The AI Battle Roars On

The AI Battle Roars On

By:Mike Butler

AMD Quarterly Earnings Preview—7% Projected Price Move

- AMD is set to inject $400 million into India over the next five years.

- 3,000 new engineering jobs could result in India over the next five years.

- AMD's stock price has almost doubled since the start of 2023.

- The company has beaten earnings per share and revenue estimates in three of the last four quarters.

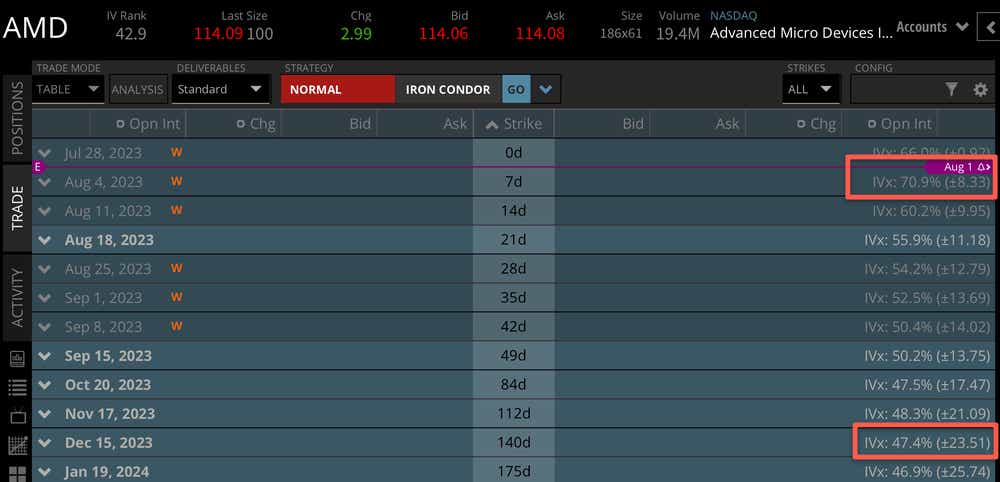

- Earnings per share are estimated to be $0.57 on $5.32 billion in revenue. The stock is projected to move +-$8.33 next week.

Advanced Micro Devices (AMD) is making moves in India. Speaking July 28 at an annual semiconductor conference, Mark Papermaster, AMD's chief technology officer, stated the semiconductor giant would invest heavily in facilitating growth and providing new jobs in India over the next five years.

The stock has benefited mightily in 2023 from the growth in the tech sector overall, with the stock price up to $114 from an opening print of $66 in January 2023. AMD continues to have a strong fingerprint in the artificial intelligence world. AMD is engaged in what seems to be a battle with NVIDIA (NVDA) over which company's technology can process large language models (LLMs) most efficiently. Artificial intelligence swept the tech space, and AMD is riding right along with the sector rally.

The popular tech company has beaten earnings per share (EPS) and revenue estimates twice in a row—can the third time be even more of a charm?

AMD is slated to announce its earnings on Aug. 1 at 3:15 p.m. CST. EPS are expected to come in at $0.57, on $5.32 billion in revenue.

AMD earnings preview: a 7% expected move

Looking at the implied volatility of the options market, we can see that next week's options cycle is projecting a +-$8.33 move next week, which contains the earnings announcement.

This is about 7% of the stock price, which is a large move relative to other earnings expected moves for similarly priced stocks.

Looking out to the end of the year at the December options cycle, which boasts a +-$23.51 expected move, the market is telling us next week's earnings report could make up for a sizable chunk of the expected move for the rest of the year.

Bullish on AMD earnings

The stock has already rallied aggressively in 2023, up almost 100% on the year, but the company continues to release growth-oriented statements, like their intention to grow dramatically in India over the next five years, while providing thousands of jobs to the community. Naturally, just being attached to the computer/tech/AI sector doesn't hurt, given the transformation we've seen in the space this year alone.

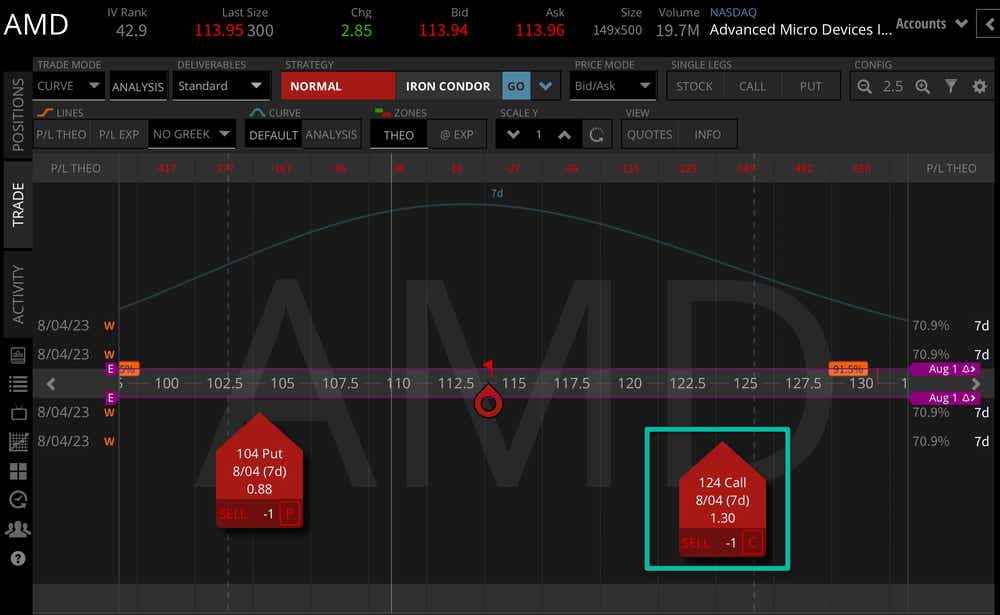

The options market is also pricing equidistant calls at a higher premium than equidistant puts. Looking at out-of-the-money (OTM) options 10 points away from the current stock price of $114, we can see the call option is trading for $1.30, compared to $0.88 on the put side. This means the market is pricing in the risk of a high velocity move, potentially to the upside. That doesn't mean the market is moving that way, but it does mean there is more interest on upside than the downside in terms of speculation/hedging.

With AMD now in the AI ring with NVDA, if they make strides in computing efficiency the company could give NVDA a run for its money and be a darling in a bullish AI investor's eye.

Bearish on AMD earnings

After a few earnings beats in a row for both EPS and revenue, if the company misses or shows weak guidance for the rest of the year, it could spell trouble for the growing tech stock. At the same time, the stock has already climbed almost 100% this year alone, so shaky investors could take profits if they've been in for the long haul and create some downside pressure post-earnings.

We shall see what the market thinks of what AMD has to say Aug. 1 at 3:15pm CST, after the market closes.

Tune in at 11 a.m. CST, Aug. 1, to Options Trading Concepts Live for a full breakdown of the earnings environment and some options trades as well.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.