Volatility Sweet Spots

Volatility Sweet Spots

Options volatility patterns for major ETFs and tech stocks show which IV ranges tend to create the best trading opportunities

Last week, we showed how volatility tends to overstate actual movements. Today, we are taking that Research farther.

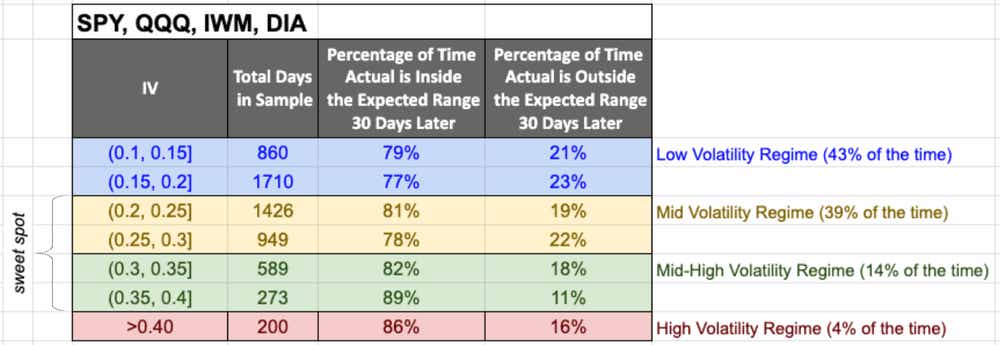

We looked at the SPY, QQQ, IWM and DIA to find volatility trading "sweet spots"—areas where implied volatility (IV) tends to be overstated relative to the realized volatility (actual price move) 30 days later. We used six years of price action for each exchange-traded fund (ETF).

That "sweet spot" for the indices is areas where IV is between 0.20 and 0.40 — mid to mid-high volatility regimes.

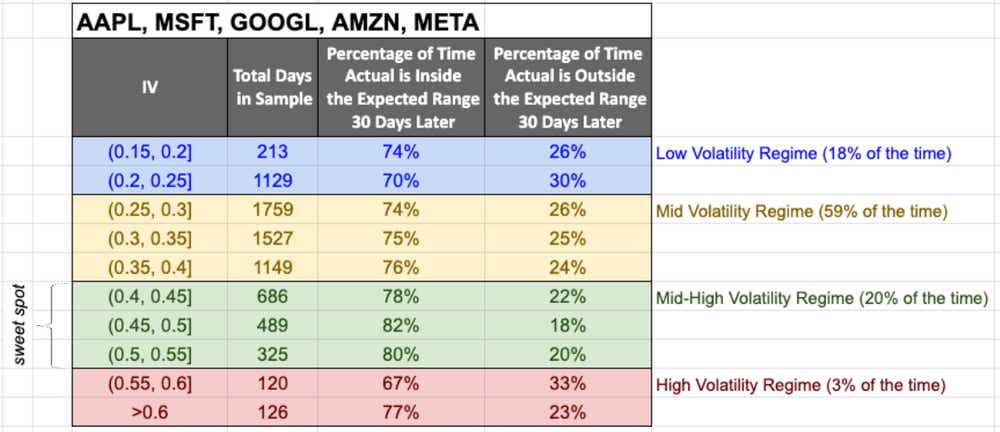

We also looked at Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) , Amazon (AMZN) and Meta Platforms (META) to find trading "sweet spots." These stocks are some of the most frequently traded and most liquid underlying, and are typically core positions for option traders. We used six years of price action for each stock.

Those sweet spot areas are where IV is between 0.40 and 0.55 — mid-high volatility regimes. IV tends to overstate realized volatility relative to other ranges.

All these stocks are in the low to mid-volatility regimes, so those are not the historically best times to sell volatility in these stocks.

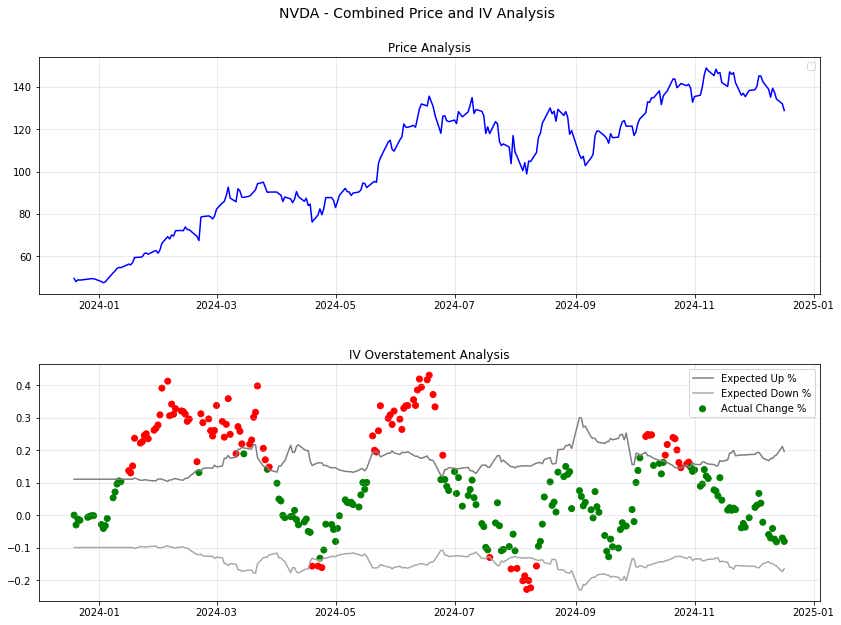

Since the beginning of the year, Nvidia (NVDA) implied volatility overstated market movements only 61% of the time. So NVDA, with its relatively high implied volatility, has been a difficult stock to make money from being short premium because it has not stayed within its expectations as much as many other stocks. The skew in option premium and risk has been mostly to the upside.

Two Trade Ideas

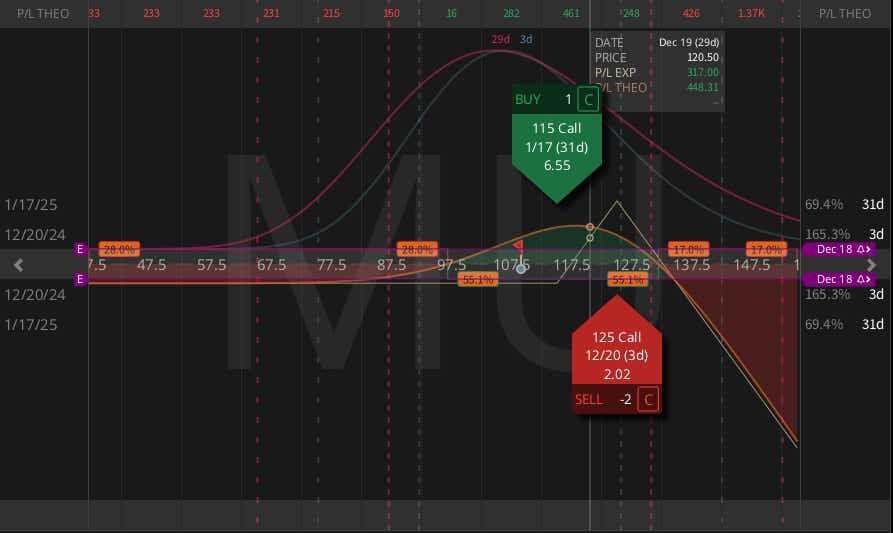

MU ($108) CRAB Trade (DEC20/JAN) $2.33 Debit

Is the recent move in AVGO pumping premium into short-dated MU options? Seems so. MU weekly implied volatility is at 165%, with a $13 expected move through the end of the week. If the stock moves $13 up to $120, a CRAB trade (calendarized ratio) would be a home run. Long the 115 call in January, with 2x the 125 calls in the front weekly, provides some position gamma/delta into an up move, with a ton of short-term theta/extrinsic value. There is, however, a naked call—so there is an upside-tail risk above 135!

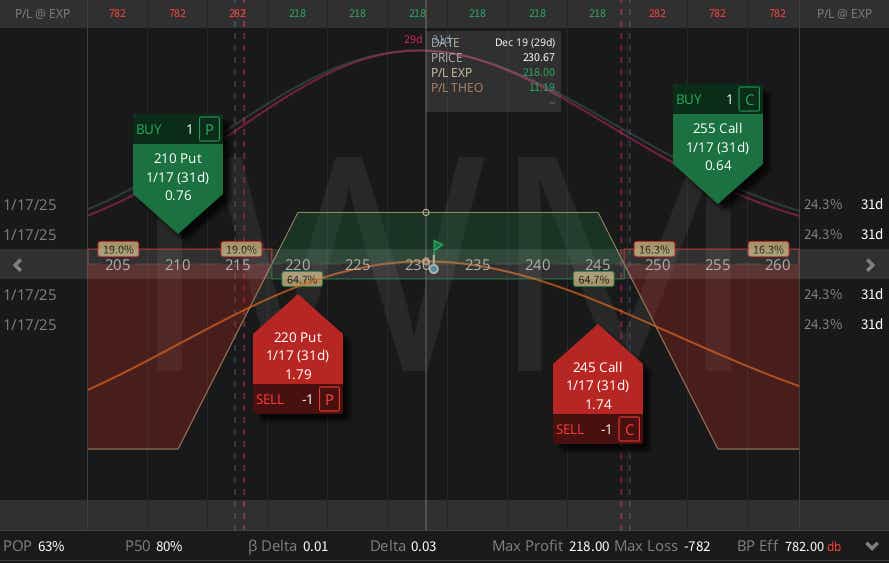

IWM ($231) Iron Condor (JAN) $2.18 Credit

The Russell (IWM) has seen some realized volatility in the last couple weeks but is back down to the middle of the range. If you think it might chop around for a couple more weeks, an iron condor short the 220/210 put spread and the 245/255 call spread would cover the entire Nov-Dec trading range.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.