S&P 500: How Will Markets Absorb New Geopolitical Pressures?

S&P 500: How Will Markets Absorb New Geopolitical Pressures?

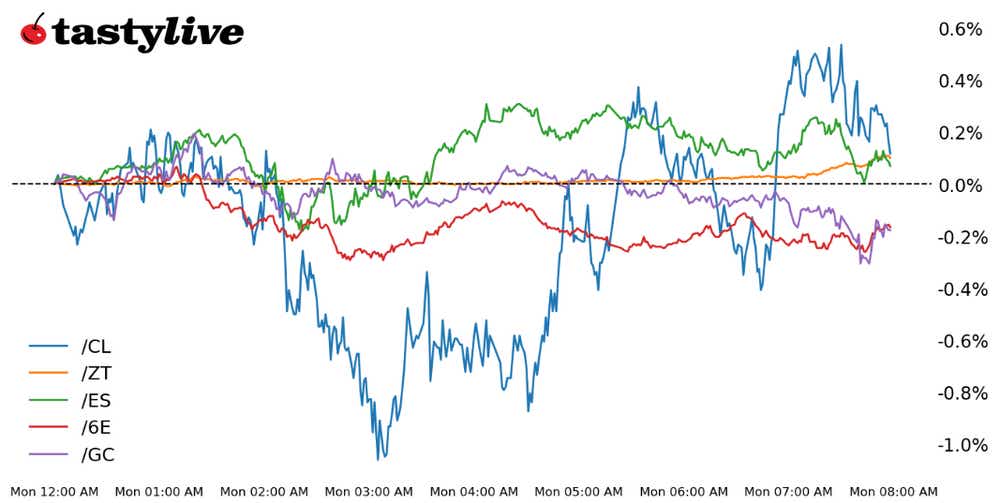

Also, the two-year T-Note, gold, crude oil and euro futures

This Morning’s Five Futures in Focus:

- S&P 500 e-mini futures (/ES): -0.53%

- 2-year T-note futures (/ZT): +0.20%

- Gold futures (/GC): +0.79%

- Crude oil futures (/CL): +3.26%

- Euro futures (/6E): -0.48%

Shocking news from Israel over the weekend sparked opening price gaps at the start of the week, although there hasn’t been much follow-through beyond the initial gaps. Markets are positioning in a classic risk-off defensive posture, with the Japanese yen and U.S. dollar leading the way, followed by strength in both precious metals and bonds. Energy markets remain a ground zero of sorts, whereby concerns that a protracted regional conflict spanning from Jerusalem to Tehran could disrupt global oil supplies.

Symbol: Equities | Daily Change |

/ESZ3 | -0.53% |

/NQZ3 | -0.64% |

/RTYZ3 | -0.87% |

/YMZ3 | -0.48% |

The enthusiasm experienced by U.S. equity markets on Friday has quickly soured at the start of the week, given the news out of Israel. However, after initially gapping open to the downside, each of the four major U.S. equity index futures are showing signs of relative stability around the start of trading in New York. The Russell 2000 (/RTYZ3) and the Nasdaq 100 (/NQZ3) are the leaders to the downside; neither has lost more than 1% thus far.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4270 p Short 4280 p Short 4350 c Long 4360 c | 53% | +345 | -155 |

Long Strangle | Long 4270 p Long 4360 c | 46% | x | -7850 |

Short Put Vertical | Long 4270 p Short 4280 p | 59% | +175 | -325 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.20% |

/ZFZ3 | +0.48% |

/ZNZ3 | +0.63% |

/ZBZ3 | +0.59% |

/UBZ3 | +0.41% |

The safe haven trade is in full effect in U.S. Treasury bonds, with the 10-year note (/ZNZ3) seeing the biggest price improvement relative to the close on Friday. However, Federal Reserve officials are starting to lay the groundwork for no additional rate hikes: San Francisco Fed President Mary Daly said last week the recent bump in yields may diminish the need for another hike; and Dallas Fed President Lorie Logan said the same thing today.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101 p Short 101.125 p Short 101.75 c Long 101.875 c | 24% | +171.88 | -78.13 |

Long Strangle | Long 101 p Long 101.875 | 53% | x | -781.25 |

Short Put Vertical | Short 101.125 p Long 101 p | 86% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.79% |

/SIZ3 | +0.75% |

/HGZ3 | +0.55% |

Gold prices (/GCZ3) are advancing higher despite a stronger dollar. The fighting between Israel and Hamas is boosting safe-haven bids. Military analysts already expect to see a drawn out and bloody conflict that may forever alter the Middle East. Gold may have more room to run this week, especially if the conflict intensifies. Today, traders will have their eyes on several Federal Reserve members who are set to speak, including Fed Vice Chair Michael Barr.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1810 p Short 1815 p Short 1855 c Long 1860 c | 18% | +390 | -120 |

Long Strangle | Long 1810 p Long 1860 c | 47% | x | -4,190 |

Short Put Vertical | Short 1815 p Long 1810 p | 74% | +130 | -360 |

Symbol: Energy | Daily Change |

/CLZ3 | +3.26% |

/NGZ3 | -0.66% |

Energy markets are advancing as the conflict between Israel and Hamas stoke geopolitical tensions in the Middle East. Crude oil prices (/CLZ3) are up nearly 4% this morning, which already puts the daily gain at the largest since May. Natural gas prices (/NGZ3) are also moving higher, with Chevron closing a gas platform in the Eastern Mediterranean at the direction of the Israel government.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 82 p Short 82.5 p Short 87.5 c Long 88 c | 19% | +390 | -120 |

Long Strangle | Long 82 p Long 88 c | 47% | x | -5,520 |

Short Put Vertical | Short 82.5 p Long 82 p | 56% | +210 | -280 |

Symbol: FX | Daily Change |

/6AZ3 | -0.39% |

/6BZ3 | -0.41% |

/6CZ3 | +0.11% |

/6EZ3 | -0.48% |

/6JZ3 | +0.21% |

Both the Japanese yen and the U.S. dollar are benefiting from their status as liquid safe havens at a time when markets are staring down increased uncertainty. The Canadian dollar (/6CZ3) is also faring well, at least relative to some of its peers, given the jump in energy prices seen since the close on Friday. German inflation figures due later this week will keep attention focused on the euro (/6EZ3) as well.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.045 p Short 1.05 p Short 1.065 c Long 1.07 c | 25% | +462.50 | -162.50 |

Long Strangle | Long 1.045 p Long 1.07 c | 43% | x | -1,950 |

Short Put Vertical | Short 1.05 p Long 1.045 p | 70% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.