Nasdaq 100, 5-year T-Note, Gold, Crude Oil, and Canadian Dollar Futures

Nasdaq 100, 5-year T-Note, Gold, Crude Oil, and Canadian Dollar Futures

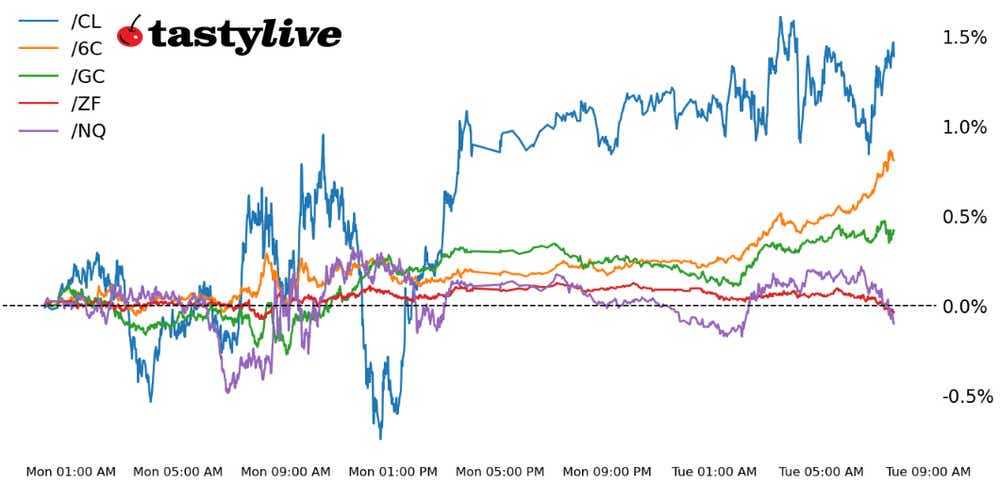

This Morning’s Five Futures in Focus

- Nasdaq 100 e-mini futures (/NQ): -0.08%

- Five-year T-note futures (/ZF): -0.09%

- Gold futures (/GC): +0.22%

- Crude oil futures (/CL): +0.76%

- Canadian dollar futures (/6C): +0.75%

A quieter day on Monday has seeped into Tuesday as traders keep their powder dry ahead of the September Federal Open Market Committee (FOMC) meeting tomorrow. U.S. housing data due out in the morning painted a mixed picture, with August building permits exceeding estimates (1.543 million versus 1.443 million) while housing starts cratered (-11.3% year over year from +2% y/y). Meanwhile, energy markets remained on the offensive, with the front month oil contract (/CLV3) hitting another fresh yearly high.

Symbol: Equities | Daily Change |

/ESZ3 | -0.01% |

/NQZ3 | -0.08% |

/RTYZ3 | +0.08% |

/YMZ3 | +0.01% |

Just like yesterday, the four U.S. equity index futures are relatively unchanged ahead of the cash equity open. This is typical, as the pre-FOMC drift—whereby markets don’t move much if any at all in the run-up to the FOMC meeting – is in full swing. A reminder, no additional rate hikes are currently discounted by markets through the end of the year (1% chance of a hike tomorrow; 31% chance of a hike in November). It remains the case that options are priced in less than a +/-1% move through the close on Wednesday for the S&P 500 (/ESZ3), and just over a +/-1% move in the Nasdaq 100 (/NQZ3) and the Russell 2000 (/RTYZ3).

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15000 p Short 15100 p Short 15700 c Long 15800 c | 28% | +1350 | -650 |

Long Strangle | Long 15000 p Long 15800 c | 44% | x | -7920 |

Short Put Vertical | Long 15000 p Short 15100 p | 65% | +585 | -1415 |

Symbol: Bonds | Daily Change |

/ZTZ3 | -0.02% |

/ZFZ3 | -0.09% |

/ZNZ3 | -0.17% |

/ZBZ3 | -0.34% |

/UBZ3 | -0.42% |

Does this sound familiar? Bonds are down across the curve, and yes, the weakness is led by the long-end of the curve—30s (/ZBZ3) and ultras (/UBZ3) are leading once again. The sustained push higher by energy prices is filtering through into elevated inflation expectations as well. But here’s the kicker: bond markets have the historical tendency to bottom at the meeting prior to the final Fed rate hike. Could ‘that meeting’ be tomorrow?

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 104.5 p Short 105 p Short 107 c Long 107.5 c | 53% | +195.31 | -304.69 |

Long Strangle | Long 104.5 p Long 107.5 c | 29% | x | -281.25 |

Short Put Vertical | Long 104.5 p Short 105 p | 83% | +117.19 | -382.81 |

Symbol: Metals | Daily Change |

/GCZ3 | +0.22% |

/SIZ3 | +0.58% |

/HGZ3 | -0.82% |

Gold (/GCZ3) is trading slightly higher in U.S. trading as traders await this week’s rate decision from the FOMC. While the central bank is widely expected to hold steady, the language provided on forward guidance will be key to bullion’s price direction. Meanwhile, soaring energy prices are seen potentially complicating the Fed’s path, which could induce further bond selling and hurt gold prices.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1930 p Short 1940 p Short 1980 c Long 1990 c | 31% | +650 | -350 |

Long Strangle | Long 1930 p Long 1990 c | 41% | x | -2540 |

Short Put Vertical | Long 1930 p Short 1940 p | 68% | +370 | -630 |

Symbol: Energy | Daily Change |

/CLZ3 | +0.76% |

/NGZ3 | +0.94% |

Crude oil (/CLZ3) is once again trading higher this morning. A recent report from a U.S. government agency expects crude production from key regions to drop for a third month in October. That, combined with output cuts from Saudi Arabia and Russia, is threatening global supply. At the same time imports to China remain strong, which removes one of the few potential headwinds on the demand side of things for the commodity. API crude oil stocks are due this afternoon, with traders expecting a 2.6-million-barrel drop.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 87 p Short 87.5 p Short 92.5 c Long 93 c | 28% | +340 | -160 |

Long Strangle | Long 87 p Long 93 c | 42% | x | -3310 |

Short Put Vertical | Long 87 p Short 87.5 p | 71% | +140 | -360 |

Symbol: FX | Daily Change |

/6AZ3 | +0.59% |

/6BZ3 | +0.34% |

/6CZ3 | +0.75% |

/6EZ3 | +0.31% |

/6JZ3 | 0.00% |

While attention will swing to the British pound (/6BZ3) and the Japanese yen (/6JZ3) in the coming days, the release of the August Canada inflation report today has the Loonie (/6CZ3) in the spotlight. Hotter-than-anticipated inflation pressures are stoking a rejuvenation of rate hike odds for the Bank of Canada, according to overnight index swaps (OIS). Coupled with mixed U.S. housing figures, the U.S. dollar finds itself on its backfoot on Tuesday.

Strategy (18DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.73 p Short 0.735 p Short 0.765 c Long 0.77 c | 72% | +90 | -410 |

Long Strangle | Long 0.73 p Long 0.77 c | 13% | x | -50 |

Short Put Vertical | Long 0.73 p Short 0.735 p | 94% | +30 | -470 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.