What Determines a Stock’s Expected Move?

What Determines a Stock’s Expected Move?

By:Kai Zeng

A stock's expected move can be calculated using option prices

The expected movement of a stock—how much it's likely to rise or fall from its current price over a given period—can be calculated using option prices. Let's break down how this works and what factors come into play.

To calculate the expected move, we look at three main factors:

Stock Price: This is the current price of the stock, such as Apple (AAPL) trading at $150 or Tesla (TSLA) at $250.

Implied Volatility (IV): This measures market expectations for future volatility.

Trading Duration: Known as days-to-expiration (DTE), it refers to the time until the option's expiry.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Among these, DTE is the least critical because traders often use similar time frames, and its impact lessens after a mathematical adjustment. The more crucial elements are stock price and implied volatility.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

You might think the current stock price, like Microsoft (MSFT) at $300, dictates option prices and thus the expected move. While it’s important, implied volatility (IV) actually has a larger influence.

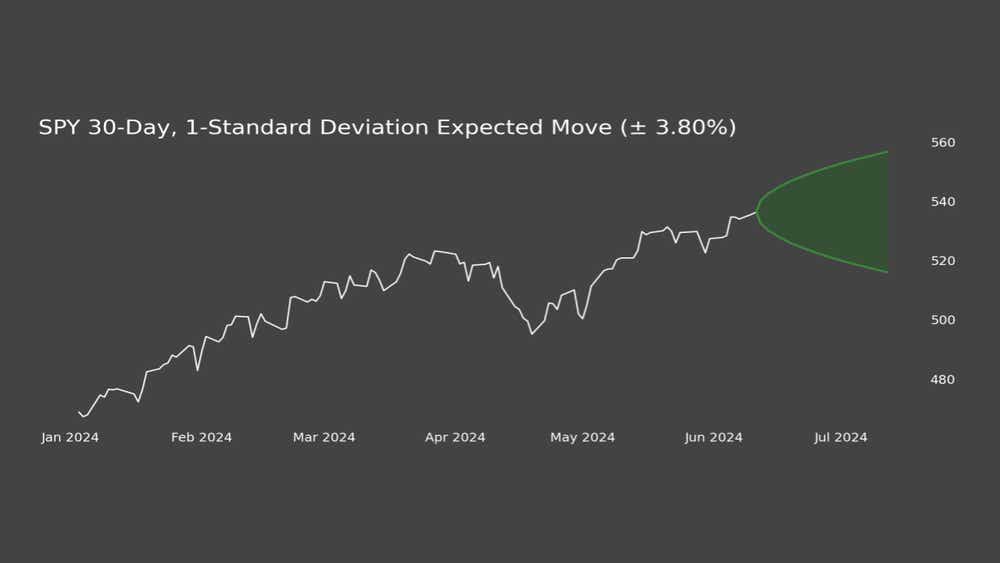

To illustrate, we analyzed 10 years of data from the SPDR S&P 500 ETF (SPY)—a proxy for the U.S. stock market—and the Volatility Index (VIX). We found that while SPY's price could fluctuate unpredictably, the VIX moved more and faster.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Suppose for SPY to double its expected move in a month, its price would have to change by 100%. This is highly unusual. On the other hand, IV shifting from 10% to 20% is not uncommon. Similar trends are evident with other stocks and their IVs. This explains why IV is the most important factor in determining the expected move.

For those engaged in trading, it's essential to recognize the higher impact of IV over other factors. The three core elements influencing a stock's expected move are:

Stock Price: Important but not the most volatile element.

Implied Volatility (IV): Has a greater impact because of its larger and faster fluctuations.

Days-to-Expiration (DTE): Least influential because it is consistent duration among traders and reduced impact after calculations.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.