Dark Clouds Dampen Wheat Prices

Dark Clouds Dampen Wheat Prices

Wheat prices see biggest daily drop of 2023.

- Wheat prices see biggest drop of the year.

- Farmers breathe a sigh of relief as rain nears.

- Speculators scale out of short bets on wheat.

Wheat prices (/ZW) were down over 5% Tuesday to $698.2, the largest daily percentage drop this year. The move follows a multi-week rally that saw prices hit the highest since February as bullish speculation resulted from dry conditions across the United States and damaged crops in China.

Despite Tuesday’s decline, front-month wheat futures remain on track to close out June with the biggest monthly gain since February 2022, when Russia's incursion into Ukraine sent grain prices soaring.

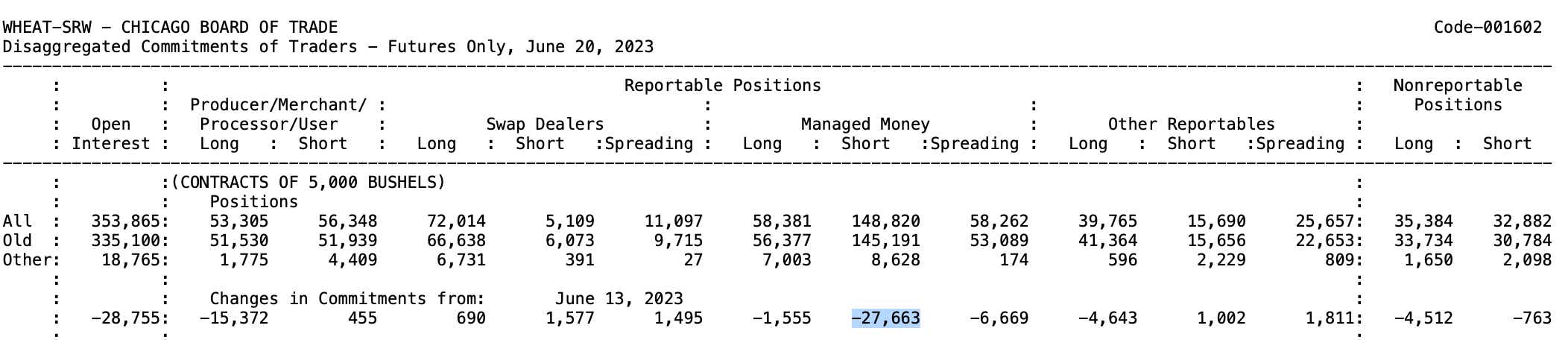

COT data shows speculators culled short bets

Friday’s Commitments of Traders Report (COT) from the Commodities and Futures Trading Commission (CFTC) showed that speculators (managed money) scaled out (-27k) of their short bets on wheat prices (soft red winter—SRW). That likely helped fuel the upside last week, as those traders had to buy back their positions. If prices resume the uptrend, it could force more shorts to cover as the net position among speculators remains tilted to the short side.

wheat cbot

Rain brings relief to drought-stricken crop conditions

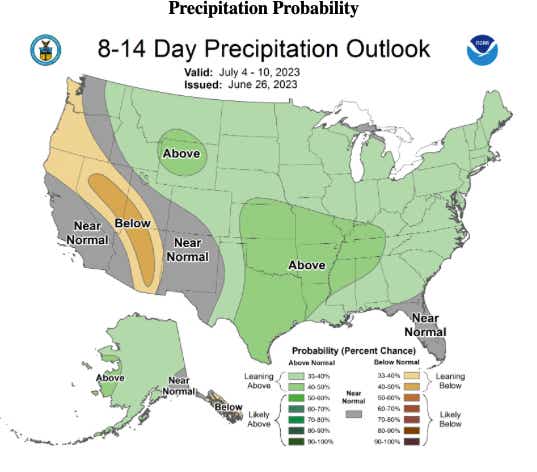

Despite a volatile session to start the week on Monday amid political turbulence in Russia—a top wheat exporter—prices are now cratering after wheat-planting states in the U.S. received a good dousing of rain over the last several days. And according to weather forecasting, more moisture is on the way.

The National Weather Service’s 8-14 Day Precipitation Outlook provided by the National Oceanic and Atmospheric Administration (NOAA), says there is an above-normal probability for precipitation across most of the United States. This is welcome news for farmers who have seen their crops get off to a bad start as drought across the Midwest and Lower Plains has dented crop progress.

The most recent Crop Progress report from the USDA highlights the lackluster start of the crop season for wheat. Spring wheat conditions for the week ending June 25 were rated at 2% excellent and 48% good compared with 6% and 53% at the same time last year. And 9% was rated as poor compared with 5% for the same period. However, these numbers should improve after recent rains.

weather forecast map

Wheat technical chart

Today’s selloff was preceded by a rejection from the falling 200-day simple moving average (SMA), which was only briefly overtaken. That marks a potential turnaround that may extinguish bullish sentiment and cause traders to take profits following the multi-week runup. A drop back to prior resistance from a falling wedge pattern may act as support if prices drop further.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Photo courtesy of Midjourney.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.