Ongoing Bond Market Carnage Limits S&P 500 Recovery

Ongoing Bond Market Carnage Limits S&P 500 Recovery

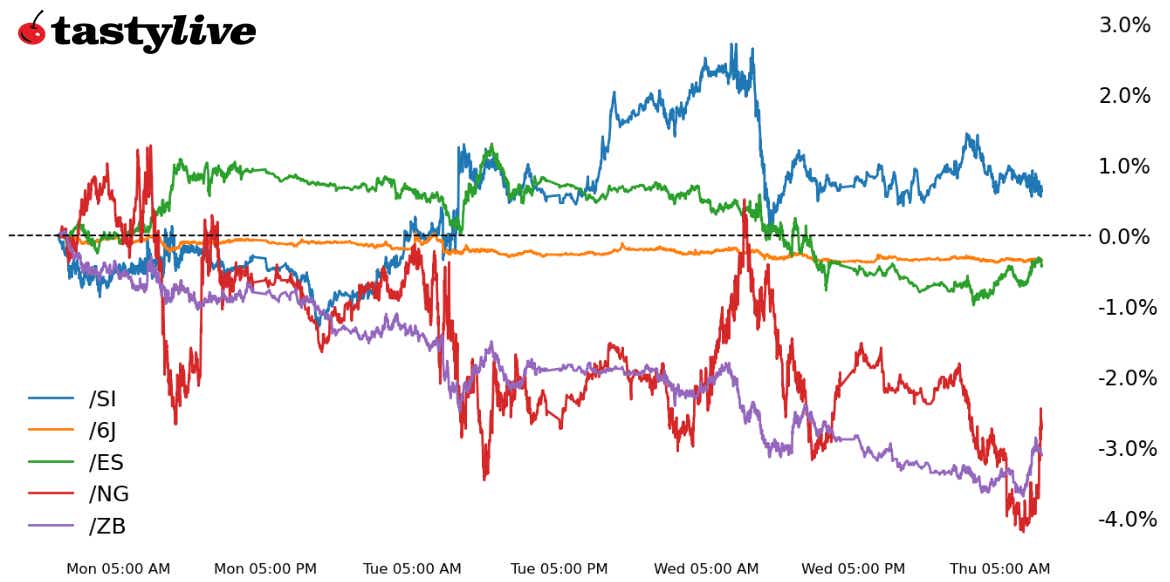

Also, 30-year T-bonds, silver, natural gas and Canadian dollar futures

- S&P 500 E-mini Futures (/ES): +0.13%

- 30-year T-Bond Futures (/ZB): -0.34%

- Silver Futures (/SI): -0.47%

- Natural Gas Futures (/NG): -0.69%

- Japanese Yen Futures (/6J): 0.00%

Mixed earnings results from a slew of companies gave traders pause following yesterday’s brutal price action over the course of the session, but lingering geopolitical risks have markets taking an increasingly defensive posture. That said, with crude oil and gold trading lower, there may be a window for traders to use to try to push up equity markets; a weaker U.S. dollar would go a long way as well. Federal Reserve Chair Jerome Powell speaks today at 12 p.m. EDT, in what will be the most important event of the week.

Symbol: Equities | Daily Change |

/ESZ3 | +0.13% |

/NQZ3 | +0.41% |

/RTYZ3 | -0.21% |

/YMZ3 | +0.01% |

Yesterday's ugly tape action has been evident all session long, but earnings results overnight and before the bell today may be providing some relief. But even as three of the four major U.S. equity index futures turn modestly higher, bond markets remain under duress, making any semblance of meaningful recovery for U.S. equities more difficult to imagine.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4310 p Short 4320 p Short 4380 c Long 4390 c | 52% | +575 | -175 |

Long Strangle | Long 4310 p Long 4390 c | 50% | x | -7412.50 |

Short Put Vertical | Long 4310 p Short 4320 p | 57% | +170 | -330 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.01% |

/ZFZ3 | -0.12% |

/ZNZ3 | -0.24% |

/ZBZ3 | -0.34% |

/UBZ3 | -0.47% |

More carnage is occurring in the bond market as issuances across the curve plumb new lows. If it sounds familiar, it is: The long-end of the curve is doing the dirty work, with 30s (/ZBZ3) and ultras (/UBZ3) falling the most during early trading today. A better than expected 20-year bond auction yesterday provided some relief, but the relief did not last. The 2s10s spread continues to narrow, now back to -28 basis points (bps).

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106 p Short 112 c Long 113 c | 42% | +531.25 | -468.75 |

Long Strangle | Long 105 p Long 113 c | 36% | x | -1812.50 |

Short Put Vertical | Long 105 p Short 106 p | 71% | +265.63 | -734.38 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.17% |

/SIZ3 | -0.47% |

/HGZ3 | -0.04% |

Silver prices (/SIZ3) slipped this morning as traders remained on edge over geopolitical tension in the Middle East. President Biden is set to address the nation today on the conflict after returning from a visit to Israel, which appeared to foster an agreement to let aid flow into Gaza from Egypt. With prices up about 6% over the last week, we may see some profit taking as long as the situation doesn’t escalate further. This morning’s jobless claims likely won’t help precious metals. Initial claims for the week ending Oct. 14 rose 198,000, missing estimates and underscoring lingering strength in the labor market. That may boost Fed rate hike bets.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.5 p Short 22.55 p Short 23.55 c Long 23.6 c | 19% | +195 | -55 |

Long Strangle | Long 22.5 p Long 23.6 c | 45% | x | -5,400 |

Short Put Vertical | Long 22.5 p Short 22.55 p | 58% | +105 | -145 |

Symbol: Energy | Daily Change |

/CLZ3 | -0.85% |

/NGZ3 | -0.69% |

Natural gas prices (/NGX3) fell about 1% this morning amid weak demand across much of the United States. Weather models for the U.S. and Europe are forecasting seasonally average temperatures, which should throttle demand. The Energy Information Administration (EIA) will report weekly inventory data later today. Analysts expect to see an 80 billion cubic feet increase.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.9 p Short 2.95 p Short 3.15 c Long 3.2 c | 15% | +410 | -90 |

Long Strangle | Long 2.9 p Long 3.2 c | 42% | x | -4,500 |

Short Put Vertical | Long 2.9 p Short 2.95 p | 75% | +110 | -390 |

Symbol: FX | Daily Change |

/6AZ3 | -0.31% |

/6BZ3 | -0.04% |

/6CZ3 | -0.16% |

/6EZ3 | +0.30% |

/6JZ3 | 0.00% |

The Japanese yen (/6JZ3) was nearly unchanged this morning as the currency’s exchange rate vs. the dollar hovers near suspected intervention levels, putting yen traders on edge. Options traders continue to position themselves for price swings over the coming months as the U.S. yield premium continues to build against Japanese rates. Traders look like they’re expecting something to break.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0065 p Short 0.00655 p Short 0.00695 c Long 0.007 c | 65% | +150 | -475 |

Long Strangle | Long 0.0065 p Long 0.007 c | 22% | x | -387.50 |

Short Put Vertical | Long 0.0065 p Short 0.00655 p | 86% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.