GameStop Earnings: Can They Post a Big Surprise?

GameStop Earnings: Can They Post a Big Surprise?

By:Mike Butler

GameStop will report quarterly earnings on Dec. 6 after the stock market closes and implied volatility is through the roof

- GameStop will report quarterly earnings on Dec. 6 at 3:05 p.m. Central Time, after the stock market closes

- Earlier this year, GameStop posted a massive earnings-per-share (EPS) surprise and the stock rallied almost $10 from $17 to $27

- This quarter, analysts expect GameStop to post a loss of $0.08 per share, on $1.18 billion in revenue

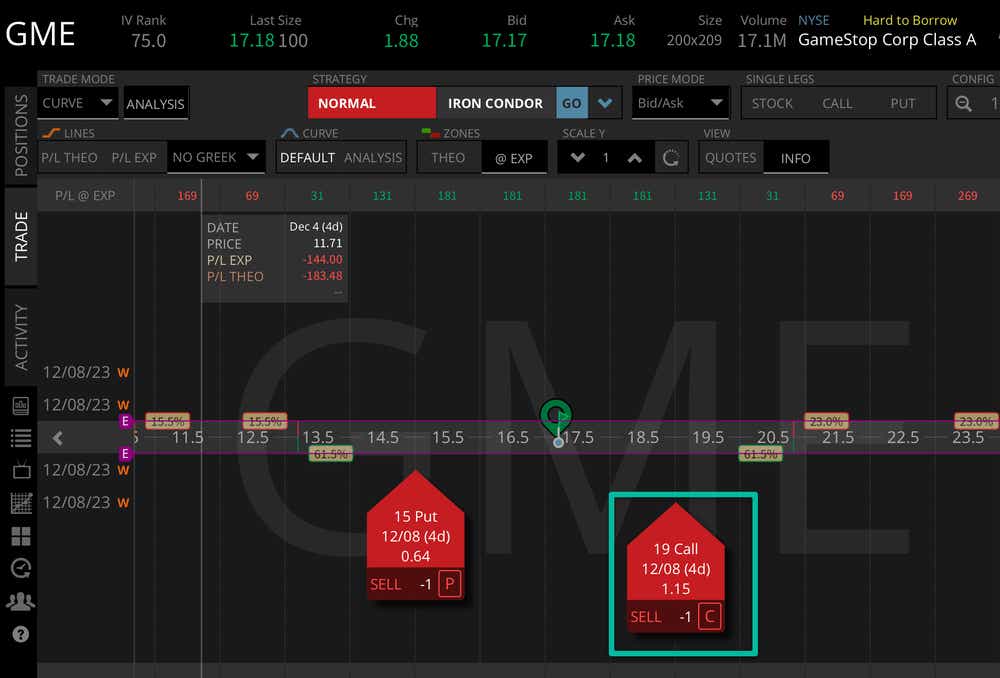

- Implied volatility is through the roof, as the market is expecting a 20% stock price move this week from the current price of $17.30

GameStop (GME) has had a wild year, as you might expect from the meme-stock craze a few years ago. Once "just" a company that sold games, GameStop is now involved in documentaries and blockbuster movies based on the crazy movement the stock has seen over the years.

GameStop stock opened 2023 at $17.25 and rallied to a high of $27.65 on June 13.

The move was attributed by observers to the earnings report on March 21, when GameStop beat EPS expectations by 220%—a gain of $0.16 per share, compared to an expected loss of $0.13 per share. This sent the stock straight up the next day, resulting in a rally of almost 60% the next trading session. The stock reached an annual low of $11.82 just a few trading sessions ago, and it vaulted from that level to the current price of $17.30 in short order.

The stock price's expected move this week based on current implied volatility is quite high with the earnings announcement looming at +-$3.49. With the stock sitting around $17, this is almost a 20% stock price expected move just this week.

Looking further to the Jan. 19, 2024, options cycle, which has an expected move of just +-$5.19, we can see that a lot of weight is being put on this week's expected move.

Bullish on GameStop earnings

Honestly, who doesn't want to see GameStop have a huge move to the upside?

It's likely that those rooting for GameStop exclude just the institutional traders that short it and contributed to the initial "short squeeze" to the upside we saw a few years ago. All kidding aside, there is a large "skew" in options premium to the upside when we look at the weekly cycle.

With the stock trading around $17, we can look at the value of the $2 out-of-the-money (OTM) options to see if there is a difference in price in equidistant options. Here, we can see that the call is trading for twice the amount of the put, both options $2 away from the current stock price. This tells us the market expects to see a high-velocity move to the upside.

This does not mean the stock is going to move to the upside, but it does tell us that the velocity is perceived to be to the upside compared to the downside, which shouldn't be too surprising considering the move we saw in March earlier this year after a big surprise.

If GameStop can post another big earnings beat when the expectation is a loss, we could see an upside frenzy like we saw earlier this year.

Bearish on GameStop earnings

Just five trading sessions ago, GameStop was trading at $12. The stock is now trading at $17. The hype train is full steam ahead, and this leads me to believe that if earnings are less than ideal, we could see this whole move reverse.

It's important to remember that if a lot of traders or investors are long GameStop stock and there is a large liquidation event on a bad earnings report, this can add to the downside pressure in the stock's price just like the upside pressure we saw on the "short squeeze" a few years ago.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on Wednesday, Dec. 6, ahead of the earnings announcement for some options trade ideas.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.