S&P 500: Stocks Open the Week With a Rebound and More Earnings Ahead

S&P 500: Stocks Open the Week With a Rebound and More Earnings Ahead

Also, the Two-Year T-Note, Gold, Crude Oil, and Australian Dollar Futures

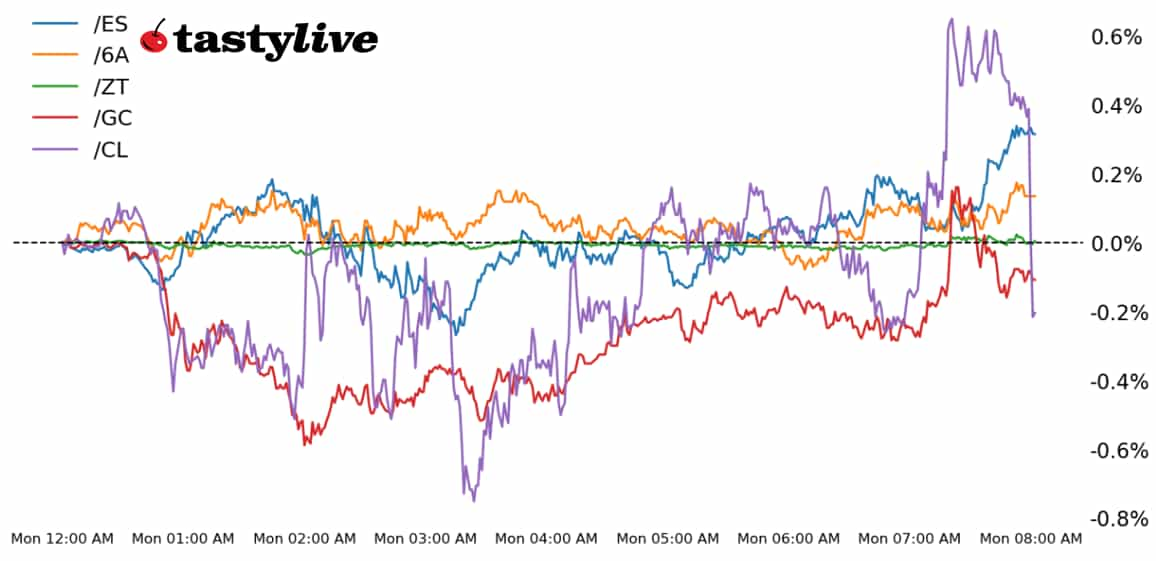

- S&P 500 e-mini futures (/ES): +0.50%

- Two-year T-note futures (/ZT): -0.03%

- Gold futures (/GC): -0.58%

- Crude oil futures (/CL): 0.00%

- Australian dollar futures (/6E): +0.46%

Deleveraging ahead of the weekend was met by the relatively good news that a temporary ceasefire was declared in the Israeli-Hamas war to open humanitarian corridors out of Gaza and into Egypt.

The darlings at the end of last week, crude oil and gold, have retreated as the calendar has turned into the second half of the month. Meanwhile, absent a meaningful macro docket in the coming days, traders’ attention will be on the bevy of earnings releases around the corner: Bank of America (BAC) and Goldman Sachs (GS) on Tuesday; and Tesla (TSLA) and Netflix (NFLX) on Wednesday.

Symbol: Equities | Daily Change |

/ESZ3 | +0.50% |

/NQZ3 | +0.33% |

/RTYZ3 | +0.87% |

/YMZ3 | +0.59% |

All four major U.S. equity index futures are back in the green on Monday after a discouraging performance to close out the week. Last week’s big loser, the Russell 2000 (/RTYZ3) is leading higher, with the S&P 500 (/ESZ3) right on its heels. Earnings will be in focus in the coming sessions. Investors also will watch and speeches from Federal Reserve officials, as the Fed laid groundwork for no additional rate hikes over the past week.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4340 p Short 4350 p Short 4420 c Long 4430 c | 57% | +600 | -400 |

Long Strangle | Long 4340 p Long 4430 c | 52% | x | -7062.50 |

Short Put Vertical | Long 4340 p Short 4350 p | 58% | +175 | -325 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.03% |

/ZFZ3 | -0.14% |

/ZNZ3 | -0.32% |

/ZBZ3 | -1.00% |

/UBZ3 | -1.33% |

Bonds are down across the curve at the start of the week as there appears to be an unwinding of a safe haven trade that played out on Friday, amid expectations that the Israeli-Hamas war could escalate over the weekend. Instead, the safety positions are being jettisoned in favor of a return to stocks. It’s noteworthy that the biggest movers continue to be 30-year bonds (/ZBZ3) and ultras (/UBZ3) instead of the two-year notes (/ZTZ3), as markets become increasingly comfortable with the idea that the Federal Open Market Committee (FOMC) is done raising rates.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 100.5 p Short 100.75 p Short 101.75 c Long 102 c | 40% | +187.50 | -312.50 |

Long Strangle | Long 100.5 p Long 102 c | 42% | x | -312.50 |

Short Put Vertical | Long 100.5 p Short 100.75 p | 92% | +78.13 | -421.88 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.58% |

/SIZ3 | -0.59% |

/HGZ3 | +0.59% |

Last week’s rush into precious metals isn’t carrying over into Monday trading, with gold prices (/GCZ3) down $10 to trade at $1,930. Bond yields are moving higher as investors seek safety amid ongoing conflict in the Middle East. Meanwhile, industrial metals are benefiting from a move by China’s central bank to inject liquidity into its economy. Copper prices (/HGZ3) are up slightly and on track to break a four-day losing streak.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1900 p Short 1910 p Short 1950 c Long 1960 c | 61% | +620 | -380 |

Long Strangle | Long 1900 p Long 1960 c | 46% | x | -5210 |

Short Put Vertical | Long 1900 p Short 1910 p | 62% | +440 | -560 |

Symbol: Energy | Daily Change |

/CLZ3 | 0.00% |

/NGZ3 | -2.65% |

Crude oil is starting the week higher as expectations mount that the United States will tighten its enforcement actions against Iranian oil exports, which could remove hundreds of thousands of barrels per day from global supply. Meanwhile, the U.S. is taking efforts to contain the Israel-Hamas conflict from broadening across the region. Energy markets are likely in for a volatile week.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 83.5 p Short 84 p Short 89.5 c Long 90 c | 20% | +380 | -130 |

Long Strangle | Long 83.5 p Long 90 c | 48% | x | -5,490 |

Short Put Vertical | Short 84 p Long 83.5 p | 57% | +230 | -270 |

Symbol: FX | Daily Change |

/6AZ3 | +0.46% |

/6BZ3 | +0.29% |

/6CZ3 | +0.28% |

/6EZ3 | +0.24% |

/6JZ3 | -0.01% |

A move by China’s central bank—the People’s bank of China (PBOC)—overnight is propping up the Australian dollar, with prices (/6AZ3) rising about 0.5% this morning despite mixed risk appetite in other assets. The PBOC pushed 289 billion yuan into the market through its medium-term lending facility. That was the largest injection in over three years.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.615 p Short 0.62 p Short 0.65 c Long 0.655 c | 48% | +240 | -260 |

Long Strangle | Long 0.615 p Long 0.655 c | 33% | x | -630 |

Short Put Vertical | Long 0.615 p Short 0.62 p | 78% | +120 | -380 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2024 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.