Gold and Silver Breakouts are Gathering Pace

Gold and Silver Breakouts are Gathering Pace

Will metals return to Earth, or is a bigger move waiting around the corner for other asset classes?

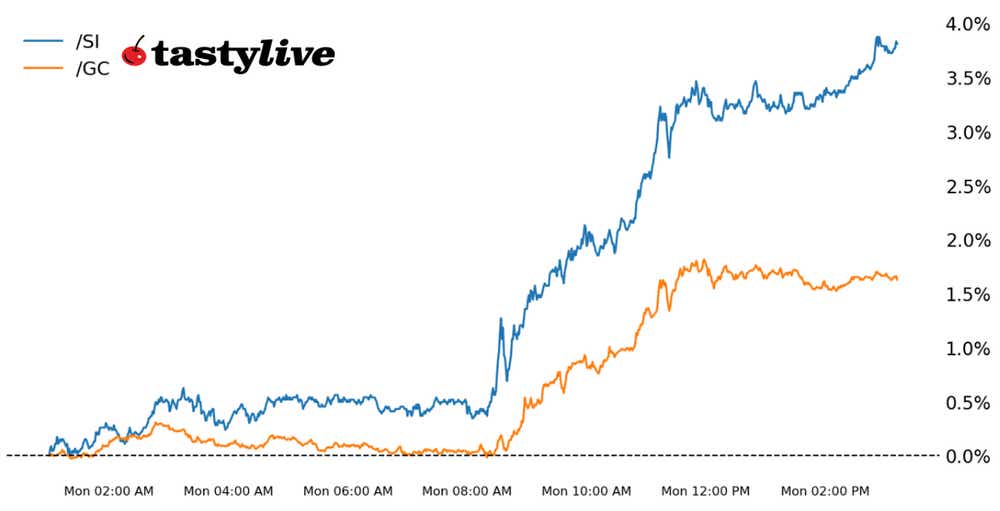

- Gold prices (/GCJ4) have surged in the past two sessions and are on pace to finish the day at a record closing high.

- Silver prices (/SIK4) are breaking out higher as well, with an inverse head and shoulders pattern in focus.

- Precious metals have indeed weathered the storm in the bond market; is the move today a precursor to a drop in yields?

Market update: gold prices up +3.44% month-to-date

U.S. equity markets have pushed to all-time highs, and bonds have failed to find legs beneath a bottoming effort, yet precious metals are acting as though tail risks have rapidly escalated or yields are on the precipice of cratering. Something is amiss, but what we don’t know. Nevertheless, that begs the question: will metals return to Earth or is there a bigger move waiting around the corner for other asset classes?

While we’ve previously argued that “gold (/GCJ4) and silver prices (/SIH4) are proving resilient in a difficult environment,” it now stands to reason that this resiliency was an early sign that bulls were waiting in the wings. Technical breakouts in both /GCJ4 and /SIK4 may just be getting started.

/GC Gold Price Technical Analysis: Daily Chart (September 2023 to March 2024)

After loitering around the midpoint of the multi-month range between 2000 and 2120, gold prices (/GCJ4) surged in recent days to immediately test topside resistance. This is mostly unchartered territory, having never closed at or above these levels previously. Momentum is firm, with /GCJ4 above its daily EMA (exponential moving average) cloud, slow stochastics trending higher into overbought territory and MACD (moving average convergence/divergence) trending higher above its signal line. For those who took advantage of the environment in mid-February (“with limited volatility (IV Index: 11.1%; IV Rank: 11.5), a long ATM call spread would be a more appropriate expression of bullishness than a short ATM put spread”), there’s little reason to get out of position yet. Likewise, there’s no technical reason (yet) to try and fade the move.

/SI Silver Price Technical Analysis: Daily Chart (September 2023 to March 2024)

The bullish falling wedge has finally kicked into gear with a concurrent breakout of the inverse head and shoulders pattern that’s been forming since the start of the year in silver prices (/SIK4). The break of the downtrend from the December 2023 and February 2024 swing highs offers confirmation of both of these bullish patterns coinciding at the same time for a perfect technical storm of sorts. As was noted in mid-February, “should a breakout gather pace, given the low volatility persisting … a long directional bias may be best deployed via a long ATM call spread.” This remains the case.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.