Stock Futures Mixed as Oil Prices Recede

Stock Futures Mixed as Oil Prices Recede

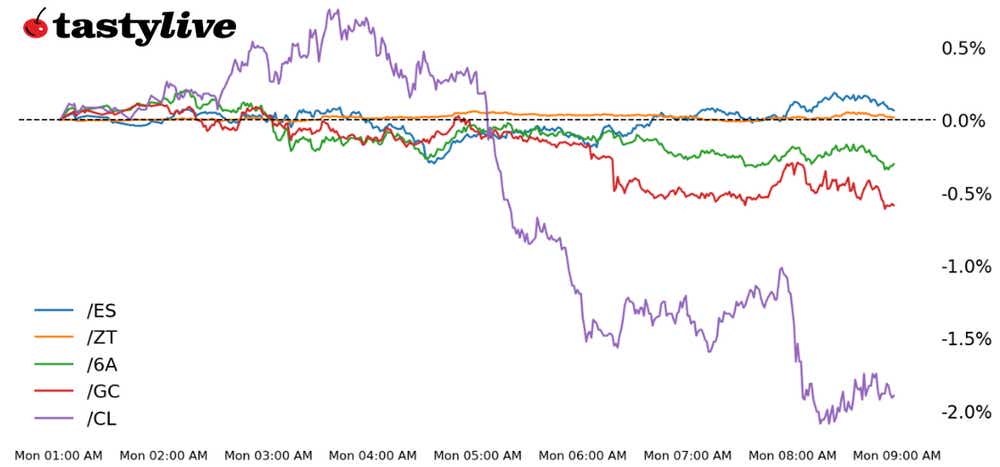

Also Two-year T-note, gold, crude oil and Australian dollar futures

- S&P 500 E-mini futures (/ES): +0.02%

- Two-year T-note futures (/ZT): +0.01%

- Gold futures (/GC): -1.17%

- Crude oil futures (/CL): -4.05%

- Australian dollar futures (/6A): -0.45%

The indecisive price action that emerged in the wake of the December U.S. jobs report on Friday is finding continuation on the other side of the weekend. U.S. equity markets are trading mixed if not slightly lower, while U.S. Treasury bonds are modestly weaker across the curve. The uptick in yields is supporting the U.S. dollar at the expense of precious metals. Elsewhere, carnage in the energy markets is back after Saudi Arabia announced a price cut for Light Arab crude, which it sells in Asia; markets are taking the decision as a sign of flagging global demand for oil.

Symbol: Equities | Daily Change |

/ESH4 | +0.02% |

/NQH4 | +0.12% |

/RTYH4 | -0.23% |

/YMH4 | -0.38% |

The S&P 500 (/ESH4) is trading slightly higher despite a selloff in China overnight and some big names in the U.S. market being down big, such as Boeing (BA), down over 8%. The start of earnings season and several data prints later this week may put traders into a cautious stance as the rate-cutting narrative that drove bullish sentiment erodes.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4680 p Short 4690 p Short 4790 c Long 4800 c | 19% | +382.50 | -117.50 |

Long Strangle | Long 4680 p Long 4800 c | 48% | x | -5400 |

Short Put Vertical | Long 4680 p Short 4690 p | 63% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.01% |

/ZFH4 | -0.01% |

/ZNH4 | -0.03% |

/ZBH4 | -0.18% |

/UBH4 | -0.31% |

The policy-sensitive two-year T-note future (/ZTH4) is unchanged this morning as traders wait for economic data due this week that could alter the outlook on the Fed’s path forward. The market may have been too dovish going into 2024, and we are now seeing those bets being pulled back. Bond traders also have their eyes on today’s 13- and 26-week bill auctions. Later this week, the Treasury will auction off three-year and 10-year notes (reopening).

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 102 p Short 102.125 p Short 103.125 c Long 103.25 c | 34% | +125 | -125 |

Long Strangle | Long 102 p Long 103.25 c | 49% | x | -484.38 |

Short Put Vertical | Long 102 p Short 102.125 p | 91% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCG4 | -1.17% |

/SIH4 | -0.79% |

/HGH4 | +0.14% |

Gold prices (/GCG4) fell to start the week as traders await U.S. inflation data due Thursday. Precious metals traders are nervous that price pressures will complicate the Fed’s path to cutting, especially after last week’s hotter-than-expected jobs report. The core measure—which excludes volatile energy and food prices—is seen falling to +3.8% in December from a year ago. However, headline inflation is expected to rise to 3.2% year-over-year (y/y) from November’s 3.1% y/y.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2000 p Short 2010 p Short 2090 c Long 2100 c | 33% | +630 | -370 |

Long Strangle | Long 2000 p Long 2100 c | 41% | x | -3450 |

Short Put Vertical | Long 2000 p Short 2010 p | 70% | +340 | -660 |

Symbol: Energy | Daily Change |

/CLG4 | -4.05% |

/HOG4 | -2.32% |

/NGG4 | -5.98% |

/RBG4 | -4.06% |

Crude oil prices (/CLG4) fell this morning after Saudi Arabia cut prices for its crude oil to all delivery regions. It’s the latest sign that demand is weakening across the globe as a year of higher interest rates and high inflation weighs on the economy. Elsewhere, natural gas prices in the U.S. are down, putting further pressure on the energy sector.

Strategy (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 68.5 p Short 69 p Short 74 c Long 74.5 c | 80% | +360 | -140 |

Long Strangle | Long 68.5 p Long 74.5 c | <1% | x | -3840 |

Short Put Vertical | Long 68.5 p Short 69 p | 91% | +190 | -310 |

Symbol: FX | Daily Change |

/6AH4 | -0.45% |

/6BH4 | -0.07% |

/6CH4 | -0.24% |

/6EH4 | +0.07% |

/6JH4 | +0.17% |

The risk-sensitive Australian dollar (/6AH4) is leading major currencies lower this morning as traders see growth weakening across the globe. Several economic data prints this week from Australia are expected to bolster rate cut expectations for the Reserve Bank of Australia (RBA). A weaker AUD may also come through the dollar, especially if this week’s inflation data from the U.S. rises above expectations.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.65 p Short 0.655 p Short 0.685 c Long 0.69 c | 46% | +250 | -250 |

Long Strangle | Long 0.65 p Long 0.69 c | 34% | x | -710 |

Short Put Vertical | Long 0.65 p Short 0.655 p | 78% | +130 | -370 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.