Top 3 Stocks to Watch in March 2023

Top 3 Stocks to Watch in March 2023

Market Update: S&P500 up 3.68% year to date

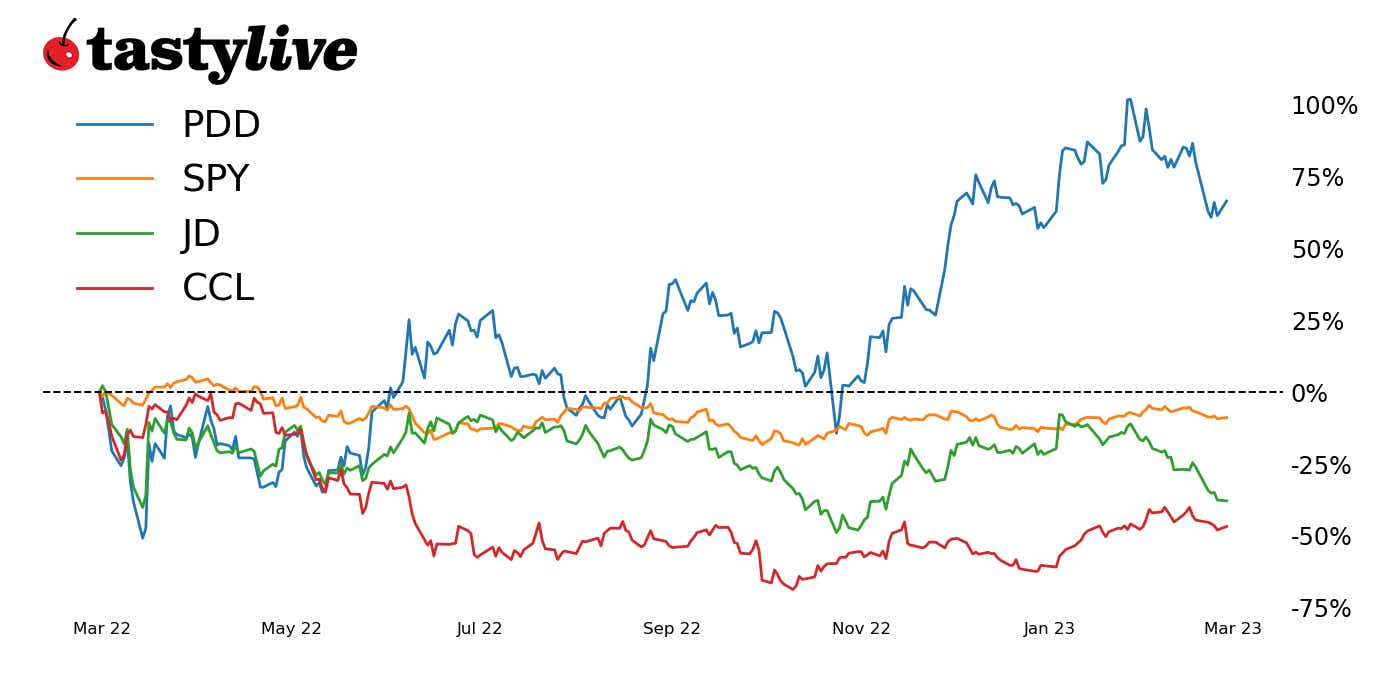

The SPDR S&P 500 ETF (SPY) is currently trading at $398.65, up 3.68% from its opening price of 2023. In late January of 2023, price action broke through the $400.00 resistance barrier and continued to $418.40, where it found selling pressure.

The SPY’s high watermark of the year was reached on February 2nd and since then we have retreated to the $400.00 price level. This previous resistance level is now being tested as support. Last week the SPY dipped down to $393.64. If we continue to see selling pressure, price action will maintain its bearish stance. If that happens, look for price to test the $387.70 price level for support.

If SPY finds and maintains buyers at its current level this week, just below $400.00, then expect price action to push higher and eventually seek out a new high for the year. The nearest resistance band above current price is around $409.42. Price action would have to break through this resistance before pushing to new highs for this year.

Top Stocks to Watch in March

- JD.com Inc. (JD)

- PDD Holdings Inc. (PDD)

- Carnival Corp. (CCL)

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

JD.com Inc. (JD)

Earnings Date: March 9th, 2023 (Before the open)

JD.com, Inc. operates as an online direct sales company in China. JD.com, Inc. is based in Beijing, China. Through its website www.jd.com, and mobile applications, it provides e-commerce platforms for business and consumers.

JD.com currently operates in the E-commerce, Artificial intelligence, Robotics, and Autonomous Vehicle industries. JD continues to develop its global presence, currently operating in Brazil, Cambodia, Chile, China, Denmark, Ecuador, Finland, Indonesia, Laos, Norway, Peru, Sweden, Switzerland.

JD is currently trading at $44.64, down 22.99% from its opening price of 2023. The last five quarters of earnings reports have been mixed. Three net loss quarters followed by two recent net gain quarters. Since JD has had mixed results recently when it comes to earnings, it continues to create uncertainty in the market and as a result we tend to see larger corrections post earnings announcements, as the market reassesses its value.

With that in mind, we take a look at the options markets in JD. March options are tight at $0.01 to $0.02 wide in some strikes, and very liquid. On March 9th the March contracts will be 7 days out, which may be too much risk for some to take the trade. However, if you want to stay defined and have the option to roll out to April contracts, then March contracts would be a good option for earnings plays.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

PDD Holdings Inc. (PDD)

Earnings Date: March 20th, 2023 (Before the open)

Pinduoduo Inc. provides an e-commerce platform allowing users to participate in group buying deals, primarily through Tencent's Wechat app. Pinduoduo Inc. is based in Shanghai, China.

PDD is currently trading at $86.23, up 0.84% from its opening price of 2023. The last five quarters of earnings reports have been net positive. In late 2021 and early 2022, PDD was spending more cash than it was retaining. However, the last two quarters have returned to positive net cash flow.

Since PDD announces earnings on March 20th, we will use April’s contract for earnings plays. Options markets in April are about $0.10 wide. April contract strikes are currently $5.00 wide but expect them to introduce $1.00 wide contracts as we get further into March.

If you are comfortable with delta-neutral undefined positions, a strangle going into earnings with very wide strikes could work well since there is a lot of premium to be collected around one standard deviation away or further.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

Carnival Corp. (CCL)

Earnings Date: March 28th, 2023 (Before the open)

Carnival Corp. operates as a cruise and leisure company. Carnival Corporation & Carnival plc form the largest cruise operator in the world. The company operates on North America, Australia, Europe and Asia. The company's brands include Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises (Australia), Costa Cruises, AIDA Cruises, P&O Cruises (UK) and Cunard.

CCL is currently trading at $10.85, up 31.67% from its opening price of 2023. The last five quarters of earning reports have been net negative. Cashflow has also been net negative for the same period. However, sales are trending up and net losses appear to be shrinking as well.

The advantages of trading CCL options going into earnings are the tightness of the markets, which are a penny or two wide in March and April contracts, and the size of the product. Since CCL is trading around $10, the price of options is relatively cheap, allowing us to place small trades.

Wide spreads in and out of the money can work well if you have a directional bias. CCL also lends itself to small undefined risk positions. However, keep in mind that the price of a cheaper product like CCL can move a lot after earnings. Expect that price will test your strikes and that you’ll have to defend your position as some point during the trade.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.