Yen May Weaken on BOJ Inaction, But the Trend Still Points Higher

Yen May Weaken on BOJ Inaction, But the Trend Still Points Higher

By:Ilya Spivak

The Japanese yen may turn lower after five weeks of blistering gains. A pullback may be a buying opportunity.

- The Bank of Japan is likely to disappoint bets on a hawkish policy reversal.

- Imported food prices make for the wrong kind of inflation for BOJ officials.

- Any near-term weakness in the Japanese yen may be a buying opportunity.

The Japanese yen extended its blistering rally for a fifth week. The currency has added over 6% against the U.S. dollar since the upturn began in mid-November. It now faces a critical test of strength as the Bank of Japan (BOJ) prepares to deliver a closely watched monetary policy announcement.

Investors have been speculating about the possibility of a sea change in BOJ monetary policy for a year since the central bank roiled markets by taking the first step to weaken its cap on the 10-year Japanese government bond (JGB) yield in December 2022.

The arrival of Governor Kazuo Ueda—who took the reins from outgoing BOJ chief Haruhiko Kuroda in April – helped underpin the sense that some kind of major readjustment is afoot. Unusually for the head of Japan’s central bank, his background is in academia instead of government.

What’s more, he comes from the stable of transformative policymakers groomed by visionary economist Stanley Fischer. Other notable disciples include former Federal Reserve and European Central Bank (ECB) leaders Ben Bernanke and Mario Draghi, respectively.

Inflation in Japan: the price is wrong

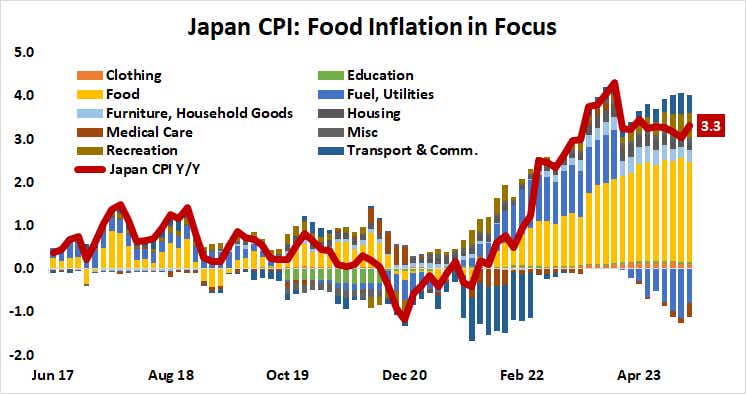

That Japanese inflation has accelerated alongside global prices has helped fuel the hawkish narrative. The benchmark consumer price index (CPI) measure of inflation showed prices grew 3.3% year-on-year in October. That marked the 19th consecutive month that it exceeded the BOJ target of 2%.

Comments from the central bank’s leadership helped create a sense of urgency around this month’s policy update. Mr. Ueda told the Diet—Japan’s parliament—that the BOJ’s job will become more challenging after year-end. Deputy Gov. Ryozo Himino gave a speech arguing that lifting interest rates would be less harmful than expected.

As it stands, the markets are not expecting a rate hike at this week’s meeting. The policy target rate, now at -0.1%, is expected to emerge from negative territory by mid-2024 and reach 0.2% by year-end. Scrapping the 0% yield cap on 10-year JGB rates—so-called “yield curve control” (YCC)—is widely seen as a prerequisite.

With no immediate changes likely on the menu, financial markets will focus on the guidance on offer in the central bank’s policy statement as well as Ueda’s post-meeting press conference. Market-watchers expecting a dialing-up of hawkish signaling may be in for a disappointment.

Bank of Japan: no pressure

First and foremost, Japan’s inflation is running hot for all the wrong reasons. Strip out food prices, and the headline consumer price index (CPI) rate drops to just 0.6%. Japan produces less than 40% of its own food, making this an imported problem. BOJ officials have stressed that they need to see sustainable, domestically driven price growth to shift gears in earnest.

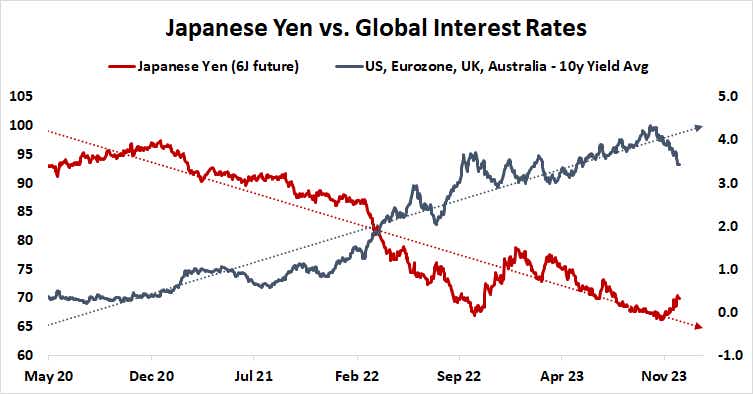

Second, there seems to be little urgency to follow up on last year’s moves to weaken YCC. The symmetrical thresholds for BOJ-tolerated departures from the 0% cap have been incrementally widened from 0.25% to 1%. That was done to avoid pitting the central bank against a hawkish Fed, whose rate hike cycle pressured yields higher globally.

Now that this pressure has evaporated alongside speculation that the U.S. central bank is finished raising rates and will begin to cut them next year, there seems to be little reason to rush YCC’s demise. The BOJ has ample time to finish the “policy review” launched this year. From there, Japan’s demographics will make any normalization slow and modest.

This might see the yen spike lower as hawkish speculation fizzles. Losses may be short-lived if a dovish turn in global monetary policy drives rates lower, reversing the perennially yen-negative “carry trade” dynamics that made it a standout loser amid the 2021-2022 tightening cycle. A near-term pullback may yet be a buying opportunity.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.