Crocs Paints a Bright Picture for 2024

Crocs Paints a Bright Picture for 2024

By:Mike Butler

So far this year, Crocs' stock is a big winner

- Crocs Inc. opened the trading week with its stock up over 20% on strong forecasting from management.

- The popular casual shoe company expects fourth-quarter 2023 revenues to grow over 1% compared to 2022, exceeding its previous guidance that indicated a decline.

- Crocs executives expect 2024 revenue to grow 3% to 5% compared to 2023.

Crocs Inc. (CROX) is having a massive start to 2024 after closing out the first week of the year at $86.45. In trading on Jan. 8, Crocs' stock jumped to a high of $104.85 after executives gave a preview of expectations for the fourth quarter's earnings report, and a strong forecast for 2024.

Second-best day ever for Crocs stock

This single-day jump in the stock price erased most of the turmoil Crocs realized at the end of 2023. Crocs beat earnings-per-share and revenue expectations in the past four quarters and the stock market is accepting the news well resulting in the second-best day in the stock's history, bested only by the rally in April of 2020 (26.3%).

2024 looks bright

"We expect full-year 2023 revenues to grow over 11% compared to 2022, slightly above our guidance of 10% to 11% growth, with our Crocs Brand growing over 13% surpassing the $3 billion mark and HEYDUDE revenues of approximately $949 million," the company's preview announcement said.

Crocs also said it had a strong holiday season and achieved market-share gains for both brands.

The company added that it paid down about $277 million of net debt and repurchased $25 million in stock in the fourth quarter.

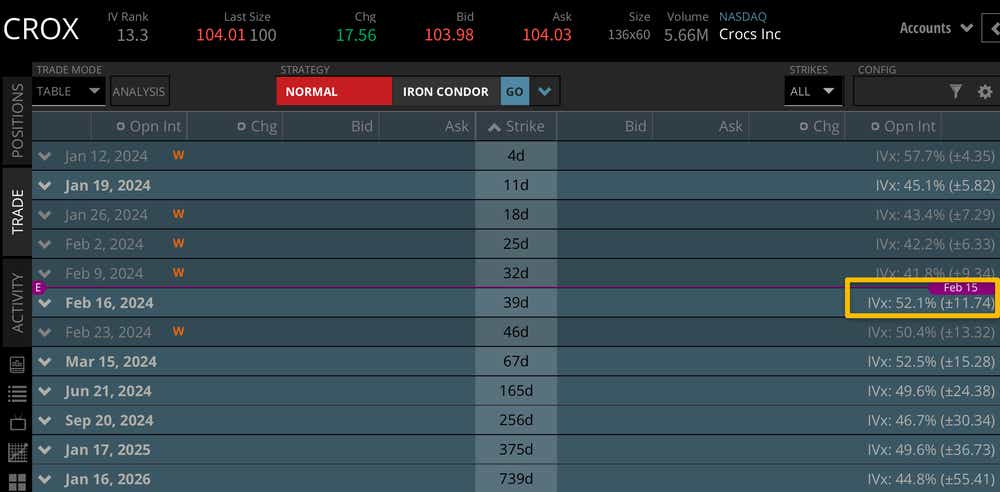

To put this move into perspective, it's important to look at the implied volatility of futures moves through time. We can see this clearly on the tastytrade platform, as the options expirations also list the expected move for each period.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.