Crude Oil’s Top, Natural Gas’ Bottom

Crude Oil’s Top, Natural Gas’ Bottom

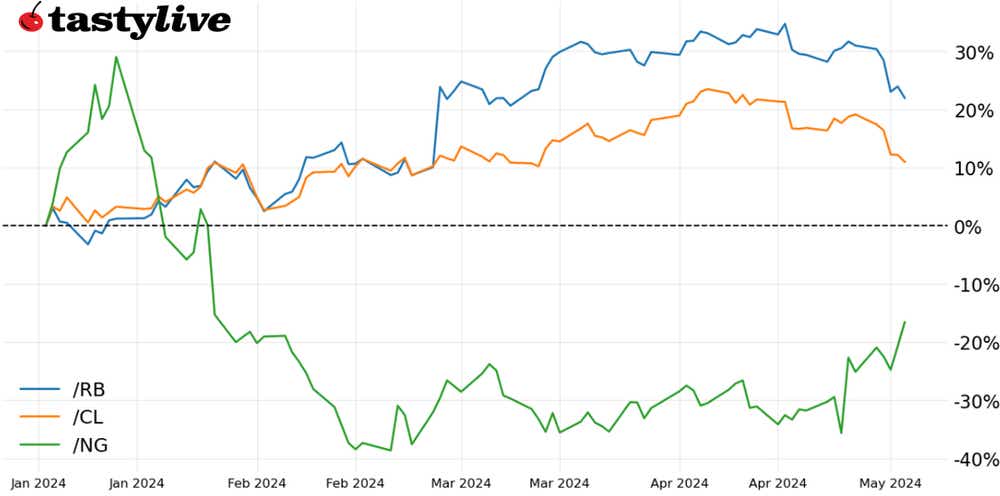

Crude oil is down 4.72% for the month so far

- Crude oil prices (/CLM4) have three technical problems coalescing at the same time.

- Natural gas prices (/NGM4) are making another earnest attempt at bottoming.

- A long /NG, short /CL position would be up 13.07% month-to-date at today’s close.

OPEC+ production is falling, and the U.S. may be readying to refill the Strategic Petroleum Reserve (SPR), but even those kinds of "supply constraint" headlines have done little to help crude oil prices (/CLM4) at the start of May.

The perceived end of the Israel-Iran chain of escalation has sapped demand for geopolitical hedges, leading to a pullback in net-longs in the futures market.

It's not all bad for energy products, however. Still mired in a multi-month slump, natural gas prices (/NGM4) have managed to stage an impressive rally at the start of May. It looks like rig counts have peaked, and estimates are beginning to come in that U.S. shale oil production is set to decline for the remainder of the year.

U.S. inventories are flooded with LNG, so the perception of any reduction in supply may be around the corner may prove enough for shorts to lift their positions, which are near the most extreme level of 2024, according to the latest CFTC COT report.

/CL Crude oil price technical analysis: daily chart (August 2023 to May 2024)

Crude oil prices (/CLM4) appear to have carved out a near-term top. /CLM4 has three primary technical issues now: first, it failed to sustain its breakout above the September 2023 high. Second, it failed to sustain its breakout above the descending trendline from the June 2022 and September 2023 highs. Third, /CLM4 has broken below the neckline of a head and shoulders pattern.

With respect to the third point, depending upon the neckline measurement–either from the April 22 swing low at 80.70 (conservative measurement), or the March 15 low at 79.51 (aggressive measurement)–the head-and-shoulders pattern is targeting a measured move of either 74.43 (conservative target) or 72.05 (aggressive target).

Momentum has rapidly deteriorated. /CLM4 is below its daily five-day, 13-day and 21-day exponential moving average (EMA), cloud, which is in bearish sequential order. Moving average convergence/divergence (MACD) is declining through its signal line, while slow stochastics are back in oversold territory.

Given the declining volatility environment, there are a variety of ways to express a bearish view: short /CL or /MCL futures; long at-the-money (ATM) put spreads; short ATM call spreads–dealer’s choice (although we should note that this trader prefers short /MCL futures).

/NG Natural gas price technical analysis: daily chart (August 2023 to May 2024)

Natural gas prices (/NGM4) haven’t done much of anything for the past six weeks. But the break of the downtrend from the November 2023 and April 2024 highs, as well as clearing out the swing highs carved out over the past six weeks, suggests that a veritable bottoming attempt is coming together.

Indeed, /NGM4 closed back above its daily 21-/34-EMA cloud for only the 14 time since the downtrend began Nov. 3, 2023.

Volatility is low (IV Rank: 13.9), making long ATM call spreads more appealing than short put spreads to express a directionally bullish bias on /NGM4.

That said, if price action in /NGM4 this Spring is shaping up as it was last spring–a rally at the end of February, peaking in early-March before declining the rest of the month then chopping around in April onwards–the longer-term prudent decision may be to wait for pullback to sell ATM put spreads under the assumption that 1.900 serves a floor in the near-term.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.