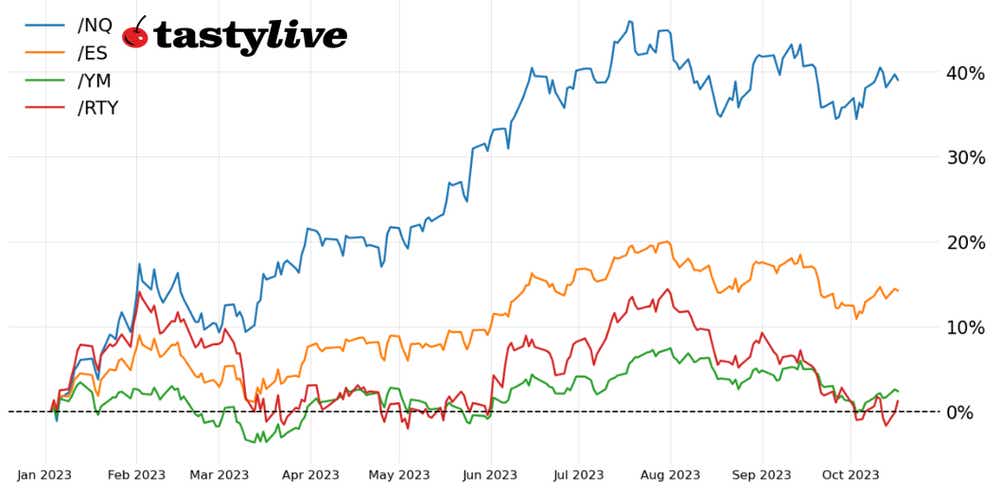

Technical Traders: Russell 2000 Leads the Way as S&P 500, Nasdaq 100 Prove Resilient

Technical Traders: Russell 2000 Leads the Way as S&P 500, Nasdaq 100 Prove Resilient

The S&P 500 is up 1.67% month-to-date. Meanwhile, bonds are breaking again.

- /RTYZ3 is leading the way higher in recent sessions after breaking the downtrend from the August and September swing highs.

- Bonds have broken down again, but stock traders seem unsure if this is an unwind of geopolitical war hedges or a sign the Federal Reserve is more likely to raise rates.

- A bevy of Fed officials hitting the lecture circuit in the coming days could provide clarity as to what to expect for the November FOMC meeting.

Resiliency is the name of the game through the first two days of the trading week, as stocks shrugged off their losses at the end of last week to turn higher through Monday and Tuesday.

Led higher by the Russell 2000 (/RTYZ3), each of the four major U.S. indexes are more than +1% off lows set since last Thursday (while /RTYZ3 is up by more than +3%). Geopolitical risks and a push higher by U.S. Treasury yields have hampered some of the gains accumulated during today’s session, but a strong push off the lows despite exogenous concerns can’t be dismissed during the month known as “the bear killer.”

/ESZ3 S&P 500 price technical analysis: daily chart (September 2022 to October 2023)

/ESZ3 continues to hang around the neckline of a head and shoulder’s pattern that formed between June and September, while /ES (continuous contract) has rebounded above the trendline from the October 2022 and March 2023 swing lows (as well as the head and shoulder’s neckline). Put another way, former resistance has switched to support in multiple instances, especially when price action around the daily 21-EMA (one-month moving average) is considered as well. Otherwise, momentum continues to improve, with MACD trending higher and slow stochastics lingering near overbought territory.

/NQZ3 Nasdaq 100 price technical analysis: daily chart (December 2022 to October 2023)

In our last update it was noted that “a range over the past 10 days around 14600/15100. A short-term double bottom may be coming together near the August low, which would point to an upside target just north of 15600. Resistance arrives soon, however. The trendline off the July, August, and September swing highs comes into focus near 15450/500 over the coming sessions.” While the multi-month descending held as resistance, the fact that former range resistance near 15100 has held up as support on multiple retests over the past week. Something must give soon (either trendline resistance or former range resistance turned support); a breakout or breakdown could be around the corner.

/RTYZ3 Russell 2000 price technical analysis: daily chart (April to October 2023)

/RTYZ3 has led the way higher in recent sessions, having broken the downtrend from the August and September swing highs while forming a double bottom of sorts near 1700/30—an area that has held up as support on several occasions since the regional banking crisis began in March. While there is still more work to be done, particularly a close back above the daily 21-EMA, which hasn’t been achieved since Sept. 1, it remains the case that “a move above 1850 through the end of the month would substantiate the technical perspective that the lows are in for the rest of 2023.”

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.