Stocks, Bonds, and the Dollar in Play on Inflation Data: U.S. CPI Preview

Stocks, Bonds, and the Dollar in Play on Inflation Data: U.S. CPI Preview

By:Ilya Spivak

Stocks, bonds, and the dollar hang in the balance as markets eye U.S. CPI inflation data

- Recession fears have fueled a dovish turn in Fed rate cut speculation.

- U.S. CPI inflation figures may show greater disinflation than expected.

- Stocks, bonds, and the dollar in play as calls for stimulus grow louder.

Recession fears have gripped the markets since late February, when U.S. economic data began to signal that the mighty service sector seemed to have weakened suddenly at the start of 2025. Wall Street took notice: The bellwether S&P 500 is on course to record its worst four-week losing streak in over two years.

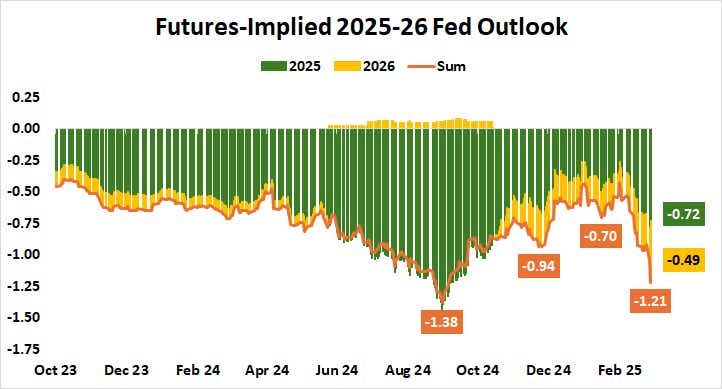

A sharp dovish repricing of Federal Reserve interest rate cut expectations has understandably come alongside the turmoil as markets bet that the central bank will have to dial up stimulus faster and with more gusto than traders or officials previously thought. Treasury bond yields have duly declined across the curve.

Fed rate cut expectations swell as markets seethe about recession

Fed funds futures now price in 122 basis points (bps) in policy easing through the end of 2026. That is a stark contrast from the 50bps on the menu just a month ago. Three standard-sized 25bps rate cuts are favored for this year, followed by two more after the calendar turn. The first reduction in this series is slated for mid-year.

Fed Chair Jerome Powell struck a calmer tone when he opined on the economy and what policymakers will do next last week. He said that the central bank does not need to be in a hurry to adjust rates, arguing that the Fed is well-positioned to wait for greater clarity. “The U.S. economy is in a good place, despite elevated uncertainty,” Powell argued.

This puts incoming U.S. consumer price index (CPI) data front and center. Inflation is expected to have cooled last month. The headline rate expected at 2.9% year-on-year, returning to December’s setting after ticking to 3.0% in January. Similarly, the core rate excluding food and energy prices is seen coming back to 3.2% from 3.3%.

U.S. CPI data in focus for stocks, bonds, and the dollar

Citigroup analytics warn that U.S. data outcomes have increasingly disappointed relative to median forecasts recently. That may tilt surprise risk in favor of another miss. Recession-minded markets may bristle at such a result if easing price pressure at the core reinforces growth concerns.

Against this backdrop, the apparent lack of urgency at the Federal Reserve might mean that markets are pushed to dial up speculation about the belated arrival of harder-hitting stimulus. Treasury yields are likely to fall alongside the U.S. dollar in this scenario. It remains to be seen if stocks find a way to take heart in dovish mythmaking, if only for a bit.

.png?format=pjpg&auto=webp&quality=50&width=759&disable=upscale)

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.