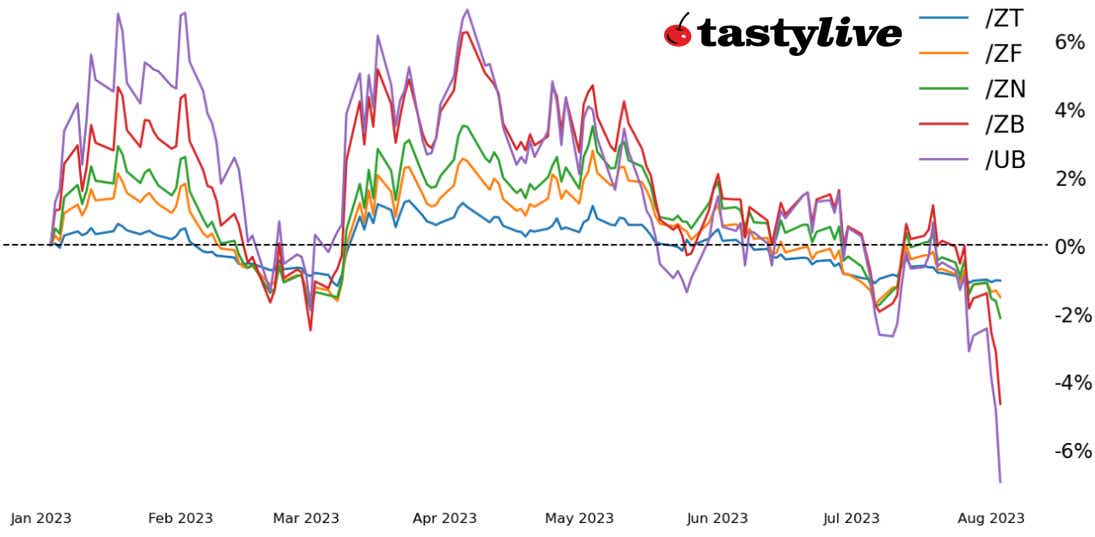

So much for the bond market reversal having legs. The sharp rally in U.S. Treasuries at the start of July stalled mid-month, and the past two weeks have been nothing short of painful for bond bulls. But the shifts higher in U.S. Treasury yields have recently taken a different tone: They’re led by the long-end as opposed to the short-end.

When markets discount shifts in Federal Reserve rate hike odds, it’s typically the short end of the curve that produces the biggest moves. For much of 2022 and early 2023, this was the case as two-year notes (/ZT) produced higher implied volatility readings (IVRs) than the rest of the Treasury curve.

But over the past few weeks, it’s been 10-year notes (/ZN) and 30-year U.S. Treasury bonds (/ZB) with the higher IVRs, suggesting a shifting focal point for traders. The long-end of the curve, unlike the short-end, reflects market expectations around growth and inflation.

Changes in expectations

And how growth and inflation expectations have changed in recent weeks. 2Q ’23 U.S. GDP came in at +2.4% annualized (in real terms), while the Atlanta Fed GDPNow growth estimate for 3Q ’23 U.S. GDP is off to a searing hot start, coming in at +3.9%. Inflation expectations, as measured by five-year inflation forwards, are holding near their highest levels since May 2022—when inflation expectations peaked. Break-even rates, a separate market measure of inflation, have pushed to their highest level since November 2022.

Selling in the long end of the curve has accelerated in recent days, sparked not by the U.S. credit rating downgrade by Fitch Ratings but instead by a hot private payrolls report that implies another strong U.S. nonfarm payrolls report, which would give the Fed ammunition to justify keeping interest rates higher for longer.

/ZB U.S. 30-year bond price technical analysis: daily chart (November 2022 to August 2023)

The breakdown in /ZN has been aggressive, but it’s been downright vicious in /ZB. As /ZB has dropped from its mid-July high of 127’14 down to 120’12, the 30-year yield has jumped from its mid-July low of 3.834% to 4.302%. A near 50-basis-point move in effectively two weeks has been a bit of a rates shock, dragging down U.S. equity markets in the process.

What’s the right trade?

A look at the options market suggests traders think the readjustment upward in U.S. Treasury yields and the sell-off in bonds, is nearing an end. In /ZB, for example, selling a put spread around the November 2022 lows, by selling the 116 strike and buying the 114 strike for the Sept. 22 expiry (50 DTE), suggests that the probability of profitability (POP) is 80%. The surge in volatility may be creating an environment where traders attempting to call the bottom in bonds may be rewarded if they approach the market in a strictly risk-defined manner.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.