AUD/USD: The U.S. Dollar May Gain Strength as Australian Inflation Cools

AUD/USD: The U.S. Dollar May Gain Strength as Australian Inflation Cools

By:Ilya Spivak

A strong U.S. economy and weak Australian inflation are setting the stage for the bigger dollar to lead the smaller one

- The Australian dollar has tumbled despite hawkish central bank guidance .

- Relative U.S. dollar outperformance owes to cooling Fed interest rate cut outlook.

- Incoming Australian CPI inflation, U.S. GDP data aim for more of the same.

The Australian dollar has been sinking against its U.S. namesake. The currency is trading at its lowest level in nearly three months. It is working on its fifth consecutive week of losses, which would amount to its worst streak since January. Economic data due for release this week might add to selling pressure.

The latest bout of selling comes even as the levers of monetary policy seem to be tuned for the opposite result. The Federal Reserve began the long-awaited interest rate cut cycle with a big-splash 50-basis-point (bps) reduction in September. It signaled 50bps in further cuts before the end of the year and 100bps in easing on the menu for 2025.

By contrast, the Reserve Bank of Australia (RBA) has resisted lowering interest rates. Stimulus bets have steadily eroded amid the central bank’s hawkish posturing since the beginning. Markets were pricing in at least two cuts for 2024 at the start of the year. No change has occurred, and none is now priced in until next year.

U.S. GDP data may give the U.S. dollar another lift

The Aussie’s drop so far has come from repricing U.S. rate expectations as hotter-than-expected economic data eroded scope for easing in the minds of traders. The 2025 policy path implied in Fed Funds interest rate futures adjusted from 123bps in cuts when the U.S. central bank met in mid-September to 82bps now.

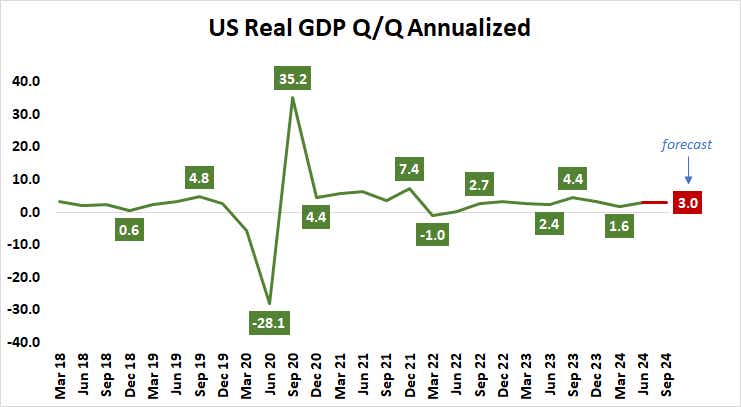

More of the same may be in store this week as third-quarter U.S. gross domestic product (GDP) data comes across the wires. It is expected to show the economy grew at an annualized rate of 3% in the three months to September, a repeat of the second quarter.

Analytics from Citigroup show U.S. economic news-flow has increasingly outperformed relative to baseline forecasts since late August. If that proves to set the stage for an upside surprise on the GDP result, further erosion in Fed interest rate cut speculation is likely to keep the greenback on offense.

Soft CPI inflation may boost RBA interest rate cut bets

Soggy Australian consumer price index (CPI) numbers might add a local dimension to the currency’s troubles. Headline quarterly data is expected to put price growth at 2.9% year-on-year in the third quarter, marking the lowest reading since the three months to March 2021.

Leading purchasing managers’ index (PMI) data from S&P Global and Judo Bank points to easing price pressures. September’s report showed average selling prices rose at the slowest pace since December 2020. If that shows up as a downside surprise in official statistics, a dovish adjustment to RBA policy bets may follow.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.