The Best AI Stocks to Watch: September 2023

The Best AI Stocks to Watch: September 2023

By:Mike Butler

Our list includes three solid AI stocks—and one underperformer.

- The NASDAQ is currently up over 40% in 2023, led by the AI boom.

- Artificial Intelligence is changing the way we work and live.

- While AI stocks have already had big gains in 2023, many believe this is just the beginning.

The tech sector is blasting off to the moon in 2023, largely because of the seismic shift in demand we've seen in the AI sector.

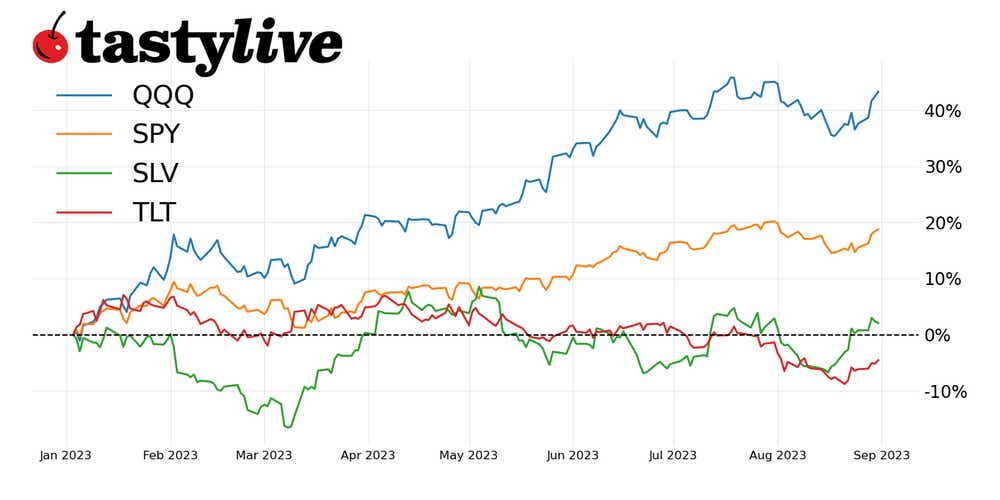

The Nasdaq ETF (QQQ) is up over 40% on the year, doubling the returns of the S&P 500 ETF (SPY) which has much more sector balance within it. In Q2'23, Nvidia (NVDA) almost doubled its quarterly revenue, and more than doubled net income.

The AI surge is real, it's just a matter of what companies will take the biggest piece of the pie at the end of the day. Compared to other sectors like silver and bonds, current annual returns don't even come close to the tech space.

- Nvidia Corp. (NVDA) - $1.14 trillion market cap

- C3.ai Inc (AI) - $3.44 billion market cap

- Advanced Micro Devices Inc (AMD) - $165 billion market cap

- Taiwan Semiconductor Manufacturing Co Ltd (TSM) - $445 billion market cap

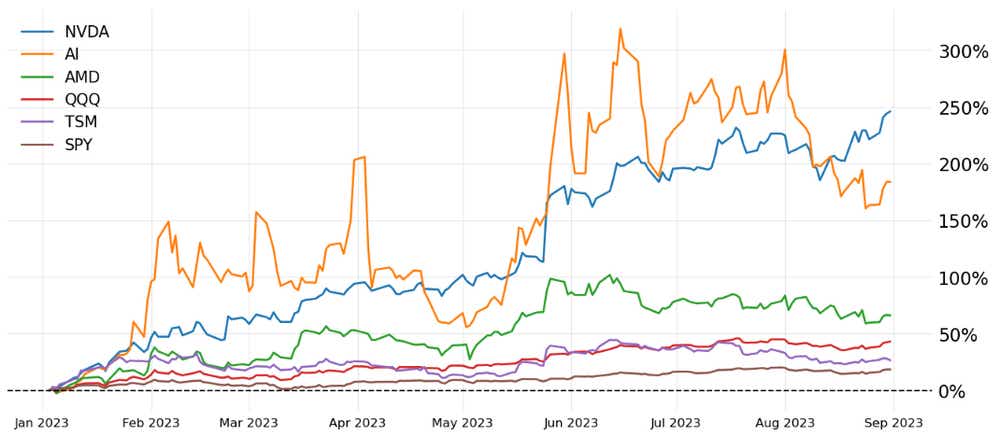

These four AI-oriented tech stocks are surging in 2023, as we can see in the chart above. These stocks are reporting massive numbers on their quarterly earnings calls, with Nvidia (NVDA) more than doubling net income last quarter. The big takeaway is the fact that Taiwan Semiconductor Manufacturing Co Ltd (TSM) has mostly underperformed. Let's break down each tech stock to see how they tick.

Nvidia

- The company is expected to distribute a 0.14% dividend on Sept. 6.

- Nvidia opened 2023 trading at $148.51 and reached a stock price record high of $502.66 on Aug. 24.

- The stock price is expected move +-$95.51 through the Dec.15 monthly options cycle, based on current implied volatility.

Nvidia has been the poster child for the tech and AI boom we've seen this year. When the company speaks, the masses listen. The tech giant has beat earnings-per-share (EPS) and revenue estimates three quarters in a row, with a staggering 29.36% EPS beat and 20.92% revenue beat in Q2.

It's eye-opening that many investors say Nvidia's stock is still cheap after hitting record highs. That might imply that the way we work and live may change drastically over the years and AI demand could seem infinite.

Bubbles come and go, but we've already seen how something as simple as chatGPT can change the way we do things. This doesn't feel like a bubble to me, and I'd say most people agree with that sentiment. Nvidia stock jumped from $305 to $394.80 a day later after earnings on May 24, which was one of the biggest post-earnings rallies I've seen in a while.

C3.ai Inc

- C3.ai scheduled its quarterly earnings call for Sept. 6 at 3:15 p.m. Central Time.

- C3.ai opened 2023 trading at $11.43 and reached a record high of $48.87 on June 16.

- The stock price is expected move +-$10.41 through the Dec.15 monthly options cycle, based on current volatility.

C3.ai Inc has been one of the more volatile AI stocks in 2023, up almost 400% at one point on the year.

The company has destroyed EPS estimates four quarters in a row by double digits, with the latest EPS beat coming in at a 23.12% surprise. It has exceeded revenue expectations three quarters in a row. However, the short interest on the stock is relatively high, which means investors are short the stock rather than long, betting on the stock price to go down—in other words, for the company to fall short of expectations over time and the stock price to drop.

With high short interest comes the possibility of a short squeeze though, which can create massive upside pressure on a stock—like what happened with AMC Entertainment (AMC) and GameStop (GME) a few years ago. This stock made the Top 10 stocks to watch in September list posted a few days ago on tastylive.

Advanced Micro Devices Inc. (AMD)

- AMD is expected to announce quarterly earnings in November.

- AMD opened 2023 trading at $66.00 and reached a record high of $132.83 on June 13.

- The stock price is expected to move +-$17.88 through the Dec.15 monthly options cycle, based on current implied volatility.

A lot of AI investors view AMD stock as one of the closest competitors to Nvidia stock in the race for GPU market share. AMD stock has beat EPS and Revenue estimates three quarters in a row, but the company is expecting some weaker sales numbers heading into Q3'23.

But, if AMD can keep its foot on the gas and continue to improve their chips, the company is likely to be in the headlines right next to Nvidia (NVDA). In fact, many chip analysts say that AMD's Radeon cards offer a higher bang-for-your-buck than Nvidia's, if you're willing to forego the ray-tracing technology that Nvidia cards offer.

4) Taiwan Semiconductor Manufacturing Co Ltd (TSM)

- TSM is expected to distribute a 2.75% dividend on Sept.14.

- The company opened 2023 trading at $75.85 and reached a stock price record high of $110.69 on June 13.

- The stock price is expected to move +-$9.59 through the Dec.15 monthly options cycle, based on current implied volatility.

TSM stock has plenty of risk associated with it, but the fact that it plays a significant role in supply to mega-tech stocks like Apple (AAPL) and Nvidia (NVDA) makes for a compelling case for a rebound here from the middle of the trading range in 2023. It beat EPS estimates twice in a row, and I expect that with strong demand for chipmakers overall the company could stand to benefit. The expected move through nearly the rest of 2023 is +-$9.59 based on current implied volatility, which is just over 10% of the stock's current price.

For more extensive coverage of artificial intelligence and AI stocks, check out the free digital issue of the AI-focused issue of Luckbox Magazine. You can subscribe for free at getluckbox.com.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.