Boost Your Returns with Bullish Strangles

Boost Your Returns with Bullish Strangles

By:Kai Zeng

Bullish strangles outperform neutral strategies in bull markets, offering higher returns and lower volatility

- The ongoing bull market has let to the popularity of strategies like naked puts and covered calls.

- Traders who anticipate increased volatility on the downside could employ an unbalanced strangle.

- The bullish strangle strategy offers a middle ground between a naked put and a neutral strangle.

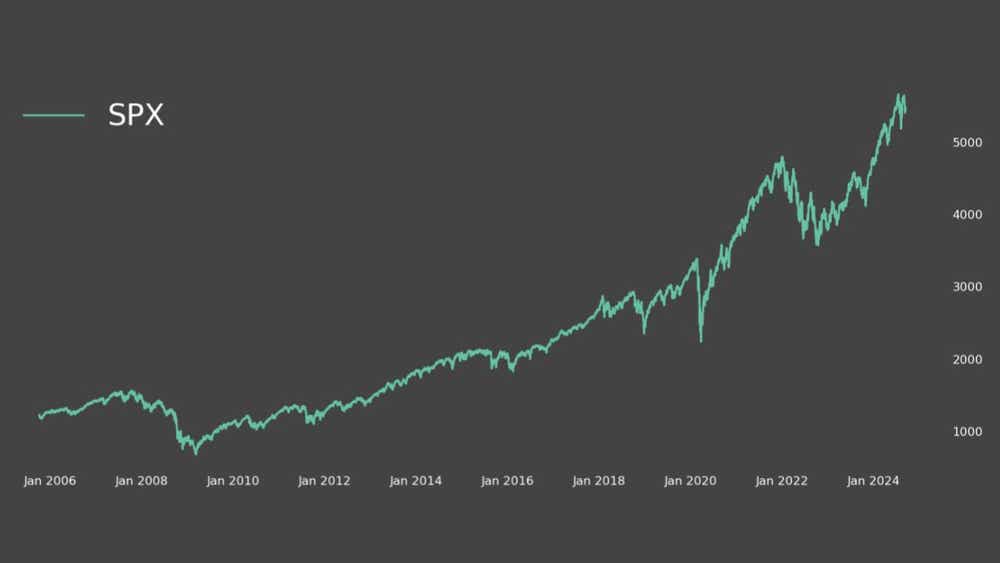

In recent years, we've witnessed one of the most significant bull markets of the past decade. This environment has made bullish strategies, such as naked puts and covered calls, particularly appealing because of their positive deltas.

For instance, a SPY 30-delta put offers a richer premium than a 16-delta strangle, potentially leading to higher success rates and improved performance.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

But what if traders anticipate continued market growth while expecting increased volatility on the downside? They might aim to collect more premium on the upside while mitigating downside risk. An effective approach to achieving that is by employing an unbalanced strangle with an overall positive delta.

To explore this, we analyzed 45 DTE SPY strangles over the past 15 years, comparing the performance of:

- 16-delta strangles

- 30/16-delta strangles (bullish bias)

All positions were managed at 21 DTE.

Strangles with a bullish bias exhibited slightly higher volatility and the potential for larger losses on the downside because of a closer breakeven point on the put side. However, they significantly outperformed neutral strangles in terms of return on capital (ROC).

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Compared to 30-delta puts, bullish strangles yielded lower ROC and success rates, indicating that losses on the call side reduced potential profits. Nonetheless, the bullish strangles demonstrated much lower volatility and smaller downside risks.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Next, we considered reversing the deltas to create a bearish strangle. How would this strategy perform compared to neutral and bullish strangles?

The bearish strangles underperformed relative to the other two strategies. Despite exhibiting the lowest volatility among the three, the ROC for bearish strangles fell short of expectations.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Key Takeaways for New Traders:

- Bullish-skewed strangles, with their positive delta, outperform neutral strategies in a bull market, despite higher volatility.

- The bullish strangle strategy offers a middle ground between a naked put and a neutral strangle, delivering substantial returns on the put side while providing better protection and lower volatility than a naked put.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.