What Happens to the Market when Interest Rates Decline?

What Happens to the Market when Interest Rates Decline?

Mortgage rates and house payments go down. And the S&P 500 tends to react positively—at first.

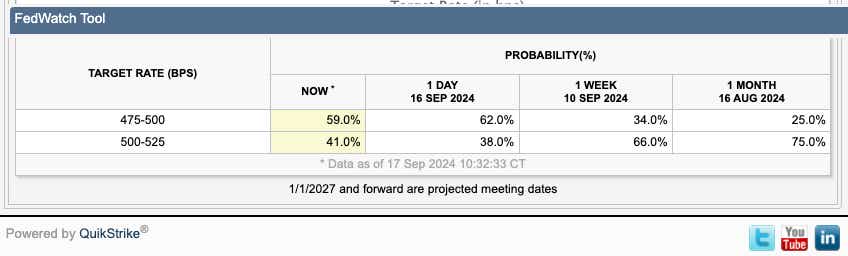

The CME FedWatch tool analyzes Fed Futures pricing to gauge market expectations for future changes in interest rates.

Currently, the market is pricing in a 59% probability of a 50-basis-point (bps) cut, which would be a 0.5 percentage point cut, and a 41% probability of a 25bps cut, amounting a0.25 percentage point reduction.

So, what happens when rates decrease?

To address that question, we examined 26 years of rate hikes and cuts, dating back to 1999, and reviewed 70 instances.

When the Fed cuts interest rates, the S&P 500 tends to react positively at first.

That's because lower rates make borrowing cheaper, which can boost corporate profits and encourage more investment. So, naturally, investors feel a sense of optimism, and we often see a short-term rally in the stock market.

But that initial excitement doesn’t always last.

The reason behind the rate cut usually becomes more apparent over time—it’s often because the economy is slowing down or there are signs of trouble ahead.

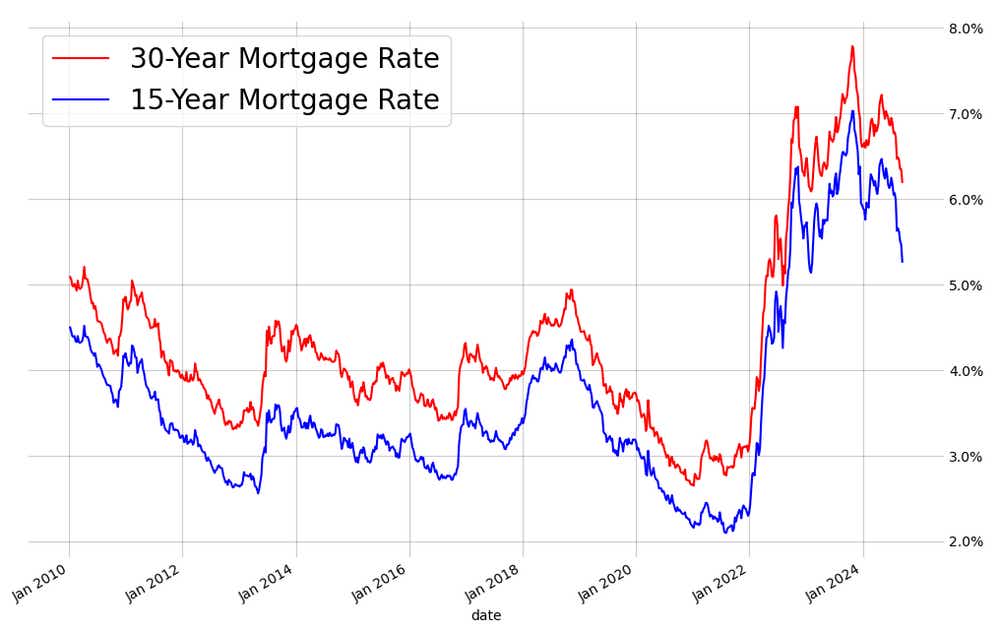

One clear benefit for everyday people is mortgage rates tend to fall when interest rates are cut.

That makes it cheaper to buy or refinance a home and leads to lower monthly payments, freeing up more disposable income for other spending.

Luckbox Newsletter

Need a little more luck in your life? Join other active traders, investors, entrepreneurs, risk-takers and alpha-types. Subscribe for free to tastylive's Luckbox letter for your weekly look at life, money and probability.

Two Trade Ideas

- XSP ($566) double calendar spread (SEP18/SEP20) $2.03 debit

Don't tell tastylive host Tom Sosnoff about this one!

There are about two points of vol difference between tomorrow and Friday because the rate decision is clearly pricing in some extra potential volatility.

If you’re looking to take a shot that it might be overpriced—a double calendar spread is an interesting way to play it.

Short the 560/570 strangle in the 1 DTE, long the 560/570 strangle in the three DTE, plays for a vol crush/inside move tomorrow with a cheap shot at some movement into the end of the week.

Cash settled—just like SPX!

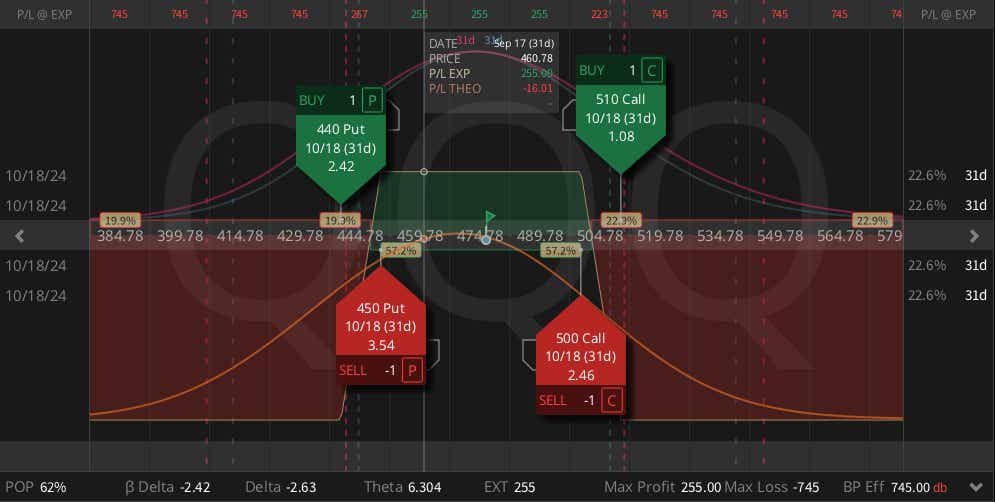

2. QQQ ($475) iron condor (OCT) $2.55 credit

The Nasdaq has been the most volatile of the major indexes—nearly a $100 range throughout 2024.

It's back right in the middle of the most recent trend. If you think we might chop around for a bit after this week's event is over, an iron condor is a defined risk way to play it.

Short the 450/440 put spread with the 500/510 call spread trades at $2.55 credit with a 62% probability of success.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He is best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.