Yearning for Yields and Earnings

Yearning for Yields and Earnings

Downloadable data from the doctor

Yields

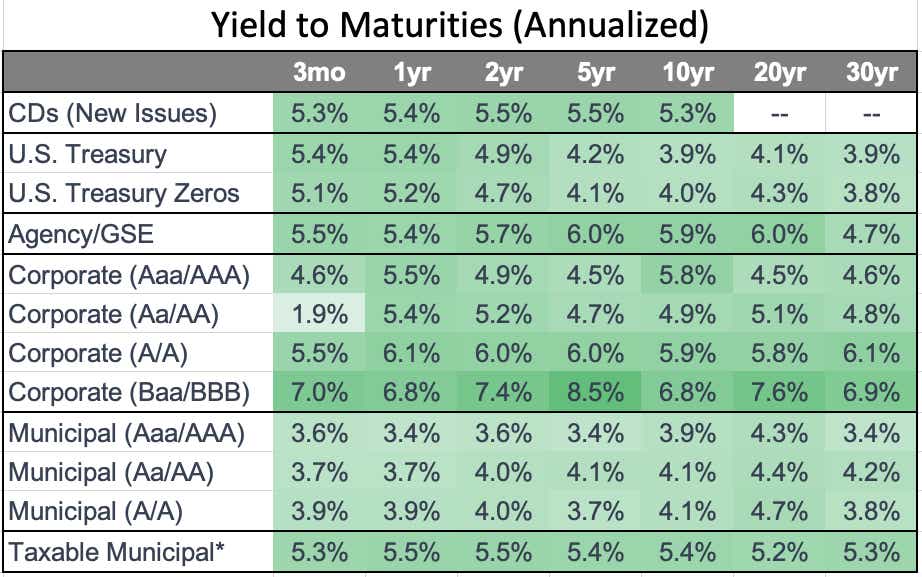

Check out the current yields to maturities on bonds. The numbers are all annualized:

Takeaways

Yields drop with longer durations. Generally, longer durations have higher yields (to compensate for the greater risk). But that is not the case in this market.

Muni Bonds have considerably lower yields. This is because they are tax-except. But what looks unusual right now is that some munis have comparable yields to corporate bonds.

The Corporate Bond with a 1.9% yield. This is probably due to the illiquidity of the market.

We continue to lean toward the market with its abundant opportunities in equities. If you choose to invest in bonds, opt for those with shorter durations. For interest-rate products offering the "most bang for the buck," those shorter-duration CDs would be our top pick.

Earnings Download

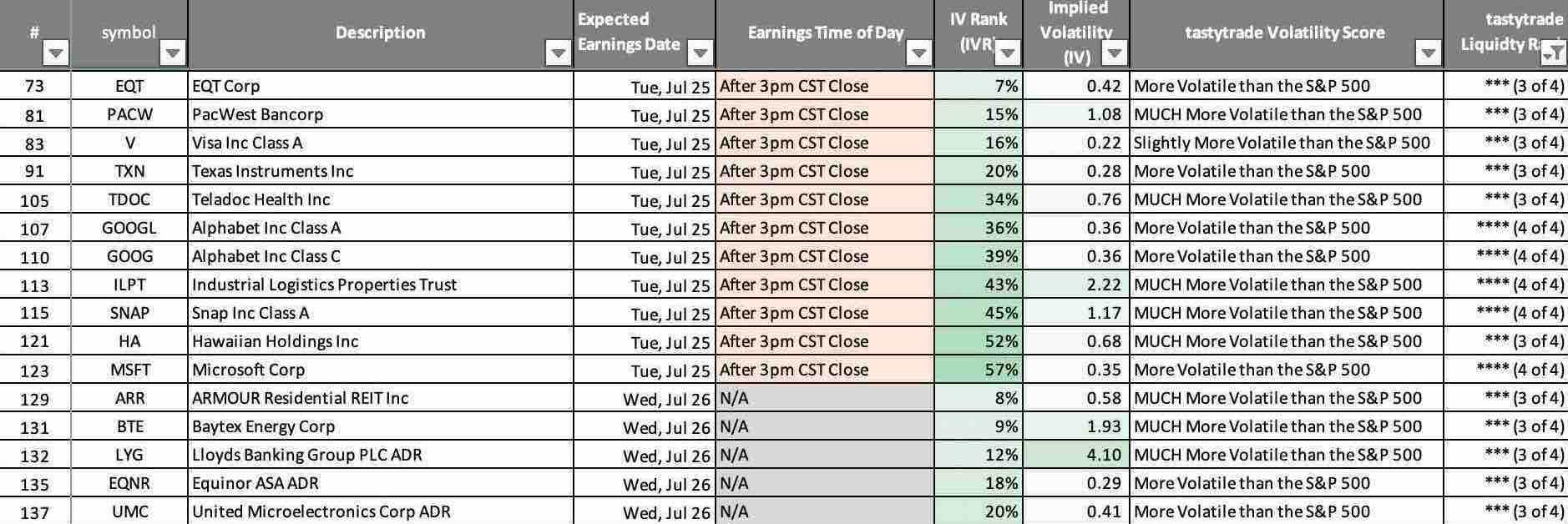

For download, we have a pretty PDF (with the 4-star liquidity stocks) and a spreadsheet with 3500+ stocks and their expected earnings dates.

Below see the spreadsheet with all the symbols. Click the filter to show all the stocks not just the 3 and 4-star ones.

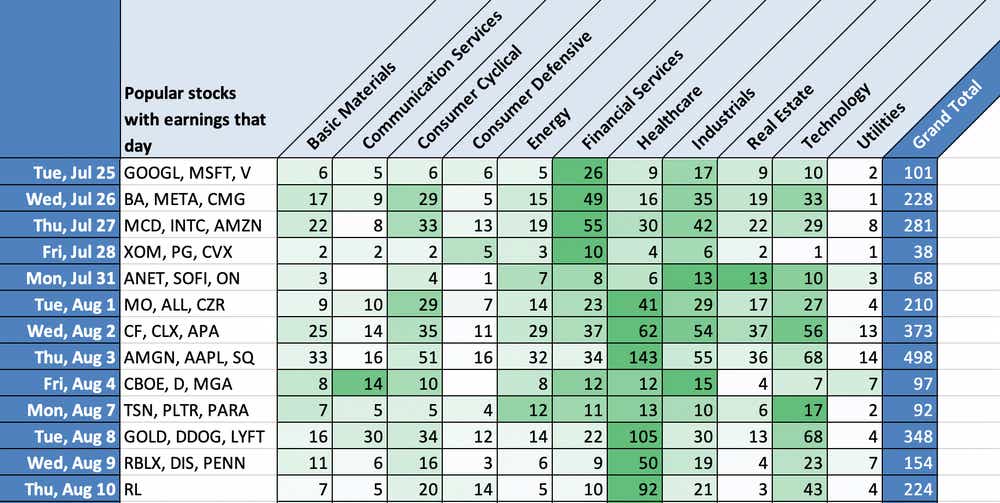

Big Earning Releases for Each Day

Financial services and Industrials are the biggest sector reporting right now. Healthcare stocks begin at the beginning of August.

Subscribe

No need to pay, Cherry Picks is free.

Sign up here: https://info.tastylive.com/cherry-picks

Michael Rechenthin (aka “Dr. Data”), managing director of Research and Development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.