Wheat Prices Collapse as Summer Harvest Advances

Wheat Prices Collapse as Summer Harvest Advances

Wheat sees its largest daily percentage decline since June 2023

Wheat prices are sinking as the crop progress shows advances in the harvest.

The Russian wheat harvest woes are likely fully priced in as conditions improve.

Plenty of volatility in wheat from the recent selloff offers healthy premiums.

Wheat contracts (/ZWU4) were down 3.26% through mid-day trading on Monday as traders anticipated a healthy acceleration in the United States soft red wheat (SRW) harvest. That marked the largest daily percentage decline since June 2023.

The United States Department of Agriculture (USDA) released its weekly crop progress report at 3 p.m. Central Time. The report, as expected, showed considerable progress in the winter wheat crop. June is typically a volatile month for wheat due to the summer harvest.

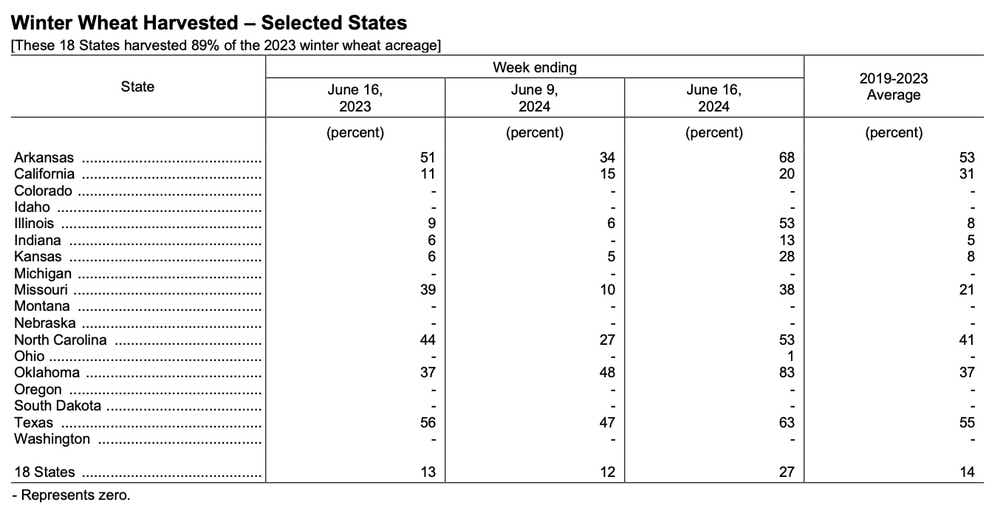

Winter wheat harvested for the week ending June 16 rose to 27% from 12% in the prior week, showing that farmers were able to take advantage of dry conditions to advance the harvest.

The 2019-2023 average for wheat harvested at this time of year is 14%, underscoring the progress on this year’s winter wheat harvest. Last week’s WASDE report also showed an improvement in the USDA’s outlook for wheat production, which helped to advance selling.

Russian wheat market flashes bearish signals

An improved harvest out of Russia has pressured prices during the past couple of weeks, with prices falling sharply through the first half of July. Russian wheat for July delivery fell $8 per metric ton to $234 last week, according to a Reuters report citing KIAR consultancy.

Meanwhile, import demand for wheat remains rather weak, especially in Europe and throughout the Middle East. That, along with improving crop conditions after a rough start, which led many farmers to resow their fields, will likely keep the demand/supply balance for the crop subdued over the short term.

Trading wheat amid the selloff

Wheat prices have likely priced in much of the bearish developments over the past few weeks and we may be entering peak bearishness—a market situation where there are limited sellers left.

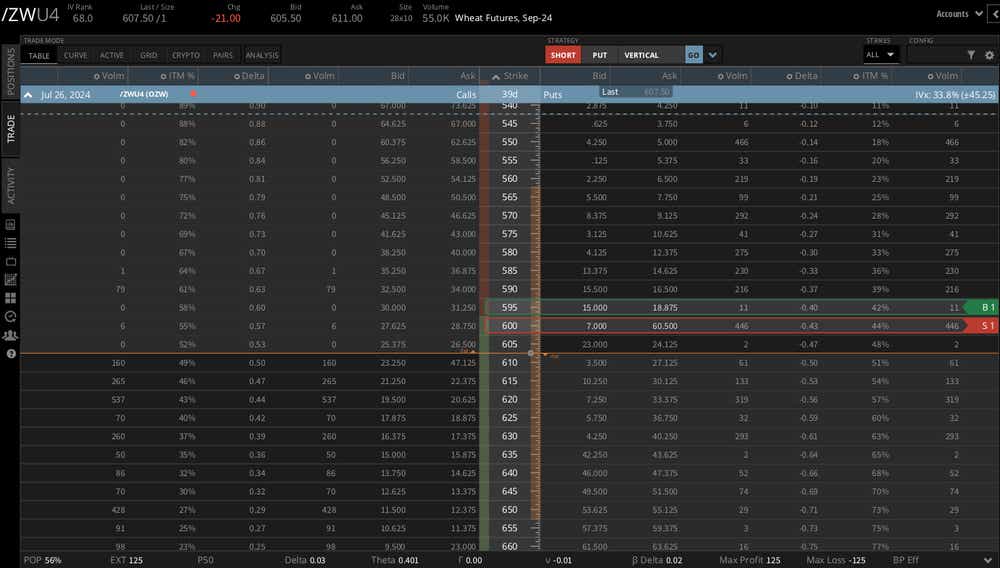

Volatility in the wheat products is extremely high due to the recent selloff, with a current implied volatility rank (IVR) of 85.4. That leaves options traders with plenty of premium for selling strategies.

The early April swing high at 605.25 may offer some technical support, offering a potential opportunity to get on the long side of the trade. Selling a put spread with the short option at 600 would offer a neutral to bullish position. Putting the long option at 595 would offer a max profit and loss of $125 and a probability of profit (POP) of 56%.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.