Wall Street vs. Vegas: The New Battle for American Wallets (Guess Who's Winning)

Wall Street vs. Vegas: The New Battle for American Wallets (Guess Who's Winning)

By:Jeff Joseph

New research reveals online sports betting isn't just entertainment—it's a structural force systematically devouring household finances, particularly among those who can least afford the loss. The $120 billion gambling industry has found a perfect business model: digitally streamlined addiction masked as casual recreation.

Once upon a time, “putting your money on the game” was a figure of speech. Now it’s a business model—one that’s legally sanctioned, digitally streamlined and disturbingly effective at separating vulnerable households from their savings.

A recent study, Gambling Away Stability: Sports Betting’s Impact on Vulnerable Households, offers a stark look at the financial fallout from America's sports betting surge—and the results are anything but benign.

Since the 2018 Supreme Court decision that dismantled the federal prohibition on sports betting, state legislatures have scrambled to cash in. By 2023, more than half the country had legalized online betting, fueling a staggering $120 billion in wagers and over $11 billion in revenue for the industry. The speed and scale of this expansion suggest something far more serious than a harmless pastime—it’s a structural shift in how Americans interact with risk, money and sport.

This isn't your uncle scribbling picks into what this year is estimated to be a $3 billion March Madness pool. (In 2023, an estimated 56.3 million Americans filled out at least one bracket.) It’s a full-scale shift in household finance, with long-term implications for savings, investment and debt.

When risk becomes routine

The study, conducted by researchers from Northwestern University, Brigham Young University and the University of Kansas, doesn’t rely on polling or anecdotes. Instead, researchers examined transaction-level data from more than 230,000 U.S. households over a five-year period—roughly 4.9 million household-quarter observations. The findings are sobering.

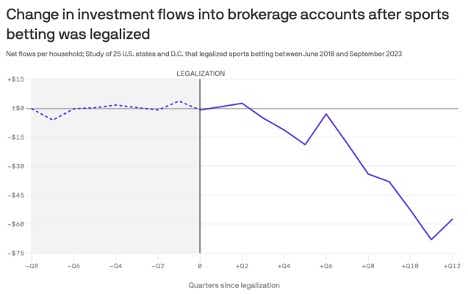

Following the legalization of online sports betting, households began diverting significant funds into betting apps. Importantly, this wasn't money previously earmarked for scratch-offs or casinos—it came directly out of investment accounts. Deposits to stock brokerages, robo-advisors and other savings vehicles declined sharply. Net investment fell by about 14% after legalization, and among lower-income, financially constrained households, the drop was even more pronounced.

The researchers estimate that every dollar deposited into a betting app reduces financial investment by nearly a dollar—it’s a zero-sum game where the house always wins, and the household loses.

Betting with borrowed money

The impact is particularly brutal for households already teetering on the edge of financial solvency. Those with low savings or recent overdrafts not only bet more as a share of their income, but also take on more credit card debt. Post-legalization, credit card balances among these households increased by an average of $368. Available credit shrank. Overdrafts multiplied. And, crucially, payments toward credit card balances fell—suggesting not just accumulation of debt but also worsening debt management.

This is not recreational spending. It’s a feedback loop of risk, loss and desperation. And it’s increasingly funded by high-interest debt and depleted savings, not surplus income.

But the effect isn’t limited to displacing investment or credit metrics. The researchers observed a shift in broader spending behavior. Households that bet on sports increased their spending on complementary consumption—restaurants, entertainment and cable subscriptions. Betting isn't just a line item; it’s become a lifestyle that drives spending outward in all directions.

This spike in consumption might look like economic activity, but it's often financed by shrinking savings and swelling debt. Among constrained households, it represents a tangible deterioration in long-term financial stability.

Betting on regulation

While some argue that sports betting offers states a lucrative new tax stream, the study suggests any fiscal benefits come with hidden costs: lost investment income, increased reliance on credit and a rising number of financially distressed households.

The authors propose modest regulatory interventions—geo-fencing, frictional design elements, perhaps even a return to physical sign-ins—to curb impulsive betting without banning the practice altogether. The goal isn’t prohibition; it’s mitigation.

Online sports betting isn’t going away. But left unchecked, it risks becoming the payday lending crisis of the 2020s—another system that profits from desperation and exacerbates inequality.

Conclusion

The study doesn’t argue that every bettor becomes a compulsive gambler or that financial ruin is inevitable. But it does make a clear, data-backed case that the rapid expansion of online sports betting is pulling money out of savings accounts and brokerage firms and channeling it into a high-cost, negative-expectation activity. For financially vulnerable Americans, the consequences are real and measurable.

Betting, like any form of entertainment, has its place. But when it starts to replace—not supplement—responsible financial behavior, we have a problem. The cost isn’t just the lost bet. It’s the foregone investment, the maxed-out credit card, the missed mortgage payment and the future that slowly slips away.

Legalized sports betting is here to stay. The question now is: What kind of financial future are we willing to gamble for it?

Jeff Joseph is Luckbox editorial director.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.