Will Stocks Finally Listen if Bond Markets Warn of Trouble After U.S. Jobs Data?

Will Stocks Finally Listen if Bond Markets Warn of Trouble After U.S. Jobs Data?

By:Ilya Spivak

Plus, keeping the Fed in wait-and-see mode suggests rates may need to go even lower later

- Bets on a Fed interest rate cut have held steady despite DeepSeek AI and Trump tariffs volatility.

- Long rates have fallen in the meantime, warning of cyclical concerns downwind.

- All eyes now turn to the U.S. jobs data, where steady results may still move markets.

Expectations for Federal Reserve policy have been remarkably stable as the markets convulsed over the past two weeks, first after the appearance of a disruptive AI model from China’s DeepSeek and then as President Trump levied—and then paused—tariffs on Mexico and Canada. Extra duties on imports from China are set to proceed.

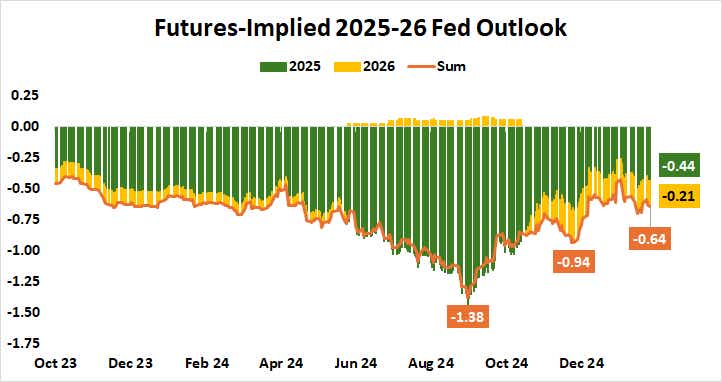

As it stands, benchmark Fed Funds futures price in 44 basis points (bps) in cumulative easing in 2025. That marks a strong lean toward two rate cuts, in line with the central bank’s own projections of 50bps. The view for 2026 splinters. The Fed expects another 50bps of stimulus, but the markets have discounted just 21bps.

Steady Fed rate cut expectations mask economic slowdown jitters

Stock markets have broadly mirrored this stability. The bellwether S&P 500 stock index has drifted sideways in a choppy range since setting a record high in early December. Similar statis is on display for the tech-tilted Nasdaq 100 and the small-cap Russell 2000.

By contrast, the bond market is on the move. While front-end Treasury yields have been broadly stable—echoing the stability in Fed policy bets—the long end has witnessed significant repricing. Yields on 10- and 30-year government debt have fallen to an eight-week low.

On balance, this seems to suggest markets are prepared to translate signs of economic cooling into lower rates downwind, which seems to imply an underlying expectation of a cyclical downswing, even as the immediate Fed policy outlook is little-changed. Against this backdrop, all eyes now turn to much-anticipated U.S. jobs data.

Bonds may rise as stocks backtrack after U.S. jobs report

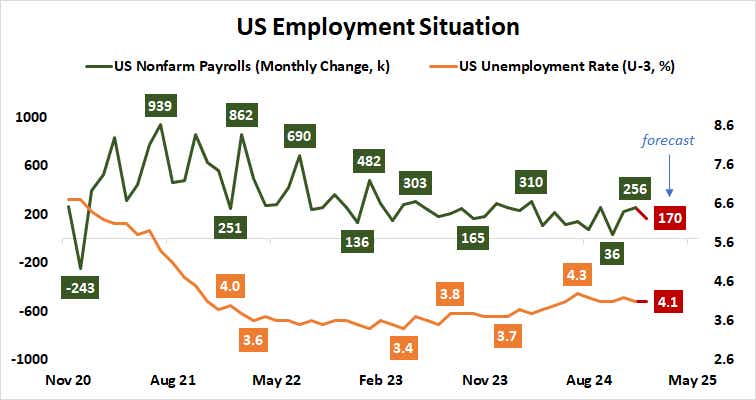

The monthly data set from the Bureau of Labor Statistics (BLS) is expected to show the U.S. economy added 170,000 jobs in January. The unemployment rate is seen holding unchanged from the previous month at 4.1%. Average hourly earnings growth is penciled in at 3.8% year-on-year, the slowest pace for wage inflation since July.

Analytics from Citigroup point to relative stability in U.S. economic data outcomes relative to expectations over recent weeks. If this continues, the jobs report may be more impactful in its passing than its substance. Figures that keep Fed policy bets anchored may give markets the green light to proceed along with previous trends.

For the bond market, that seems to translate into still lower rates at the long end. In fact, keeping the Fed in wait-and-see mode for now implies rates may need to go even lower later, if markets are indeed anticipating slower growth on the horizon. Stock markets may face selling pressure if they opt to pick up on that lead.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.